- As of this fortnight, CS Brazil has already crushed 40% of its cane and produced 13.3mmt of sugar in 20/21.

- At this point, a production change (i.e. sugar mix decrease) is unlikely as sugar prices still best ethanol’s.

- Hydrous ethanol sales continue to gradually recover.

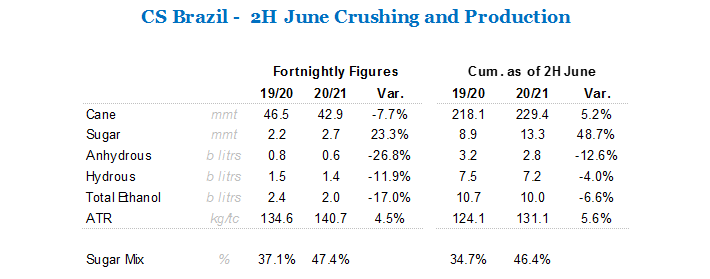

Summary Table 2H June

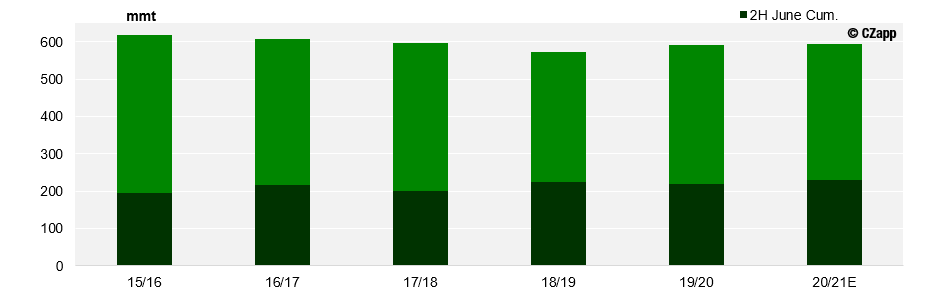

40% Done

- Despite heavy rains at the end of the fortnight, 2H June crush totalled almost 43mmt.

- This takes cumulative crush up to 229mmt, or 40% of the 2020/21 season.

Cumul. Cane Crush: 2H June vs. Total of the season – 40% of cane processed so far

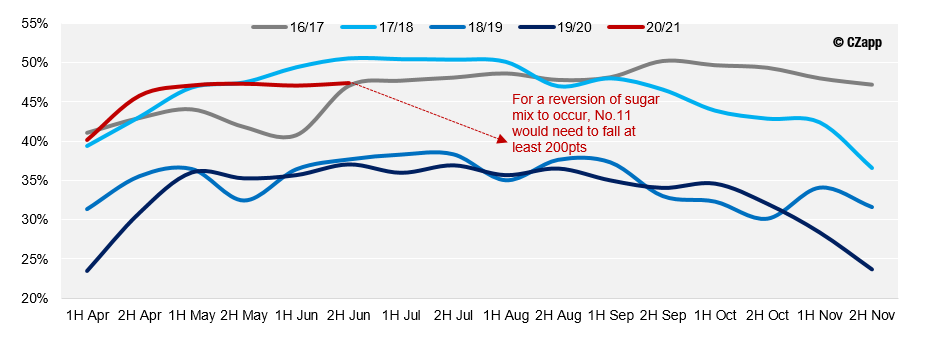

- So far no surprises regarding the production mix: mills are maximizing sugar output.

- We expect this behaviour to continue as long as the ethanol market does not incentivize washouts.

- The present combination of No.11, FX and hydrous prices does not incentivize buybacks that would allow millers to shift their production mix to ethanol

- And with the current outlook for hydrous prices , it might be too late in the season for this to occur.

Fortnightly Sugar Mix – no surprises as CS continues to max sugar mix

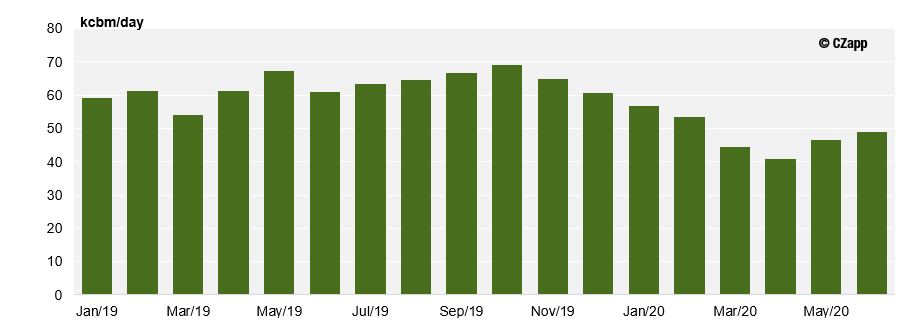

Ethanol Market

- Hydrous sales by the mills totalled 1.47bi litres in June.

- Despite being 20% below yoy, it is still showing a gradual recovery after the demand valley registered in April.

- Fuel demand in Brazil is recovering as social distance measures are eased and this is expected to be reflected in ethanol sales data in the upcoming months.

- However, hydrous price parity at the gas stations has already surpassed 65%, which might limit the upside in sales figures from now on.

Fortnightly Hydrous Sales – slow and steady ethanol recovery