- Cane harvested from now on is expected to show lower yields.

- Crop could end sooner than expected.

- Concerns for 21/22 are also on the table.

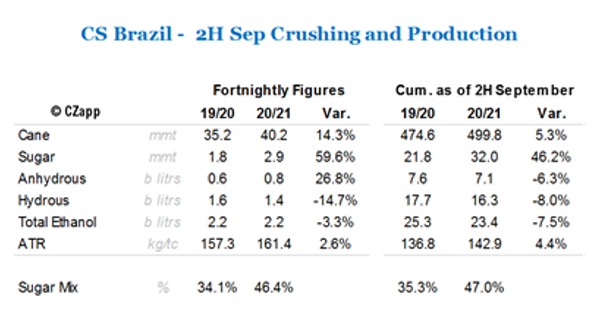

Summary Table 2H September

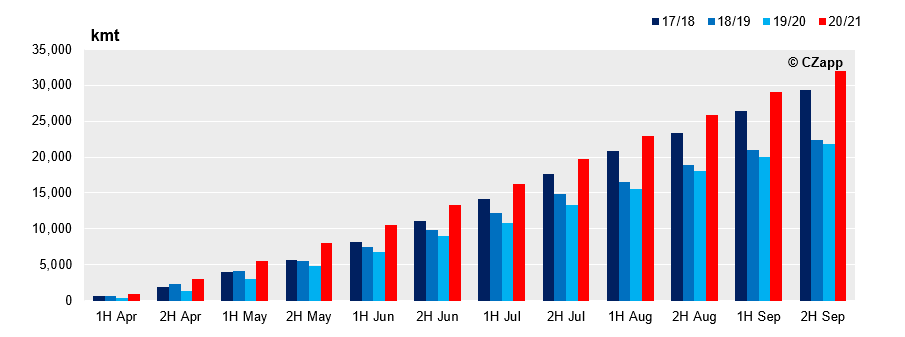

Record Crush Levels

- The dry weather of the lasts 6 months has favoured the operationalization of the sugarcane harvest.

- Until the end of September, mills were able to achieve a record crush of 500mmt for the period – and 5.3% ahead yoy

- Additionally, the amount of sugar content in the cane in a max sugar scenario has contributed to a cumulative sugar production of 32mmt – again, another record.

CS Cumulative Sugar Production – Until September CS sugar output has reached 32mmt

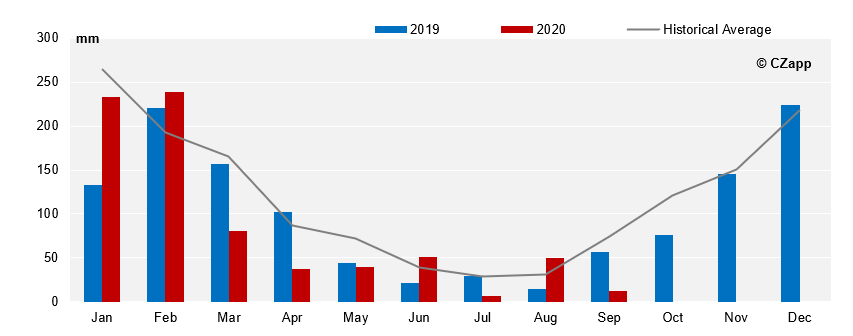

The Dry Spell Continues

- Until September, cumulative rains in CS Brazil were 40% below historical average.

Monthly Rains in CS Brazil – This has been a significant dry season

- Although, dry weather is good for the quality of the cane – allowing a higher sugar concentration – it can hinder development.

- With such high temperature and lack of rains, it is expected a decrease in the ag. yield for the cane harvest from now onwards;

- Furthermore,the insufficiency of rains in recent months delays and compromises cane development for the 21/22

season. - This sugarcane field below was harvest in June:

- We can see some parts of the field that have not even grown;

- And the parts of the field that did grown should be bigger by now in normal weather conditions.

- In summary:

- The 20/21 crop could end earlier than expected,

- Plant development delay can affect yields and the harvest calendar for next season.

Ethanol Market

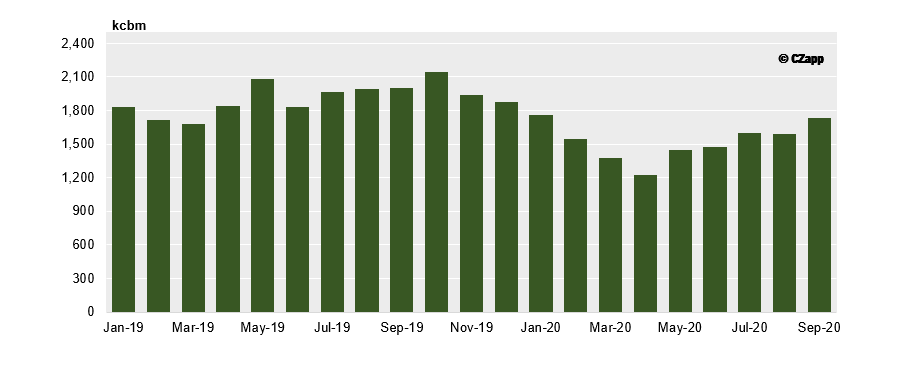

- Hydrous sales by the mills registered,1.73 bi litres in September, 13% decrease yoy.

- The retraction observed in September was below the values registered until now

- This indicates a slowly recovery of consumption of the biofuels.

CS Monthly Hydrous Domestic Sales – slow recovery