857 words / 4 minute reading time

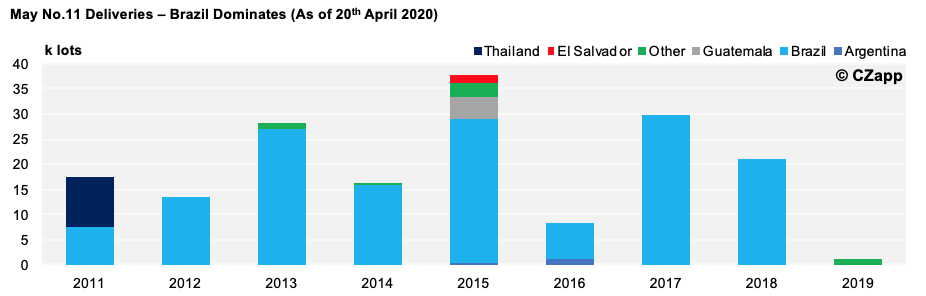

- The ICE New York May Futures contract expired on Thursday 30th April with a record 2.26m tonnes of raw sugar changing hands.

- Unlike the recent bizarre expiry of the West Texas Intermediate crude oil futures contract (where the price a barrel of crude oil became negative), the sugar expiry was an orderly affair.

- With this in mind, we thought it would be worthwhile to explain how the delivery mechanism works.

The Exchange, Futures and Physical Contracts

The sugar trade, like many other commodities, is based around a central ‘Exchange’, so called because it acts as a forum for buyers and sellers to come together and for sugar to change hands. This can happen now or at an agreed point of time in the future (across one of four contracts each year; March, May, July and October), hence the term ‘futures contract’. The contract is primarily a price discovery mechanism, where buyers and sellers lock in their pricing requirements forward. These forward contracts determine the volume of sugar and the time period when sugar will either be available or will have to be picked up.

Although the Exchange contracts are used as a pricing reference point in a lot of sugar purchase and sale contracts, traditionally, relatively little sugar actually changes hands through futures expiries. The majority of trade happens directly between buyers and sellers in physical sugar contracts.

Where sugar is different from many other commodities is, once these pricing contracts expire, the sellers are obligated to physically deliver the sugar to the buyers and the buyers are obligated physically receive it. Many other commodities are simply cash settled with no actual exchange of goods occurring.

The exchange of goods happens in accordance with the No.11 raw sugar futures contract specifications, which lays out each party’s obligations to each other. During a 75 day window, the receivers are bound to pick up / ship this volume to other parts of the world, and the deliverers are bound to make the full volume available over this period.

What’s in it for the Seller?

The rules provide a list of ports around the world that the seller can deliver the sugar to, and the seller can choose which port that is. It doesn’t need to be one port; the sugar can be scattered around the world! The buyer is taking a risk because they have no control over where their sugar is going to be delivered. This a potential logistical nightmare…

In addition, different countries produce different qualities of sugar. Sugar delivered from Brazil is the gold standard in terms of quality, whereas sugar delivered from Thailand or Central America may not have quite have the same appeal.

In general terms, the bigger the ship, the cheaper it’s going to be per tonne to transport the sugar. So, if the buyer is forced to call at many ports to pick up small parcels in small ships, it’s going be expensive!

What’s in it for the Buyer?

In the current environment, with global markets crashing and economies in tatters, it’s easier to see why someone might want to sell sugar to the Exchange. The Exchange is a safe haven and a guaranteed buyer. What isn’t quite as clear is why someone would want to buy that much sugar from the Exchange.

What if the buyer had access to excellent market analysis and knew the sugar was going to delivered in just one place: Brazil? Suddenly, receiving becomes more appealing. The buyer knows they are going to receive the best quality sugar and they can present the biggest vessel that can fit into a Brazilian port. They also have a 75 day window to do this. Buying sugar directly from another seller would probably involve a standard physical sugar contract giving a 30 day window.

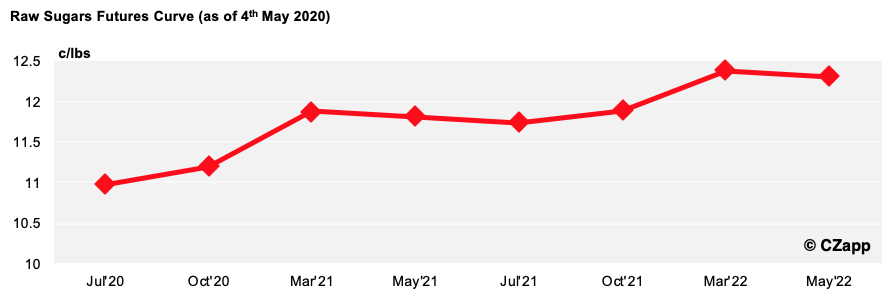

The benefits don’t stop there. Each of the futures contracts are rarely the same price. In this instance, the price of the May contract was lower than the price of the July contract. The 75 day window to pick up the sugar stretches from the 1st May until 15th July. The receiver is, therefore, able to buy sugar in July for the price of sugar in May!

What’s are the Risks for the Buyer?

Even with these benefits there are still risks in receiving sugar from the Exchange. The inland freight and port logistics in Brazil can only work so quickly. With so much sugar being exported from Brazil this can cause bottlenecks.

A port, by and large, acts on a first come first serve basis. If your ship turns up and there are other ships being loaded, you have to wait. The more vessels that are ahead of you, the longer this wait may be. If their vessel turns up and joins the back of a long queue, the buyer has to pay for the time his ship is sat waiting, which can be very expensive! This may be exacerbated by the COVID-19 lockdown in Brazil, limiting the efficiency of both inland and port logistics.