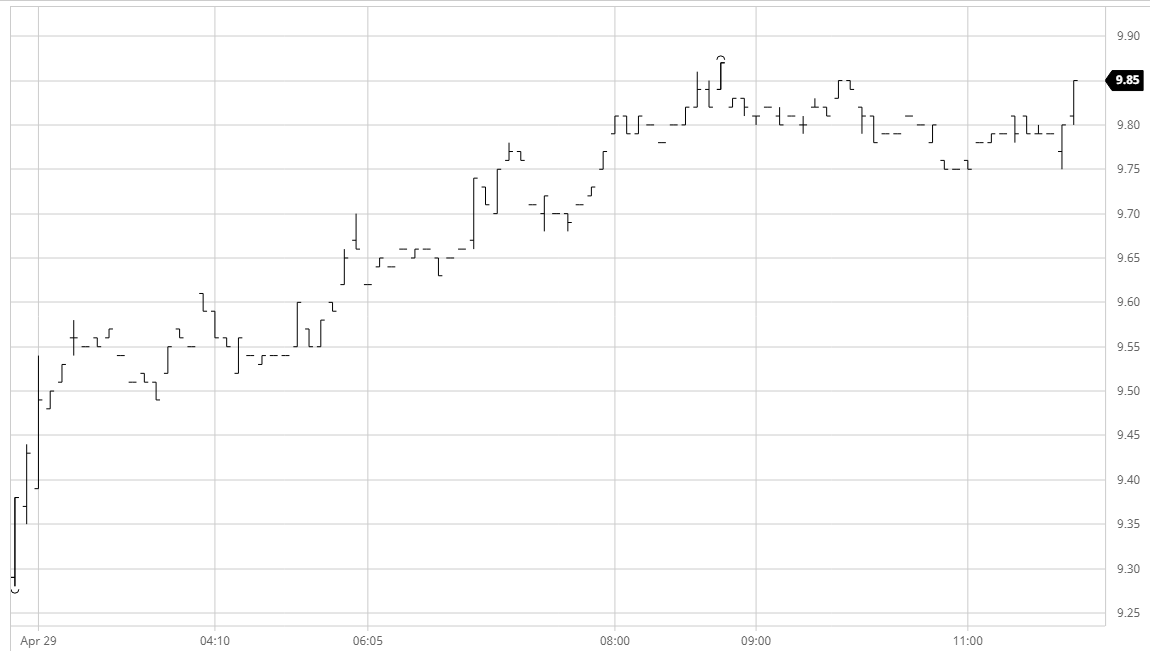

There was opening buying that spiked values higher during the first few minutes and the positive tone was maintained for the day with prices continuing upwards at a calmer and steadier pace than those initial moments. As has happened so much in recent times the market direction was being influenced by the macro with strength in the CRB encouraging smaller specs to take some cover while algo’s played from the long side. Further macro positivity emerged during the afternoon as the USDBRL followed up yesterday’s firmer performance by printing to 5.3729 intra-day amid talk that Paulo Guedes, the economy minister is now gaining control in the struggle with other officials and politicians over the federal budget. By mid-afternoon the push higher saw Jul’20 trading back above 10c, meaning that the last four sessions have seen two days of recovery to reverse the previous two days losses. This poses the question of whether the recovery may signal a bottom or it is merely corrective action. Fundamentals continue to suggest the latter, let’s see whether the macro continues to suggest the opposite.

No.11 Futures