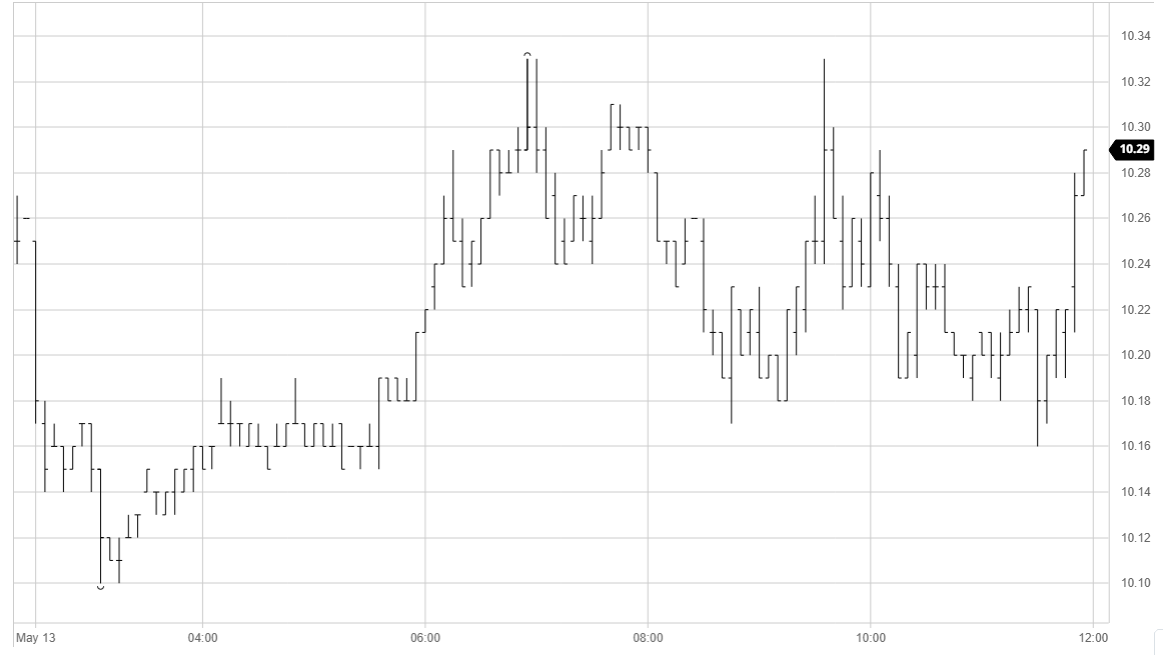

Recent range bound action continued with the market opening a little lower but only seeing very light volumes trade during the morning. In an environment where we have been largely disregarding fundamental news it was interesting to see prices push up to 10.33 on news that Iraq had agreed to cut oil supply, an indicator that short term specs remain engaged by an oil correlation and maybe an indicator that they could look to sell the market lower should June WTI head lower towards expiry in the same way that the May contract did. Conditions remained quiet into the afternoon and we also disregarded the continuing weakness of the USDBRL to remain either side of last night’s closing levels as the currency headed to a new low mark of 5.94. There was some spec buying in the closing stages (short covering?) which ensured that Jul’20 settled a single point higher, concluding a very quiet inside day.

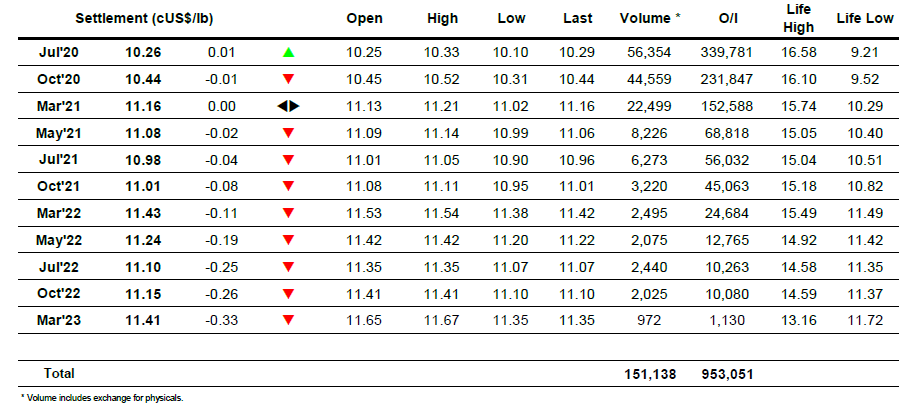

No. 11 Futures

ICE Futures U.S. Sugar No.11 Contract

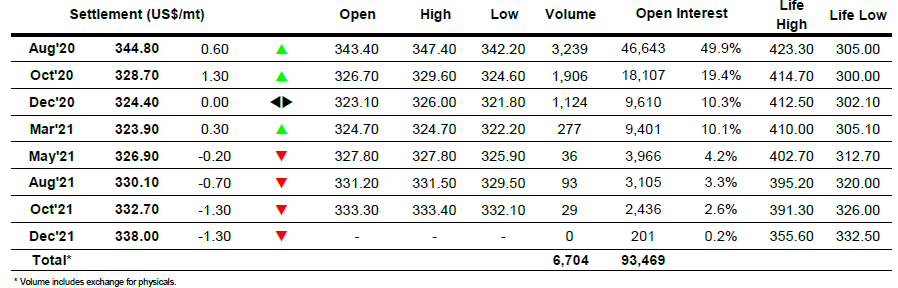

ICE Europe White Sugar Futures Contract