The day began very slowly with the recent sense of apathy towards the outrights continuing, only some moderate buying versus overnight sales in the Far East preventing us from sliding back lower. With the buying completed the market slipped back below 12c though it made little impact upon outright volumes as we again looked to the continuing index roll to provide the bulk of the activity. Remaining range bound only the announcement of the latest UNICA data seemed likely to exert any influence upon values, but this was received with only a whimper as the figures showed 42.113m tons cane / 2.933m tons sugar / 46.84% mix / 156.07 kg/t ATR which was closely aligned to most estimates. Instead prices simply continued within the range, hugging the lower end in the 11.80’s until the final hour when the usual defensive buying from longs appeared to dress the market back up. Failing to clamber back above 12c may inflict a little psychological damage and it will be interesting to see whether we continue to see the physical buying interest having now spent a few days in this area as without it we seem likely to look to test the recent lows again in the near future.

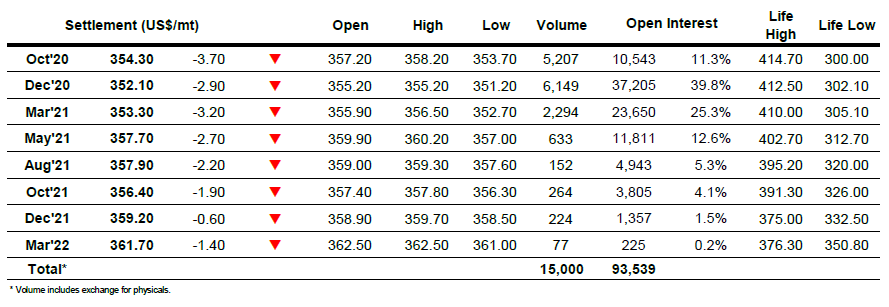

Oct – Sugar No.11

ICE Futures U.S. Sugar No.11 Contract

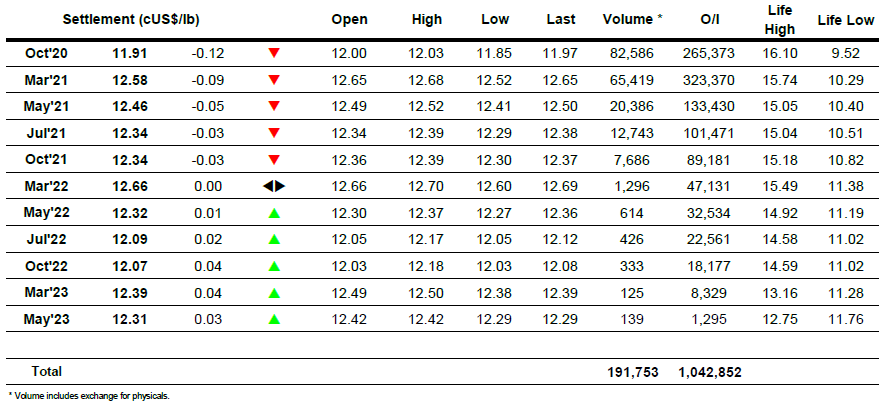

ICE Europe White Sugar Futures Contract