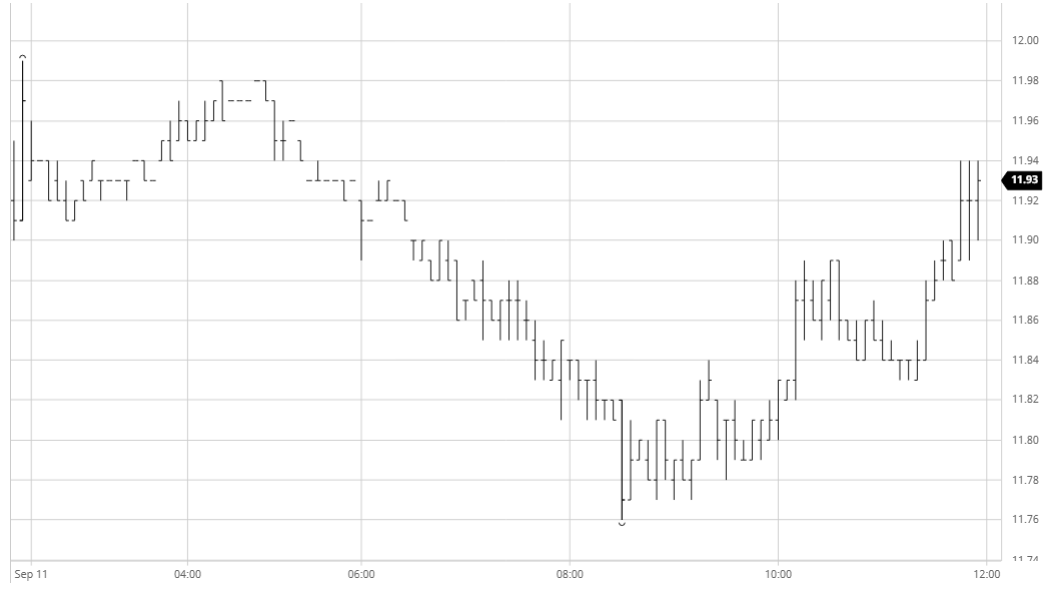

Morning buying had a lesser impact today and though we edged a little higher we would only reach 11.98 to match the levels seen on last night’s post close before beginning to fall back away. There was little in the way of fresh news and the grind downward lasted several hours as we searched out the recent 11.78, but though we reached this and saw a brief spike in volume as traders pushed marginally through to 11.76 there proved to be sufficient scale buying to hold values from falling any further. The selling at the lower levels from specs/algo’s looking to force prices down in search of stops led to a round of short covering later in the afternoon but that was about all as the wider environment remained quiet. Similarly quiet was the spread with this week’s index fund roll having failed to make any significant impact on the differential, today ranging only between -0.69 and -0.66 despite volume in excess of 36,000 lots. The usual closing buying emerged to try and paint some gloss ahead of tonight’s COT release which is expected to show a reduction in the net fund long though its unlikely to be sufficiently significant to lend any fresh direction at this stage.

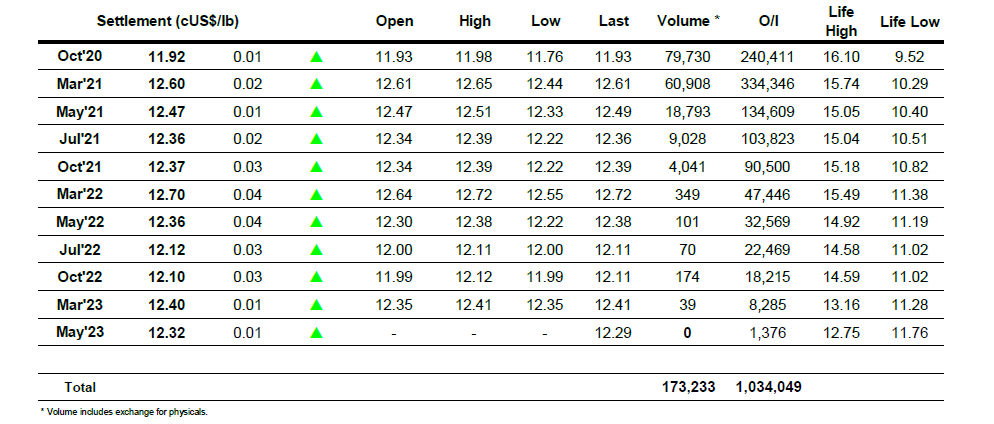

Oct – Sugar No.11

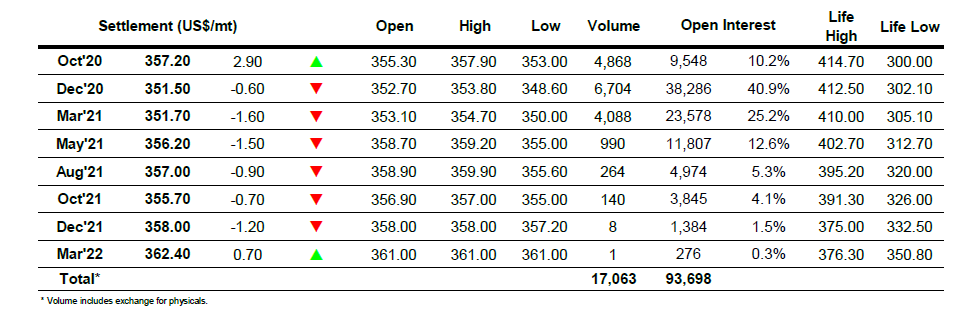

A marginally higher opening period could not be sustained and outright values slipped back to be slightly negative as the morning progressed. With only three sessions remaining until the Oct’20 expiry we are now seeing the last of the fine tuning as those that will not be involved in the tape head for the exit, though somewhat surprisingly the Open Interest remains steady at 9,548 lots having seen only a modest fall on steady volume yesterday. Oct/Dec’20 remained the most active position and pushed out to $5.50 intra-day as traders continued to roll forward, though with only a few hundred AA’s posted we are likely to see only a modest fall for the OI again come Monday. Outright values again languished with only Oct’20 showing positive due to the spread, and increasingly there is a feel of apathy that the recent slide lower may lead to further support testing, the first potential target for Dec’20 at 336.80 basis the July lows. A mixed closing period saw nearby values swing within a slightly wider band as day traders tidied positions ahead of the weekend.

Dec – White Sugar

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract