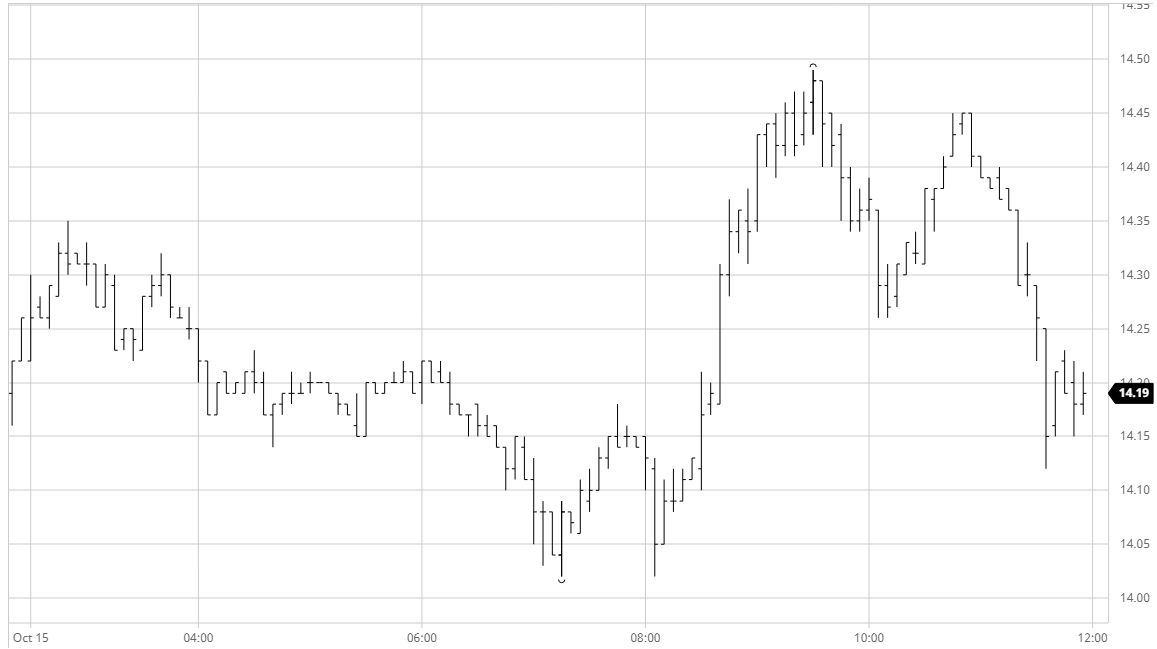

Mar 21 – Sugar No.11

The market continues to try and re-establish itself at the upper end of the recent range and this morning saw light buying push March’21 immediately up to 14.35 before stalling and dropping back into the range. In a low volume environment we than saw a gradual erosion over the course of a few hours and with buyers thin on the ground were trading down to 14.02 by early afternoon although spreads were holding up relatively well with March/May’21 unchanged at 0.49 points. An initial bounce proved short-lived and prices returned to match the 14.02 low, however holding this level then provided the catalyst for a rather unexpected rally with more significant buying pouring in from specs to push through the thin overhead environment and take March’21 into the 14.40’s. Better selling from producers stated to be seen as we approached Monday’s 14.55 high mark, with progress visibly becoming harder from 14.45 and stalling at 14.49 which led to some long liquidation. Tellingly the move saw a huge widening of nearby spreads which emphasised the spot spec nature of the buying with March/May’21 reaching 0.65 points (+0.16), March/Jul’21 reaching 1.17 points (+0.27) and March/Oct’21 a mighty 1.33 points (+0.30), though these gains softened as spread selling appeared to take advantage. A second push upwards fell slightly short of the first and with little other buying to provide support we fell back during the final hour on further spec/algo liquidation. By the close we were trading back into debit across the board, and though March’21 only settled marginally lower at 14.18 meaning that nothing has really changed the specs will feel disappointed not to have achieved some success for their efforts.

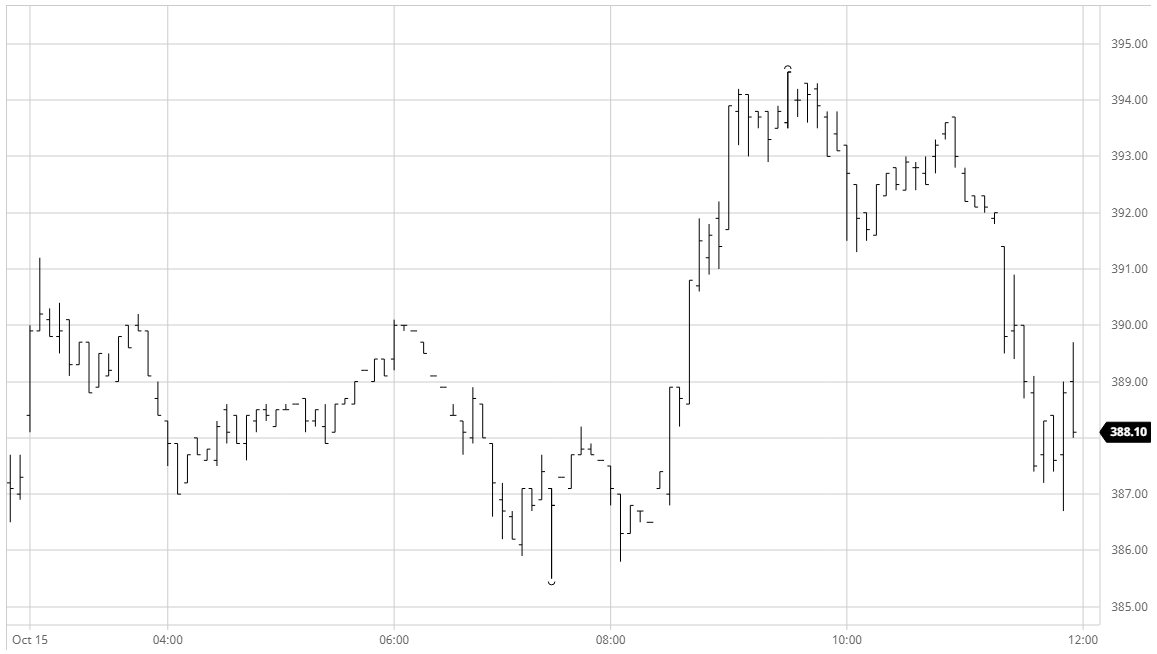

Dec 20 – White Sugar No 5

A rollercoaster week continued with Dec’20 immediately pushed up to 391.20 before stalling the recovery with a slide back down to 385.50 by early afternoon. Despite slipping back into negative territory there was a reversal of yesterday’s white premium losses for 2021 prompts with March/March’21 trading above $77, May/May’21 to $87 and Aug/Jul’21 at $89, though these highs were not sustained and later in the session we were trading back down once again. The afternoon bought a No.11 inspired rally which pulled Dec’20 to 394.50 and the Dec/March spread up to parity, the heavier spec buying for No.11 encouraging in some lesser interest to the whites despite a rather mixed macro and otherwise quiet environment, though with selling very thin it really did not take much buying at all to achieve. The rally was sharp and impressive but having stalled ahead of Mondays 395.90 high it struggled to regain its spark and eventually pulled back to mid-range against some long liquidation. Further selling into the close sent prices back within a couple of dollars of the lows with Dec’20 at 388.20 marginally higher but still providing a disappointing conclusion for the bulls.

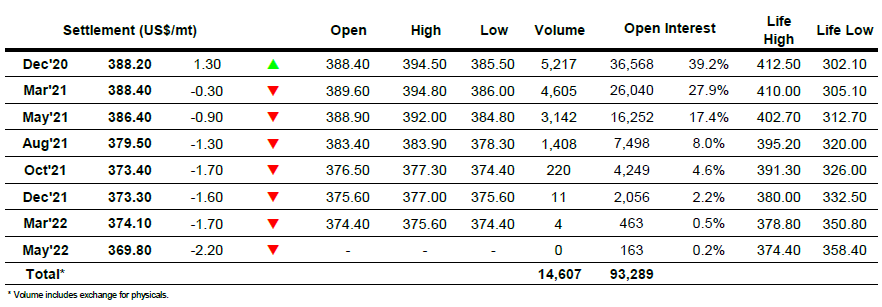

ICE Futures U.S. Sugar No.11 Contract

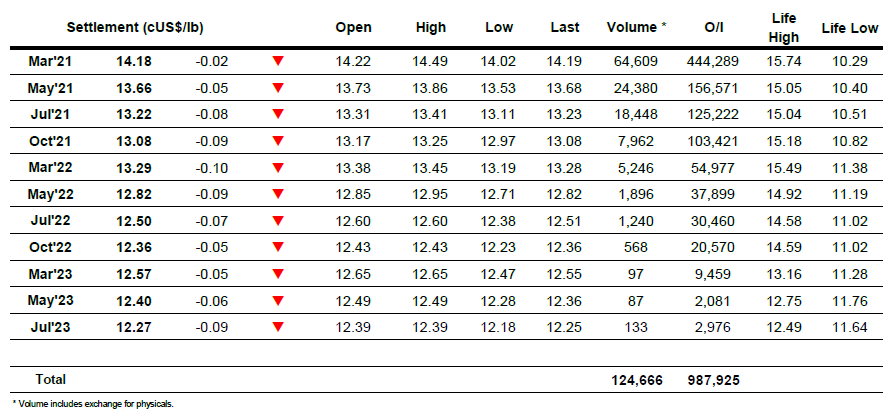

ICE Europe White Sugar Futures Contract