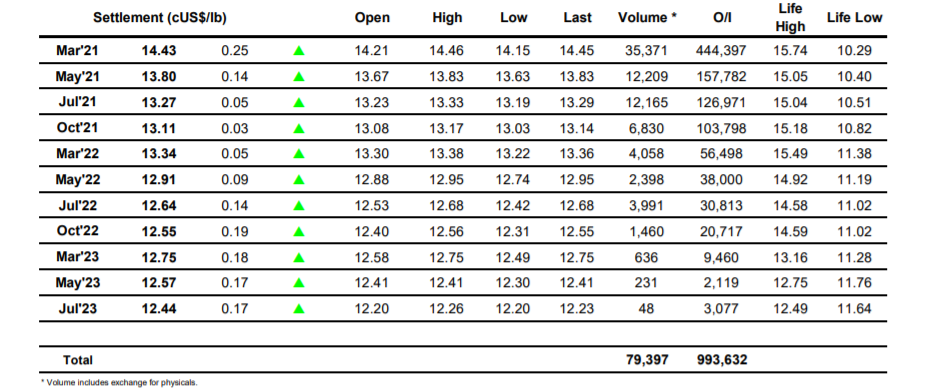

Mar 21 – Sugar No.11

The old saying that if at first you don’t succeed, try, try again certainly holds true this week as we saw the latest round of spec buying attempt to push the market further upward, quickly gathering up small early losses to set the move on its way. While in keeping with recent session the volume changing hands was relatively light the progress remained steady with the spot March’21 contract reaching 14.40 by mid-session with the nearby spreads repeating yesterday’s action and widening out once again. Hopes that specs may step up the buying during the afternoon quickly faded with the 14.40 level forming an intra-day ceiling and despite many making comment upon the potential positivity of the dry weather in Brazil combined with the continued silence from India over their policy we simply edged along within the range. This remained the case until the closing stages when specs returned with some aggressive buying to force a new session high at 14.46 and ensure a positive technical conclusion to the weekly chart despite the fact that today represented an inside day on the daily. Eyes now turn to the COT report which is expected to show another increase for the spec positon despite last Mondays volatile activity, raising the question of how much more they will be prepared to buy in order to maintain the market move.

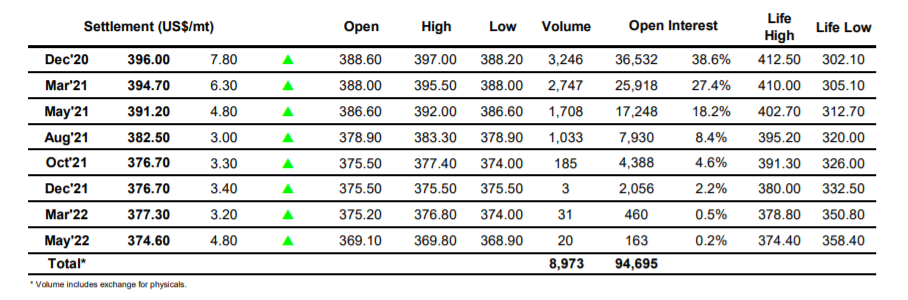

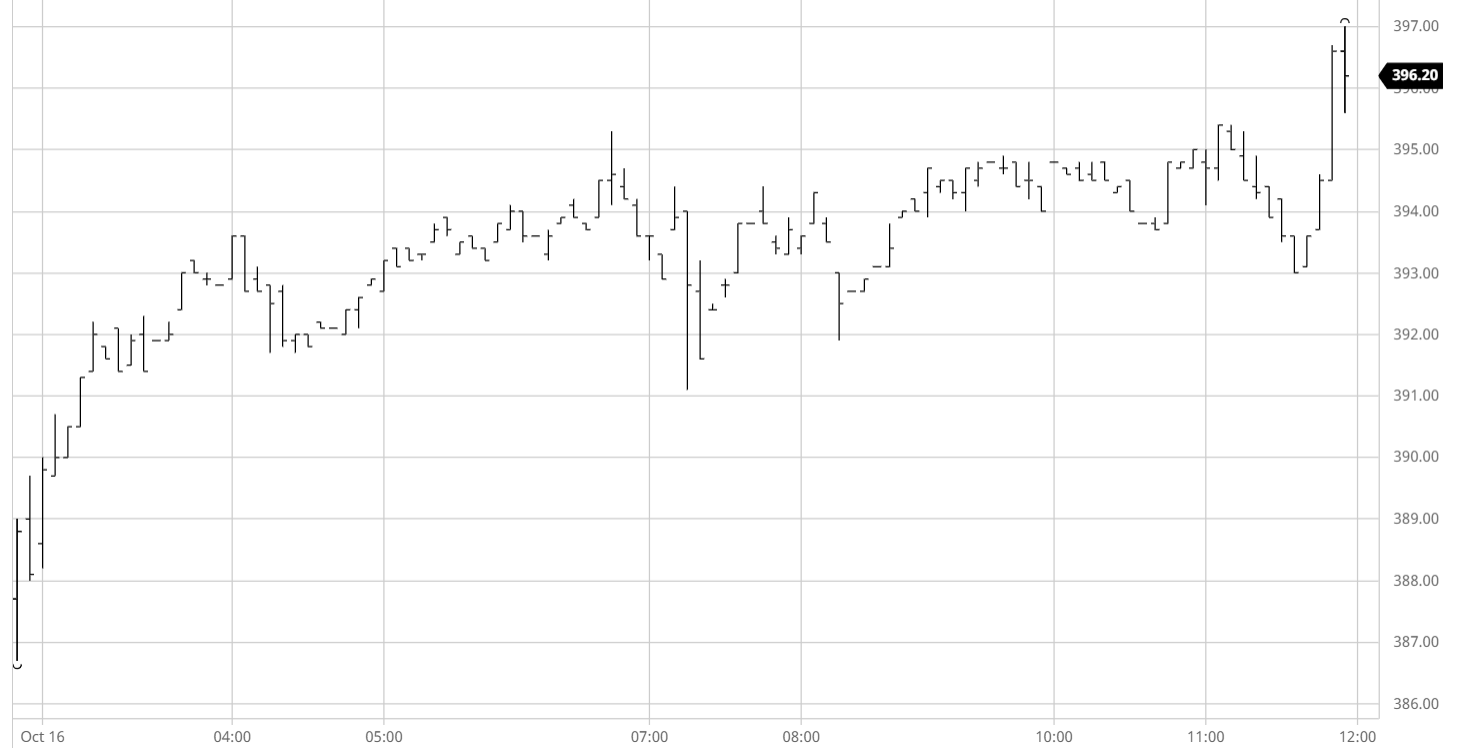

Dec 20 – White Sugar No 5

There was very little selling for the market this morning with the thin nature allowing longs to very easily push nearby values up by more than $5 within the first 90 minutes. There clearly and understandably remains a desire from the longs to continue defending their position and push upward at any opportunity and the buying continued into the early afternoon with a brief push above $395.00 for Dec’20 before stalling back into the range. Similar to recent days we also saw the white premiums moving upwards intra-day to nudge into overhead producer pricing, with March/March’21 to $78, while the Aug/Jul’21 nudged $90 for the first time in a while before slipping back by a dollar. Nearby spreads meanwhile were firmer than in recent days with Dec’20/March’21 having recently stalled at parity today finding the strength to work through to a widest $1.50 premium. The afternoon saw prices continue within the range until the final 10 minutes when a burst of defensive buying sent Dec’20 through Mondays levels to a new recent high of 397.00, ensuring technical strength as we ended the week.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract