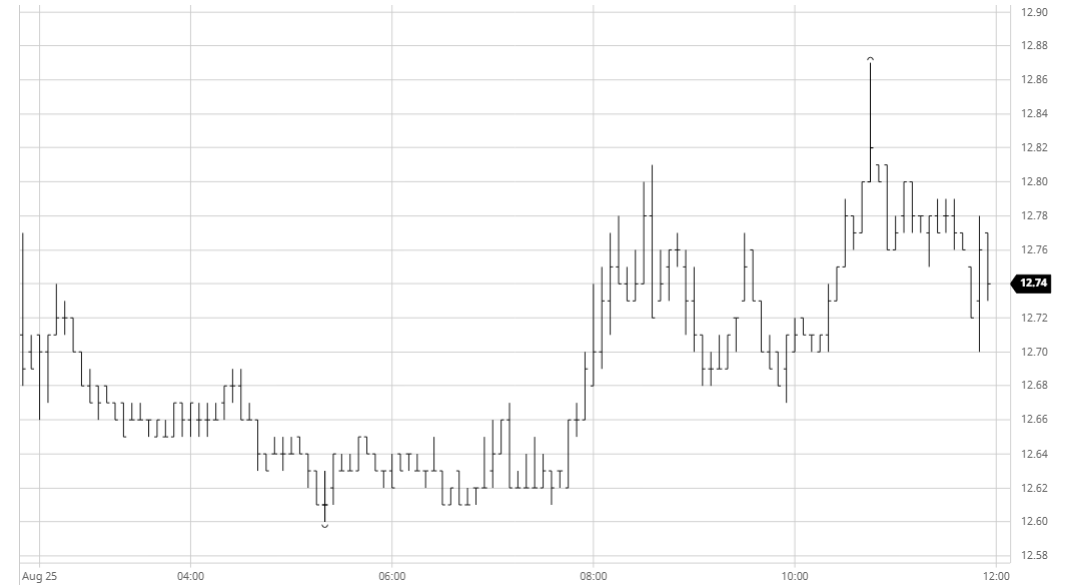

It was a somewhat quieter affair today as following on from three successive sessions of decline we saw the market make efforts to consolidate within the range to provide some kind of footing for the longs to attempt to rebuild from. This did not prevent the morning from being played out almost exclusively within the red column as Oct’20 edged sideways within the 12.60’s for the most part, but inevitably the US morning brought with it a little more buying interest that allowed prices to push back to positive ground albeit in a rather subdues manner. The same could not be said for the whites which are continuing to endure a period of struggle leading to narrower white premium values, though having declined to $81 for Oct’20 we may now be nearing short term lows as these levels will have removed refiner interest from the equation. No.11 did see a brief burst of spec/algo activity which led to session highs later in the day but that was insufficient to trigger outside interest and we quickly slipped back to the range to conclude quietly in keeping with the day that had passed, and although Oct’20 settlement at 12.76 did break the downward sequence there was little to suggest that we may see anything other than a continuation of the range for the coming days.

Oct – Sugar No.11

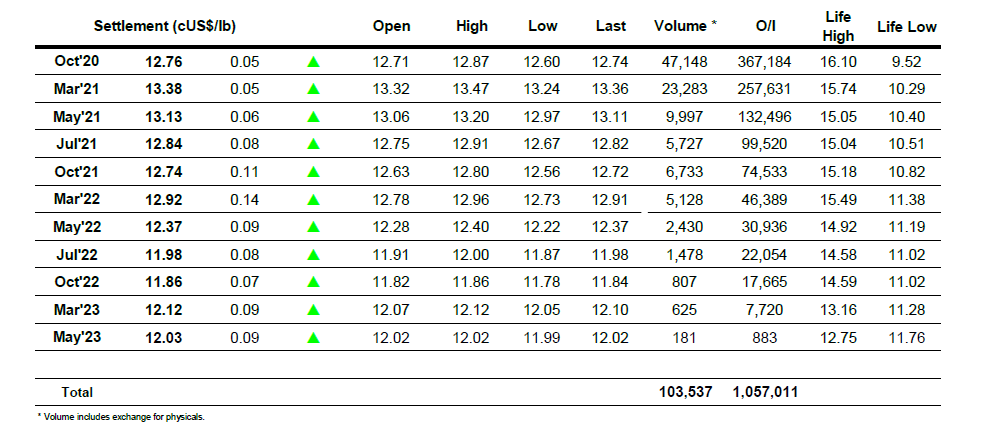

ICE Futures U.S. Sugar No.11 Contract

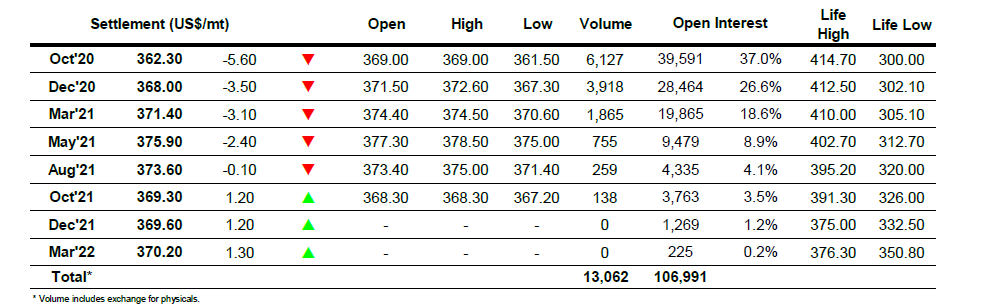

ICE Europe White Sugar Futures Contract