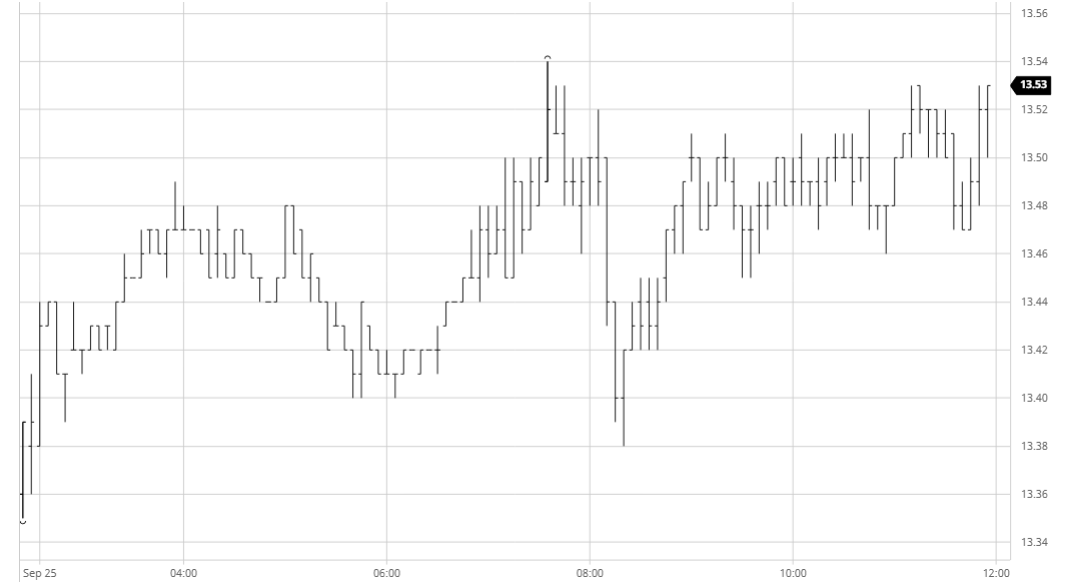

Early trading saw prices edge upward to record steady gains however the action was reminiscent of yesterday’s range bound session and we were lacking any kind of spark which might enliven proceedings. There remains a sense of apathy within the CRB as recent dollar action has taken the momentum away from commodities and in the absence of any fresh fundamental news we are struggling to generate fresh upward momentum. News from the first Thai crop survey that production will fall next year only served to confirm expectations and was disregarded by a market which remains dominated by bearish Brazilian and Indian numbers and though there remains a desire from specs to push upward it seems that this will only happen if the macro obliges to provide the necessary support. Notwithstanding this we did edge a little higher to 13.54 during the afternoon, stalling just shy of this weeks 13.57 high before pulling back into the range as buying eased once more. Producer activity was limited to scale selling down the board despite the USDBRL returning to 5.58 to improve returns, while for the spot Oct’20 we saw more than 12,000 AA’s posted alongside solid spread volume for Oct’20/Mar’21 ahead of next week’s expiry. Prices pushed back towards the earlier highs during the final hour, ending the week positively from a technical standpoint keeping the market at odds with the wider fundamentals.

Mar 21 – Sugar No.11

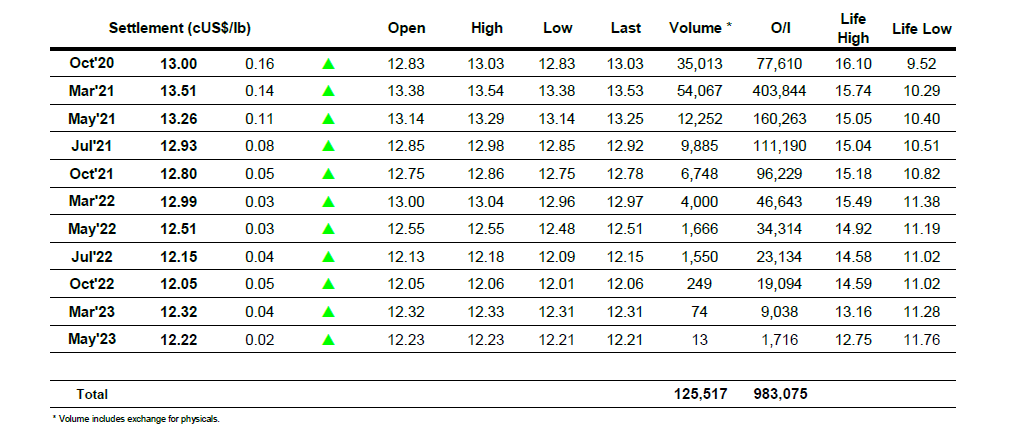

Initial gains for nearby positions were eroded over the course of the morning with the market still struggling to regain the momentum of last week despite the best efforts of specs to pursue the long side. The pullback put white premium values under pressure, giving back some of yesterday’s gains with March/March21 back beneath $78 at one stage before some buying reappeared and pulled values away from the lows. What followed through the afternoon could best be described as steady range bound action with no real buyer standing out yet with values remaining firm despite an ongoing apathy from the wider commodity macro. Spreads meanwhile were incredibly quiet as Dec/March held a mere 0.30 cent range throughout the session, while further down the board spread volumes were incredibly light even by usual expectations. Buying arrived during the final hour to leave values closing just shy of session highs, placing the market on a solid technical footing to try and push higher should macro conditions allow.

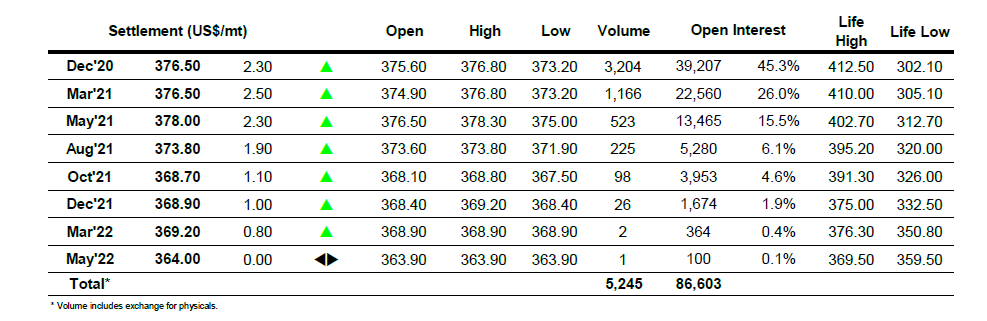

Dec 20 – White Sugar No 5

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract