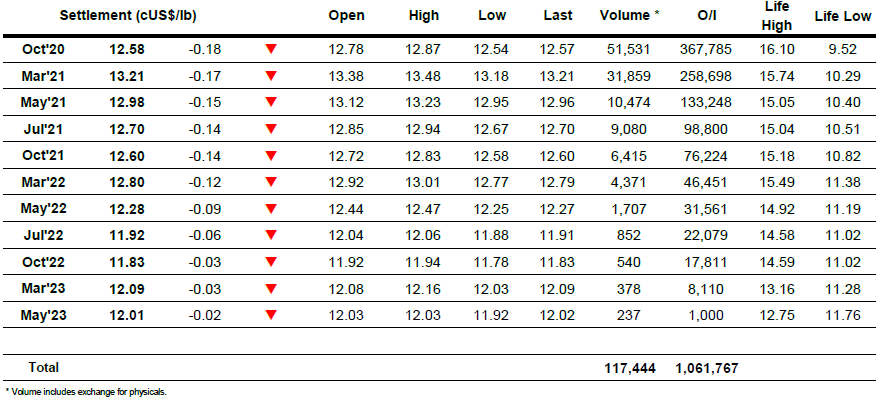

There was some light buying around during the early part of the session which sent Oct’20 up to 12.86, however as with the past couple of days the push upwards lacked substance and prices soon faded back towards overnight levels. The US opening, so often synonymous with a run of buying instead saw a burst of spec led selling that led the front month down to 12.56, suggesting that the exhaustion seen through the whites in recent days has more substance and that a continuing retreat into the range is required for the near term at least. While the push downward was short-lived the market struggled to recover and despite the UNICA numbers showing sugar production very marginally below estimates (46.4m t cane / 3.22 m t sugar / 47.7 % mix) the market struggled to respond and remained at the lower end of the range. Heading in towards the close we were right back on session lows and we ended the day relatively weakly suggesting that we may look towards the recent 12.41 low during the second half of the week.

Oct – Sugar No.11

ICE Futures U.S. Sugar No.11 Contract

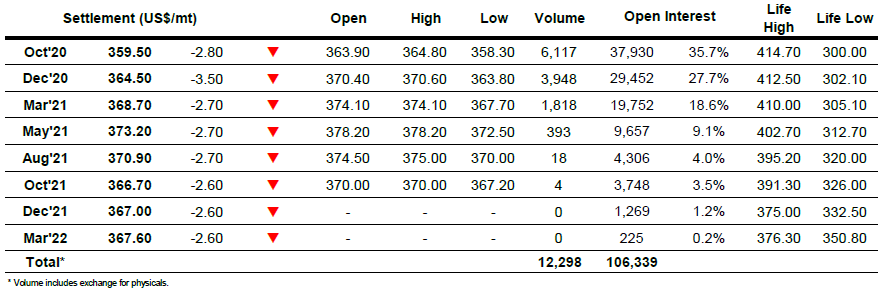

ICE Europe White Sugar Futures Contract