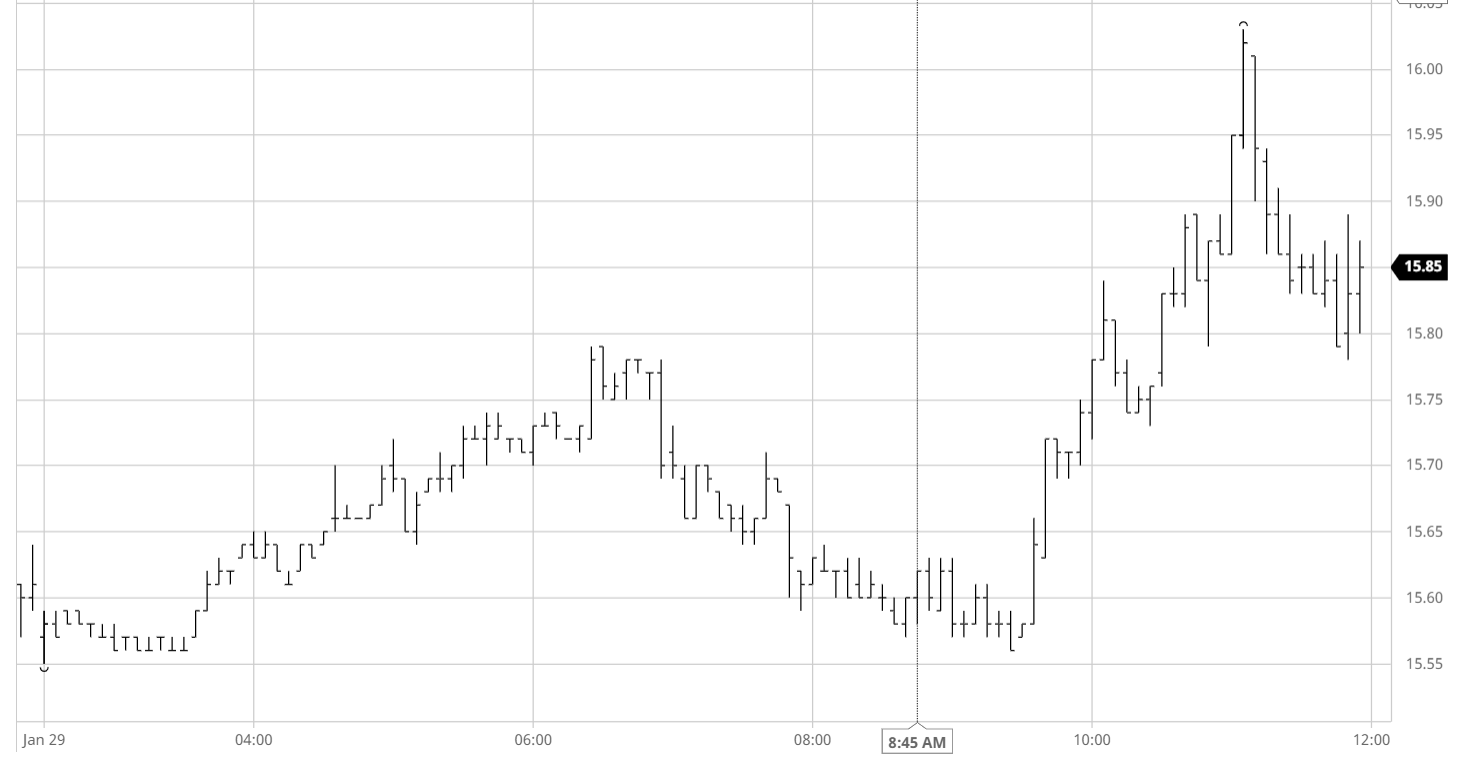

Sugar #11 Mar ’21

No.11 continues to show some resilience though whether todays efforts will provide the basis to reinvigorate the upside remains to be seen. Initial apathy was soon broken with the latest in a series of spec led pushes higher and over the course of the mon ring we saw March’21 edge up towards 15.80 on low volumes with little resistance seen as we continue to go over the same ground. As the buying faded so the market eased back down once again and when by mid-afternoon we found ourselves matching the morning lows in the 15.50’s it seemed as though we would conclude the month on a negative note. The specs of course had other ideas and maintaining their recent persistence they once again entered the market midway through the afternoon and drove March’21 upwards with significantly more force than their morning effort. Across a couple of waves of buying we saw the print month reach a daily high at 16.03 but similarly to yesterday’s effort the 16c area could not be maintained and the final hour had prices back within the range once more. The rally did have a positive impact upon nearby spread values with the March/May’21 reaching a widest 0.80 points before falling back late on to end the day at 0.75 points. There was some MOC buying which attempted to push values back up to conclude the month more positively however it met with some end of day position squaring to end a choppy close with March’21 settling at 15.83.

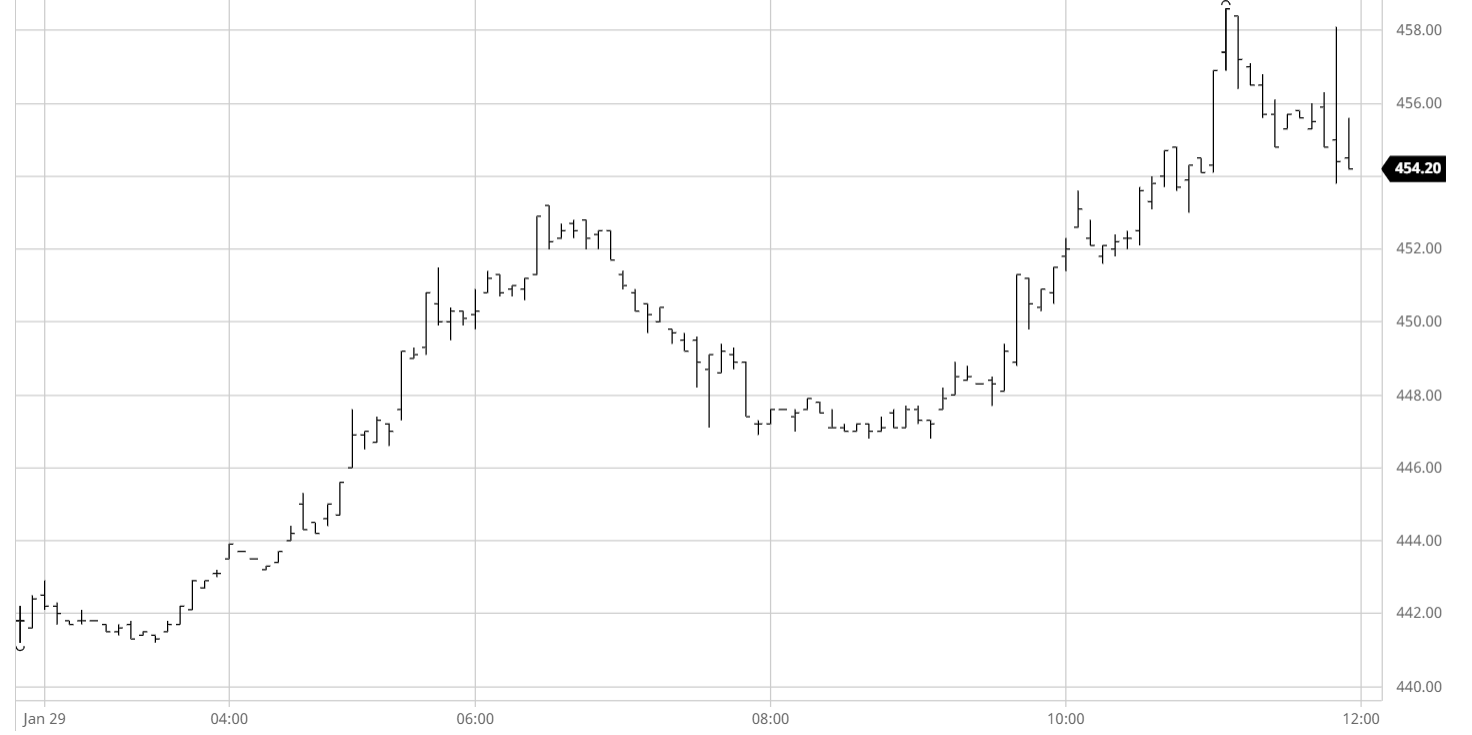

Sugar #5 Mar ’21

A muted start to the day saw nearby values initially little changed on low volumes with members of the trade seemingly disinterested while many consumers are continuing to stand away from the market hoping for better pricing opportunities. Prices then began to climb away from the early lows with the rise led by buying (and rather limited selling) of the March/May’21 spread which following some heavy pressure during the first part of the week was making sweeping gains, reaching up towards $17 and in so doing taking March’21 above $450 before the morning was over. The gains began to fade once more during the early part of the afternoon but despite the rest of the board falling back closer to last nights levels the spot month remained buoyant with the spread unwilling to give back the earlier gains. Indeed as the afternoon progressed these gains were built upon and we ultimately reached session widest trades at $20.10 for March/May’21 and $17.50 for May/Aug’21. With such strength at the front of the board there were also strong gains seen for white premiums with March/March’21 rocketing out beyond $105 while May/May’21 shot through the $100 mark to be touching at $103. The session high for March’21 was recorded during the final hour as another push from specs saw March’21 trading all the way to $458.60 though some long liquidation brought us back by a few dollars ahead of the close. A volatile closing call ranged between $453.80 and 458.10 and when all was said and done a stronger settlement price for March’21 at $456.10 was established to conclude the month.

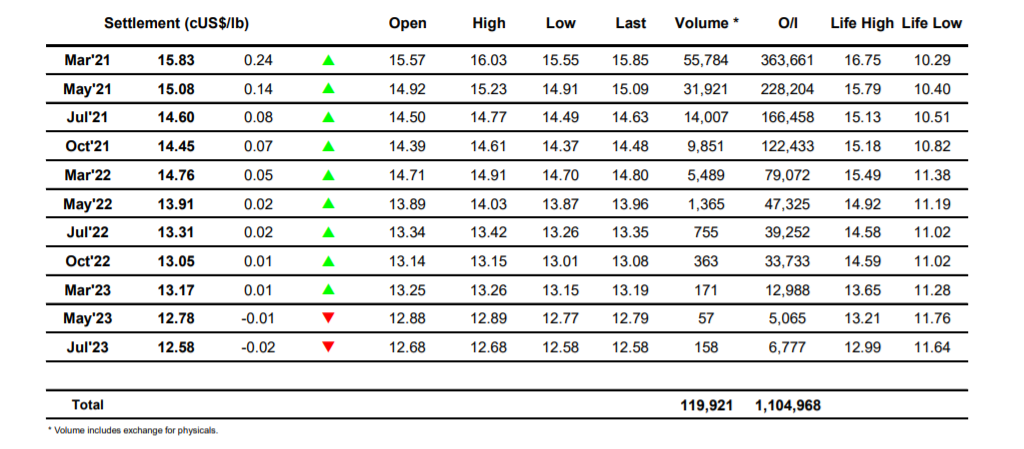

ICE Futures U.S. Sugar No.11 Contract

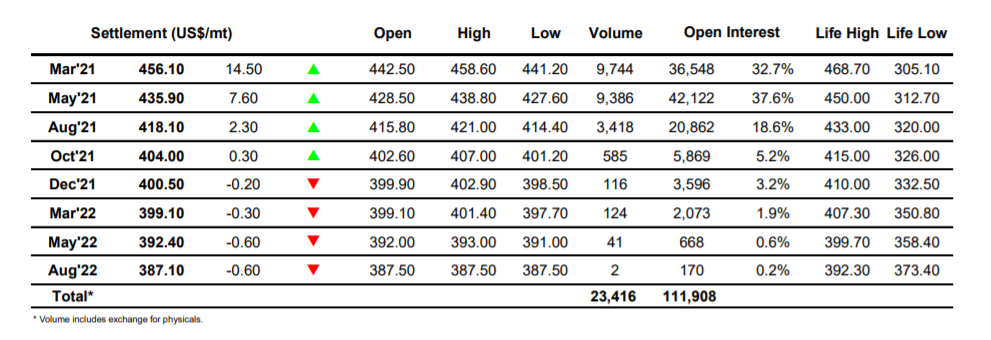

ICE Europe White Sugar Futures Contract