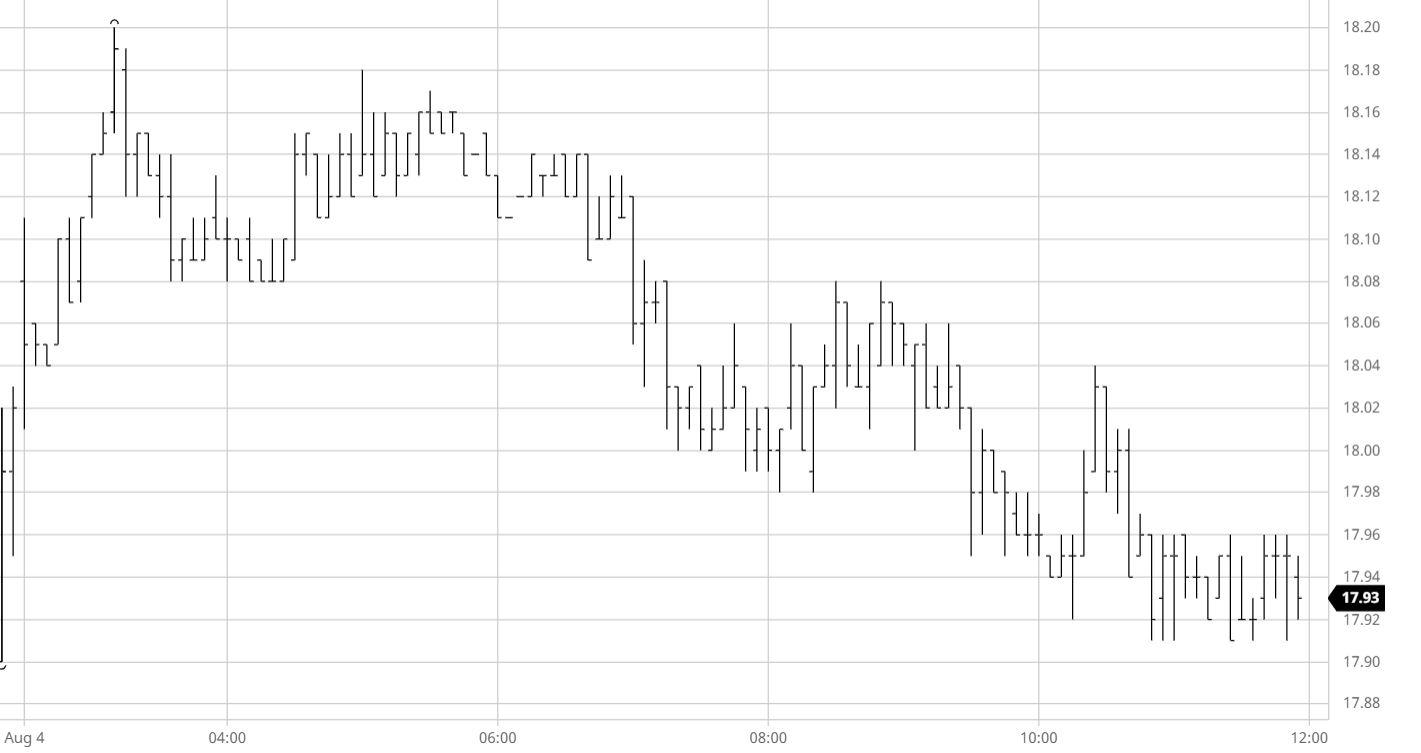

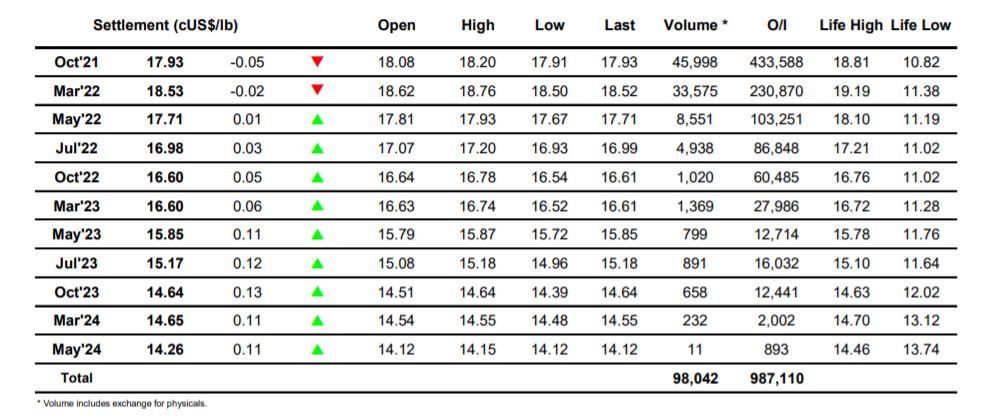

Sugar #11 Oct’21

Some early buying for Oct’21 looked to set a positive tone and reinvigorate the move started yesterday afternoon but despite an initial push up to 18.20 the move lacked any significant buying and we soon eased into a consolidation pattern a few points below. The macro was providing very little assistance with a mixed picture being skewed negatively by a weaker energy sector and during the early afternoon this factor led prices to ease back a touch further before finding light support at unchanged levels. The only area finding noteworthy activity was the Oct’21/March’22 spread which lost some more ground and traded to -0.60 points and in such a low volume environment this seemed to deter buyers from stepping back into the flat price and so leaving Oct’21 to nudge along aimlessly in the 17.90’s. Such was the quiet nature of the day and lack of spec activity that the market did not even change course with any position squaring late on, concluding the quietest day for some time with another settlement price in the 17.90’s, on this occasion a mere 2 points lower at 17.93.

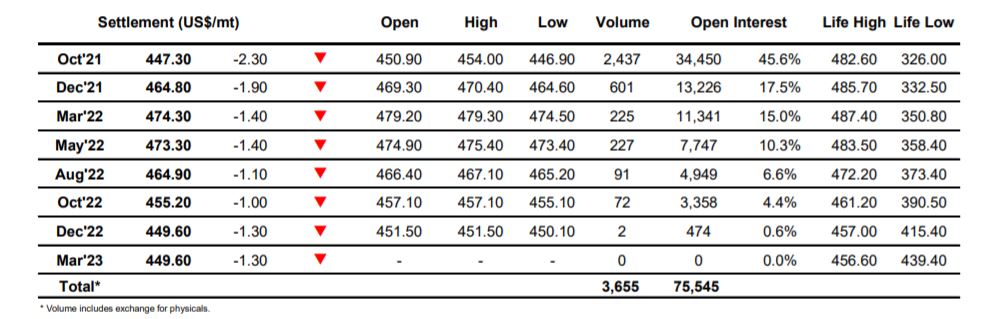

Sugar #5 Oct’21

Despite seeing an incredibly low volume of just 86 lots over the first 30 minutes of trading the Oct’21 contract somehow clawed its way up to $454.00 to maintain against No.11 before easing back and consolidating in the region of $452. With activity remaining light throughout the morning we looked towards the US morning in the hope that more interest could be generated for sugar or the macro to inspire some activity, however with this also proving to be a damp squib we simply eased back further to sit around unchanged levels. The ongoing quiet environment led prices to drift down further to $447.00 as the afternoon progressed but with the Oct/Dec’21 holding relatively well at -$17.50 there was little prospect of falling back to the recent lows and most traders continued to stand aside. Continuing at the lower end of the range through to the end of the day Oct’21 eventually settled at $447.30 with most participants simply happy to end the tedium and hope that tomorrow brings greater interest and activity.

While the white premiums saw only very limited volume the apathy for the flat price led values to contract by a dollar or so on the day to end with Oct/Oct’21 at $52.00, March/March’22 at $65.80 and May/May’22 at $82.90.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract