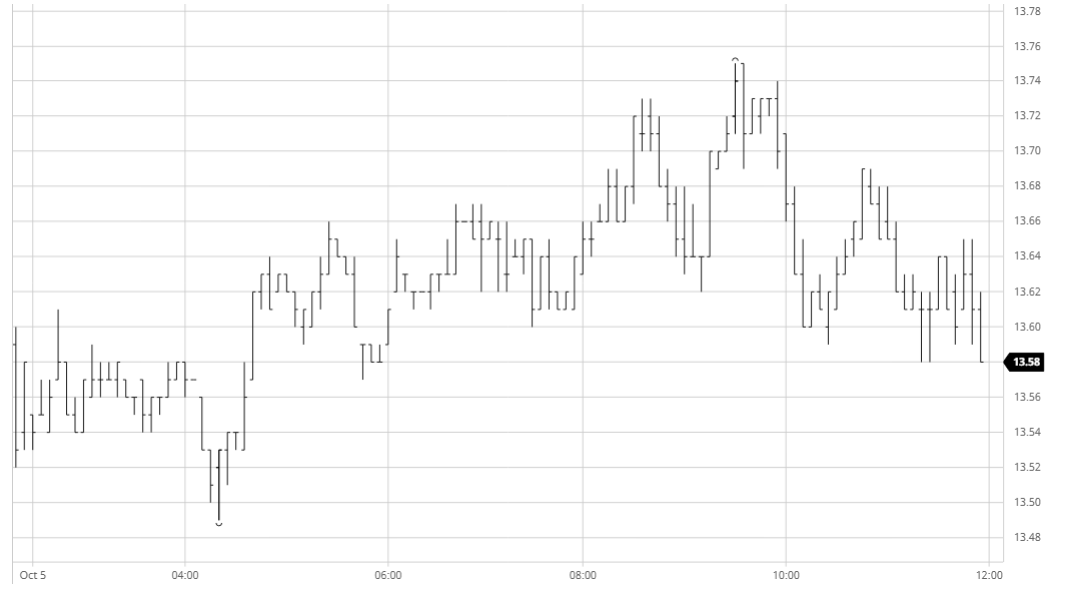

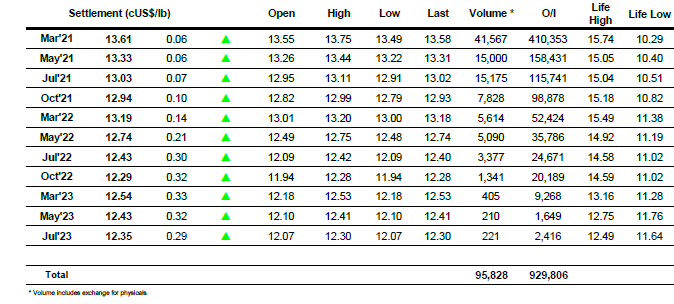

Mar 21 – Sugar No.11

With no significant fresh fundamental news the market remains focussed upon the ongoing situation regarding in the US regarding Trump’s health and the forthcoming election. Last night’s hospital drive by motorcade to present an image of improving health had been well construed by markets this morning with equities trading higher, while a mixed commodity macro was being skewed to the upside by a firmer energy sector. Despite this Sugar had a rather muted opening and in early trading was working either side of unchanged levels on very light volumes. In keeping with the recent pattern the trade are still largely absent and so it was no surprise to see the market remain within recent parameters into the afternoon when speculative involvement picks up, though even here March’21 initially struggled to escape from the mid 13.60’s. Friday’s COT report showed that the speculative community have increased their net long to a recent high of 200,904 lots and it seemed that despite an improving macro there was little fresh buying appearing save for a brief push into the 13.70’s which fell short of the 13.77 double top resistance level. The higher levels meanwhile continued to see some scale selling though producers were less aggressive than of late with currency moves for the BRL back to 5.58 not working in their favour, but despite this the buying waned and we fell back into the range. The final couple of hours proved to be quiet and we ended the day showing only modest net gains which may be considered disappointing to the longs given the failure to match the macro.

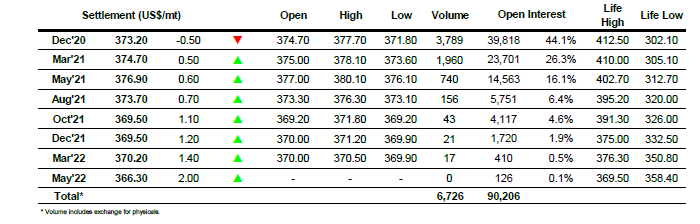

Dec 20 – White Sugar No 5

The new week began with focus remaining on the macro environment which is dominated by the situation in the US, and the positive noises being made by the presidential office over Trump’s health were being well received by equities and the energy sector with many markets cautiously higher as we began. Initially we moved either side of unchanged however by late morning we had joined the macro to be consistently working to the upside though volumes remained painfully light. Despite the net gains being made there were concerning signs from both the nearby spreads and white premium values which were both showing to display any real strength as Dec’20/March’21 fell short of parity before slipping back to $-1.10 while the March/March21 WP drifted between $75 and $76. A brief spec push to 377.70 during the afternoon fell well short of last week’s highs and despite an improving macro picture we were struggling to find a spark to match what was happening elsewhere. Prices slipped back to mid-range during the final couple of hours and remained there until the closing stages when selling appeared to push values back into deficit. Dec’20 traded to a new session low 371.80 late on while March/March’21 fell to $74 to send a negative signal as we headed out.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract