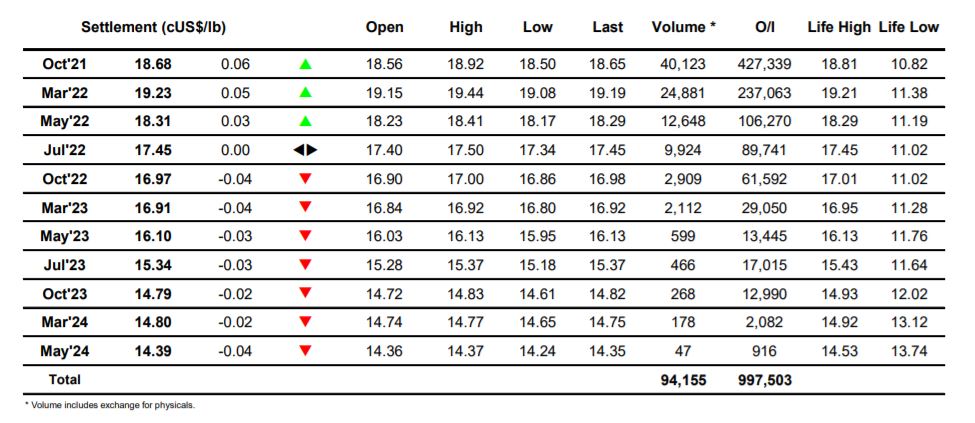

Sugar #11 Oct’21

Opening selling sent Oct’21 down to 18.50 however such was the nature of yesterday’s technical strength that we immediately picked back up to hold in the 18.60’s with the longs clearly keen to ensure that the picture did not break down. A tight range prevailed throughout the rest of the morning as it became clear that further upward progress would be in the hands of the specs and as the US morning got underway they did not disappoint in showing their intentions with a sharp push upward to challenge and break the 18.81 contract high. Beyond this we found further resistance from the yearly first month continuation high at 18.94, something which proved a tougher nut to crack and led to a hour or so of consolidation beneath the new Oct’21 contract high mark of 18.92. With momentum lost and the buying easing up it was inevitable that we would find some long liquidation send values back into the range, and we fell to leave something of a bump on the intra-day chart with Oct’21 back consolidating the 18.60’s/18.70’s. With spreads having flattened back out due to the retracement of Oct’21 and March ’22 (the remainder of the board had struggled to follow) the closing stages continued to be calm, leading Oct’21 to settle marginally higher at 18.68. Overall while not a bad performance the market for today at least has exhibited signs of fatigue in the same way as previous rallies. Specs will be sure to defend as always though without some fresh news or macro stimulus we may find the continuation double top presents a reason to slip back into the range once more.

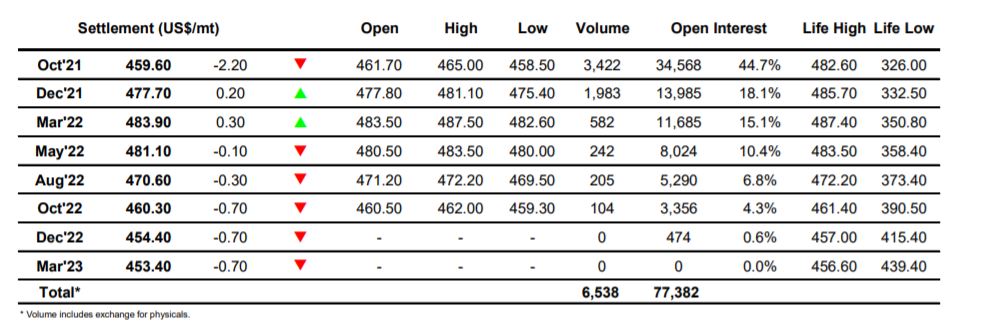

Sugar #5 Oct’21

Yet another very slow morning for the whites saw values edging sideways on low volumes and with our sentiment in the doldrums right now attention continues to move toward the No.11 to provide direction. It was only during the early afternoon that even this arrived and when it did the drive was to go higher in a continuation of technical strength which is not mirrored here due to the lack of desire for sugars and resulting white premium weakness. Still we pulled up to $465.00 on the coattails of the raws before softening back into the range when the spec buying eased, though at this stage we did at least find some premium support which maintained Oct/Oct’21 above $50. There was no such support for the spreads however as the afternoon progressed and we saw Oct/Dec’21 pushed back towards its lows with trades at -$18.50, not a great sign of confidence if a rally has any chance of sustaining. The rangebound action through the later afternoon was ended with some very aggressive closing selling which sent Oct’21 to a session low %458.50 with settlement to end the week at $459.60.

The late selling impacted on white premium values and left Oct/Oct’21 ending the week poorly at $47.80, while there were more moderate losses down the board as March/March’22 closed at $60.00 and May/May’22 at $77.20.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract