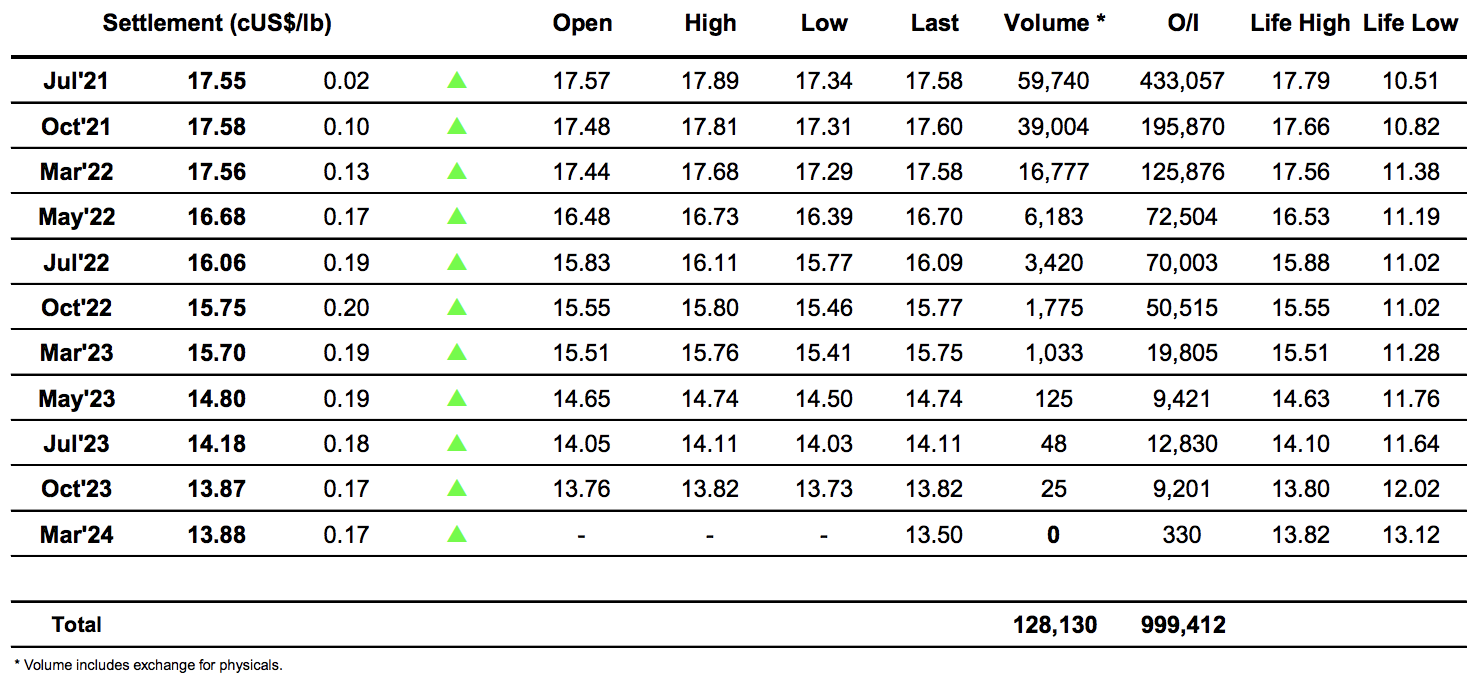

Sugar #11 Jul’21

Building upon the technical positivity for sugar and the strength within the wider commodity sector we found strong buying from the word go this morning that took Jul’21 surging to a new life of contract high of 17.89 before anyone had the chance to draw breath. The move was on volume of around 6,000 lots and though things soon calmed with prices easing back from this high mark as the buying diminished we still continued positively in the vicinity of 17.75 throughout the rest of the morning. This consolidation set the basis of a foundation to look higher again once the US based specs came into play however with no sign of any second wave of buying we instead saw some of the early longs looking to dump their positions back out which set values back towards unchanged levels. There were mixed signals from the macro with the CRB positive overall due to softs/ags/metals while conversely crude and the energy sector were struggling in deficit, and though the USDBRL at 5.27 could ordinarily be seen as a positive the lack of recent producer pricing renders it somewhat meaningless at the present time. A push back down to 17.34 was soon reversed by some defensive buying and this set prices back to the centre of the range where calmer trading ensued as we moved through into the closing stages. Despite the flat price being supported late on to ensure net gains on settlement value we saw weakness for the Jul’21 spreads during the later afternoon which flags ongoing concerns over the sustainability of the higher outright move, Jul/Oct’21 ending the day at -0.03 points discount. The outright settled a couple of points up at 17.55 and despite the spread movement there will doubtless be a desire from the specs to try and keep things firm tomorrow to ensure technical positivity ahead of the weekend.

Sugar #5 Aug’21

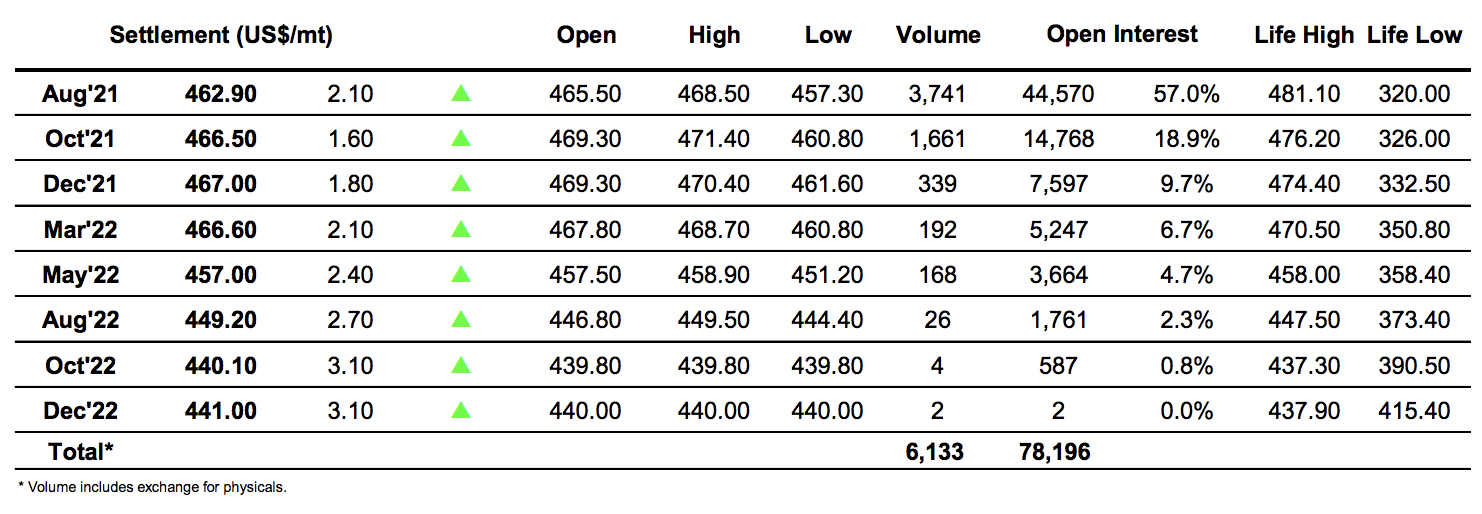

A continuing surge in No.11 values had us called to begin firmer and the market duly obliged with a significant gap established for the intra-day chart as Aug’21 immediately printed above $467.00. Soon after we recorded a high at $468.50 and with the market already almost $8 higher so early in the day it was to be expected that we settled into a sideways consolidation pattern with the longs content to maintain the gains ahead of the busier afternoon period. As Americas based traders joined the fray we remained in the same positive consolidation but it soon became apparent that there was no second wave of buying emerging and instead we embarked on a downward path with some position-squaring taking place. Over a period of two and a half hours the price continued to erode and we filled the overnight gap on the way to being more than $11 shy of the morning highs at $457.30. Following on from this sizable correction the price quickly rebounded back to the centre of the range (short covering possibly) where we then levelled out through the closing stages. Spreads were rather calm on the day and we saw Aug/Oct’21 make small inroads in regaining some of the significant recent losses, though by the latter stages the gains were just $0.50 to provide a closing value at -$3.60. Outright values remained mid-range with Aug’21 settling at $462.90.

· Spot white premium values showed further signs of recovery today and by the close we saw Aug/Jul’21 trading at $76.00, though there were small losses for Oct/Oct’21 at $79.00 and also for March/March’22 at $79.50.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract