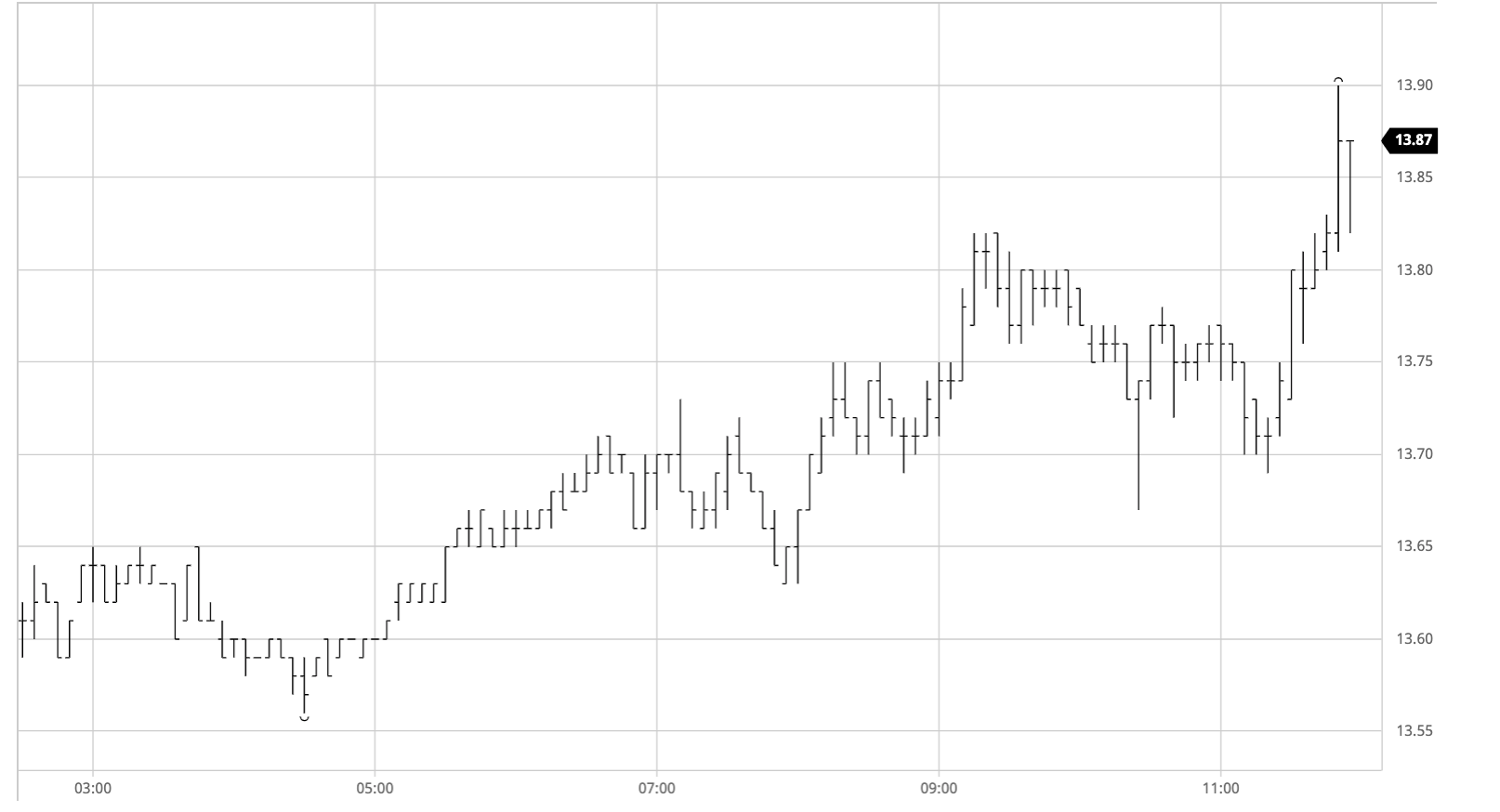

Mar 21 – Sugar No.11

The market experienced another slow morning, trading sideways within a 10 point range on very low volume despite the macro maintaining yesterday’s recovery and showing further gains. The US morning brought with it a little more buying which nudged prices up into the 13.70’s once again, edging into the scale selling though initially stalling a few points shy of the recent 13.77 high. The situation changed a little by mid-afternoon with a more concerted push by specs keen to capitalise on the opportunity to search out potential buy stops in the hope of driving towards 14c, however despite the strength of the BRL limiting selling from that region (USDBRL to 5.49) there were no worthwhile stops and we only reached 13.82 before consolidating. Values slipped back a little but were swiftly defended on any dip with the spec longs keen to maintain the technical strength garnered by breaking above 13.77, and with the energy sector still leading the macro gains we saw fresh spec buying push March’21 to new session highs approaching the close. These were surpassed on the call with aggressive buying sending March’21 to 13.90, ensuring a positive technical close from which to try and keep pushing.

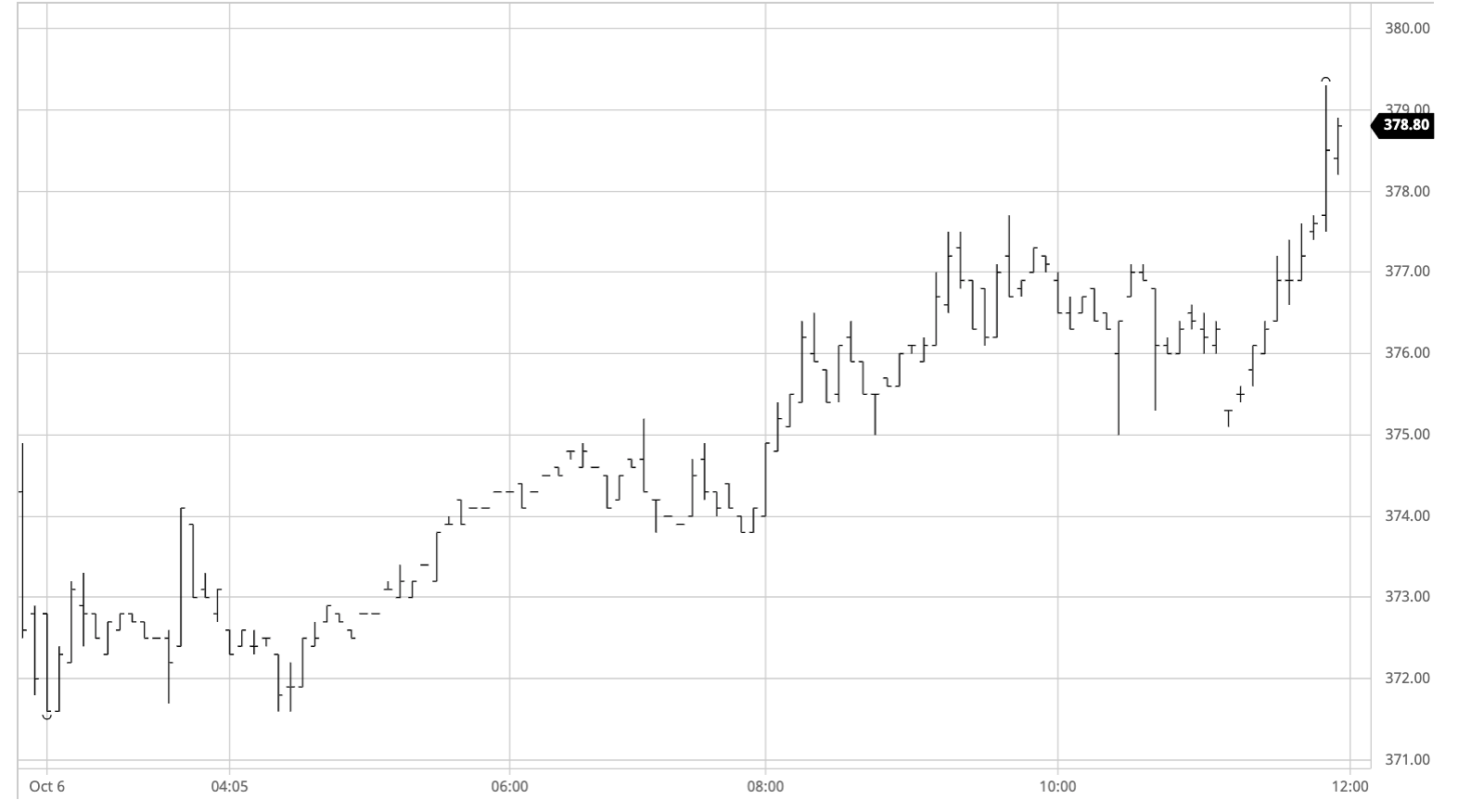

Dec 20 – White Sugar No 5

Last night’s disappointing whites close hung over into early trading today with Dec’20 slipping to $371.60 initially before stabilising and edging along nearer to unchanged through the rest of the morning. Buying picked up a little during the early afternoon as a supportive macro environment helped to pull things upwards, though as with resent days it seemed that a large part of the spec activity hit the No.11 market and it was the white premium orders which did much of the work as the algorithm tracked No.11 values. The premiums themselves remained relatively flat through all of this action and though the move pulled nearby values up above yesterday’s session highs March/March’21 continued around $74 and May/May’21 around $83. Having slipped back from session highs as we entered the final hour a fresh wave of spec buying emerged to pull values upwards once again, culminating in a high of 379.30 on the call to ensure the technical strength that the specs had been targeting.

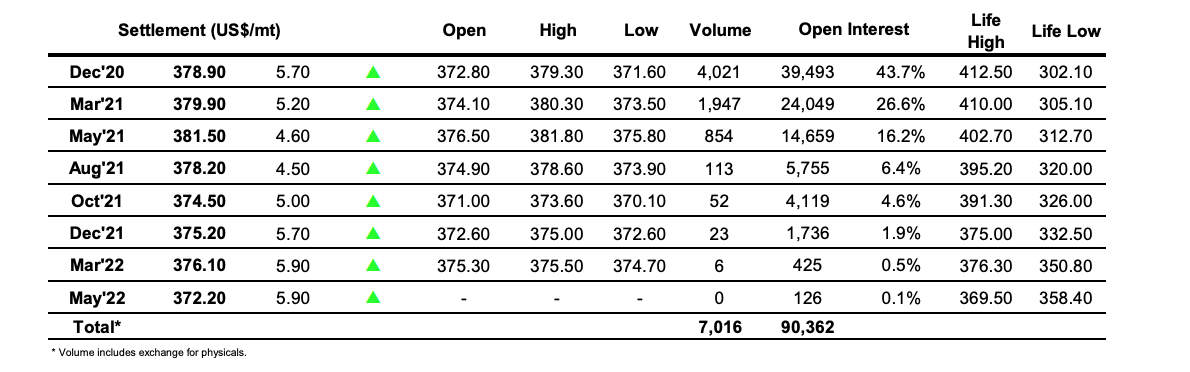

ICE Futures U.S. Sugar No.11 Contract

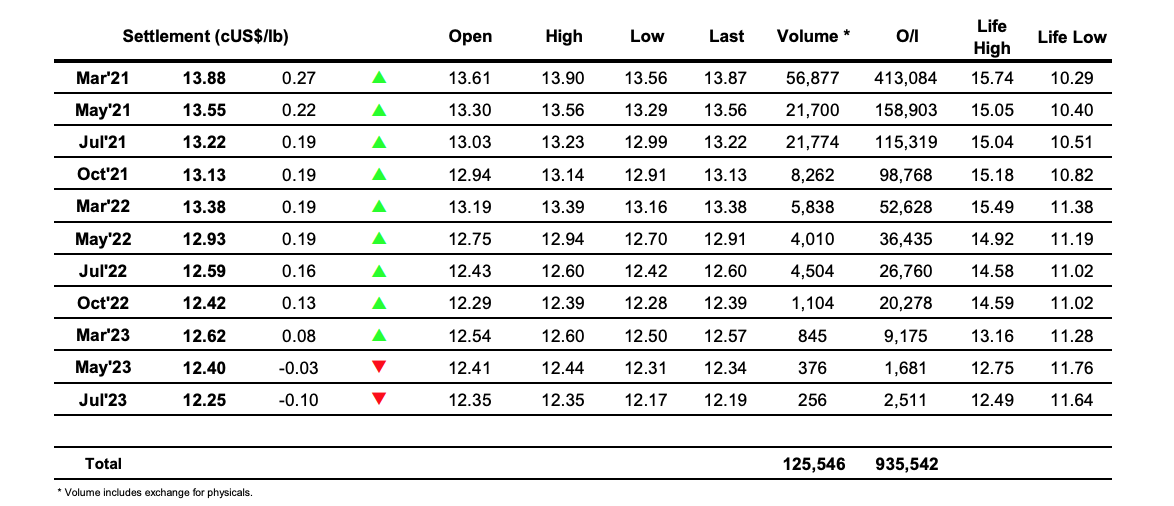

ICE Europe White Sugar Futures Contract