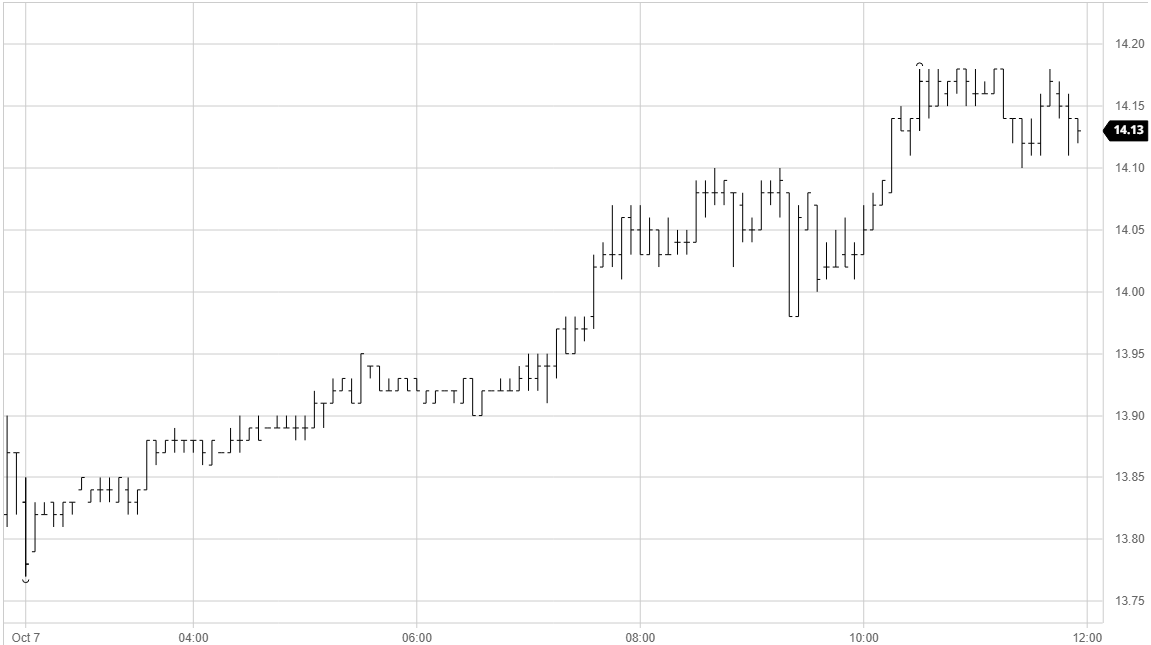

Mar 21 – Sugar No.11

Yesterday’s strong technical close above the near term 13.77 double top gave renewed encouragement to the speculative sector keen to build upon their growing long holding and following a slow sideways start we gradually began to climb upwards once more. Through the morning the gains were slow and steady with only moderate volumes changing hands, and progress stalled in the mid 13.90’s with more significant producer selling showing ahead of 14c. It took a burst of more aggressive fund buying to punch through this area and when this occurred prices found it a little easier to push on with selling more limited for a few points until fresh orders started to be fed in. Interestingly given how dominant the Brazilian growers have been from the short side we were today seeing pricing emerge from other regions, the 14c handle clearly acting as a psychological magnet to pull them in. Unlike in recent days the gains were being driven despite the macro which was today showing some weakness with the larger losses seen for energy products where recent gains were pared, with newswires attributing the move to concerns over next year’s Brazilian crop due to dry weather, though this may be a case of making the story fit the move given just how far away that is at present. Spread values were incredibly firm with the back half of the board remaining in net deficit, emphasising the reliance of the move upon nearby spec buying, however that did not deter them with any hints of a dip quickly defended and further new highs recorded during the final couple of hours. Despite continued solid buying the rally stalled at 14.18, however we did not fall back by very far ensuring a positive settlement level at 14.14 and maintaining technical strength.

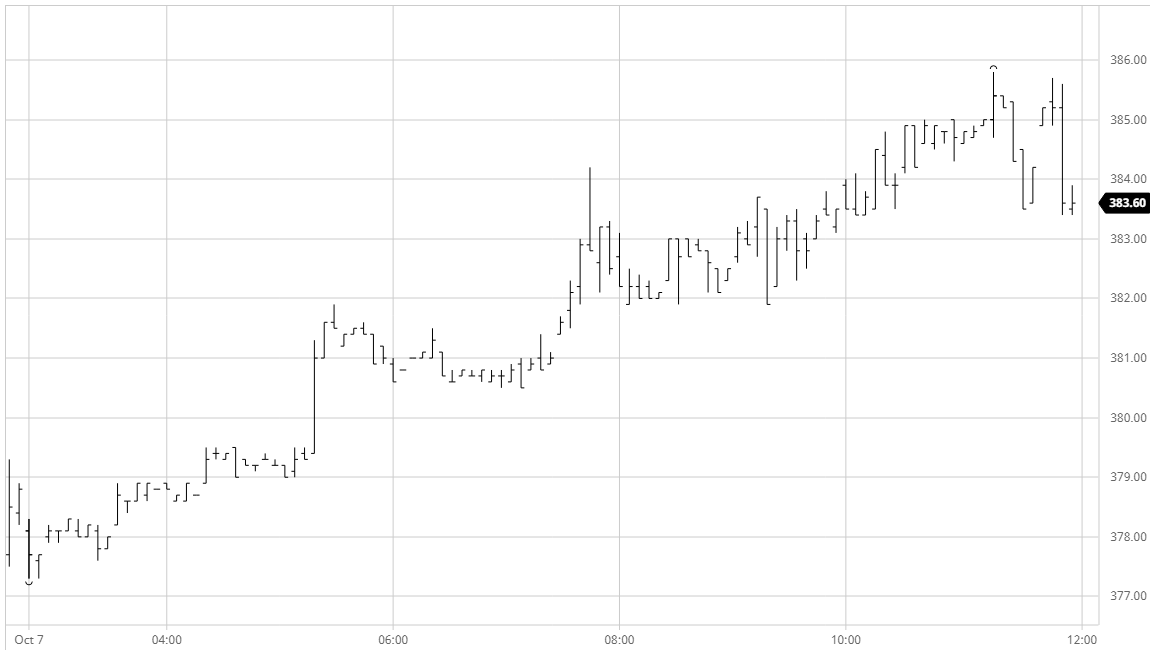

Dec 20 – White Sugar No 5

The recent strong technical performance has encouraged specs to continue pushing from the long side and the market was on the front foot from the start today, quickly beginning to climb up towards $380 basis Dec’20. This set the tone for a continuing gradual climb with better volume seen for the front two positions than has been the case in recent days showing that some spec interest has returned to the whites rather than us just being pulled along by the No.11. Late morning saw some buy stops triggered as we moved beyond $380, action which briefly pushed white premium values out by a dollar although we then consolidated and only resumed the upward path during the afternoon when the larger fund volume in the No.11 picked up. Progress remained steady but largely unspectacular as by late afternoon we reached $385.80, breaking above the August highs to reach levels not seen since early March just before the Covid-19 led collapse. The closing stages then saw a mixture of profit taking and continued support from longs and though the settlement level at 384.10 was shy of the session high it was above 383.80 and so maintains good technical strength.

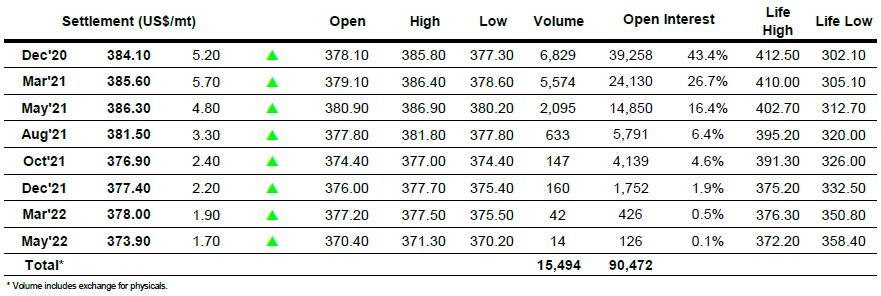

ICE Futures U.S. Sugar No.11 Contract

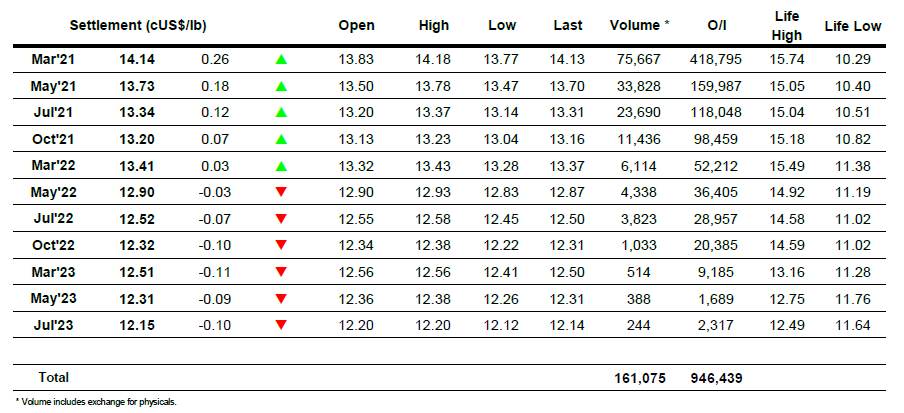

ICE Europe White Sugar Futures Contract