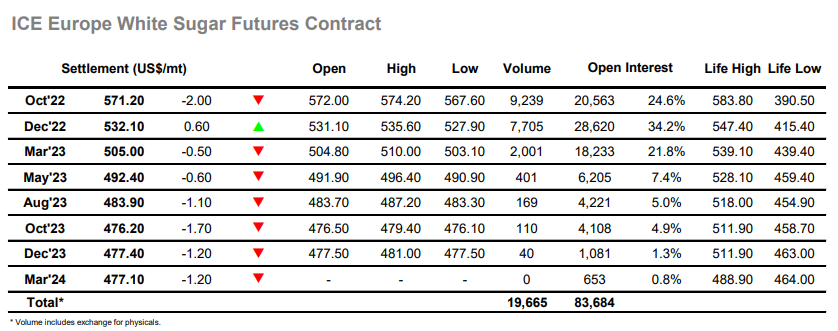

A slow morning for No.11 saw Oct’22 continuing to trade either side of 18.00, the recent apathy continuing as underlying fundaments and a lack of new spec activity paralyse the market to a range. A little more buying interest began to emerge from the shorter-term specs early in the afternoon (unexpectedly given that the recently buoyant whites were having a calmer day) and their actions pushed the front of the board back up into the lower 18.30’s, however once again the elevation from 18.00 discouraged any continuation buying. This led prices to descend back into the range as the afternoon progressed, the movements merely representing a sideshow as liquidation sent Oct’22 back down to the 18c pivot during the final hour. Volume was more sizable than of late due to strong activity in the Oct’22/March’23 spread as rolling gets underway from both trade and specs ahead of the main index roll. Their movements saw the differential widen to 0.32 points at one stage in the afternoon before falling back to the lower 0.20’s as index activity moved it, with daily Oct/March volume topping 60,000 lots. The session concluded on mildly higher with Oct’22 at 18.05 and the spread at 0.23 leaving the near-term parameters fixed for another day.

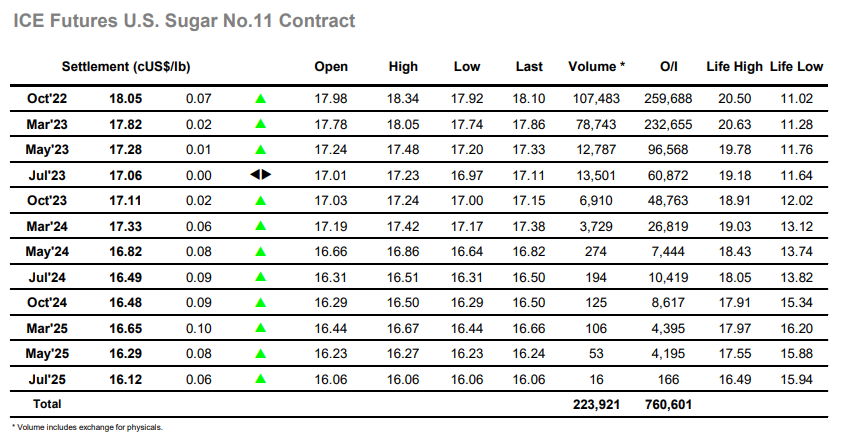

The market was lacking some of its recent zest as attained by a mildly lower opening, and in quiet early trading prices nudged along sideways. Most of the volume was again emanating from the consistentlyactive Oct/Dec’22 spread, with pressure being applied to send the differential back down beneath $40 as a small part of the recent gains was given back. The flat price meanwhile saw the smallest movements for many days, selling of the nearby premiums keeping Oct/Oct’22 pegged in the lower $170’s with buyers more conspicuous than has been the case in recent times. This same situation rumbled along ad nauseum for the duration of the session, efforts to push the flat price back higher failing to gain any traction in the first real recent show of exhaustion while a large percentage of the volume continued through the front spread. The only spark of interest arrived during the final minutes as some aggressive buying took Oct’22 back to session highs, though by then settlement had been made at $571.20 to end a very ordinary session.