Sugar #11 Oct’21

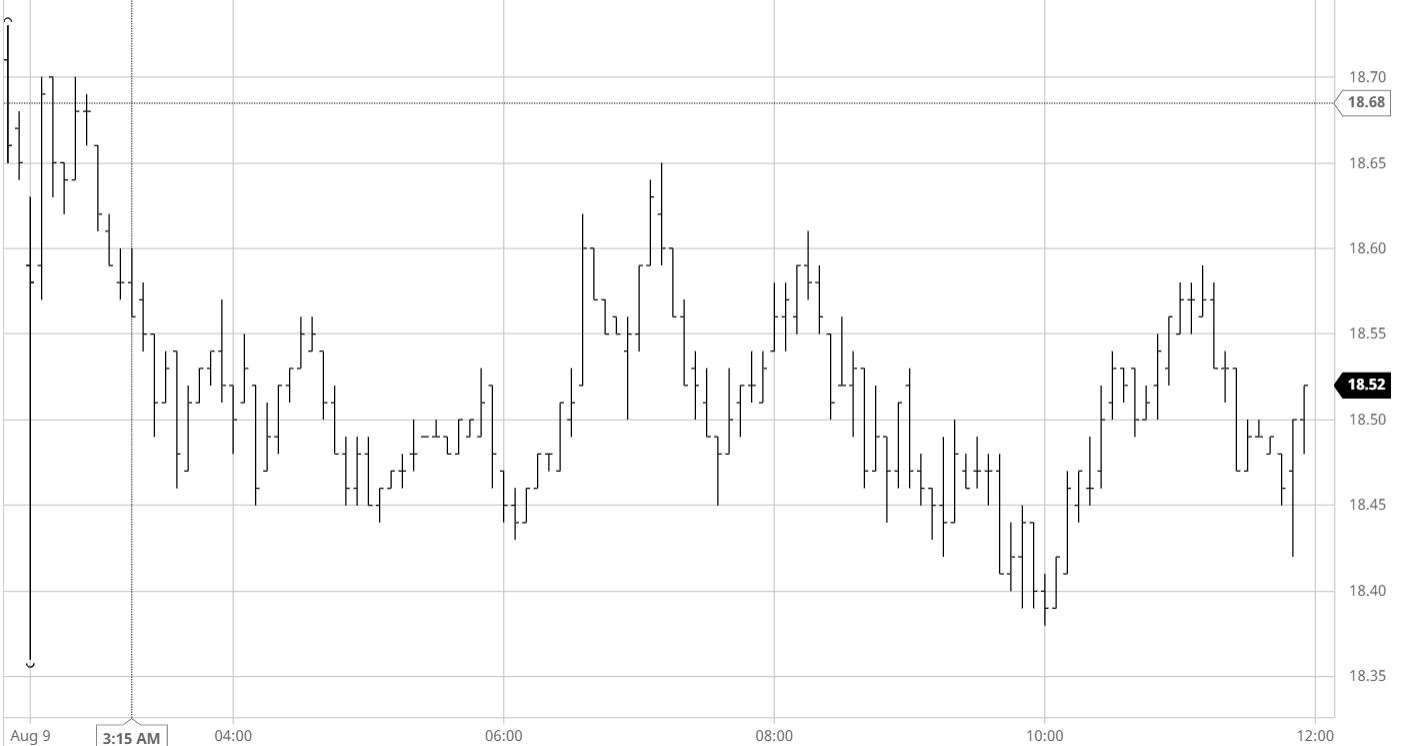

Commencing a new week there was immediate volatility with opening selling sending Oct’21 down to 18.36 with an immediate recovery which led prices to be trading at unchanged just a few minutes later. Despite this initial volatility there was very little volume flowing in and prices soon drifted back down into the red, only levelling out to consolidate once we reached the 18.50 area. The latest COT report showed a net speculative long position of 233,169 lots as at 3rd August and with the likelihood that this holding increased on Thursday and Friday we may be see the specs become reluctant to add significantly to positions without some assistance from the macro to provide additional reassurance. This was certainly not forthcoming today with the wider commodity world also leaning to the downside and the resultant lack of interest left outright values drifting along within the confines of the early range for the duration of the session. Spreads too were quieter than of late with Oct’21/March’22 easing back a little to -0.58 points while March/May’22 narrowed to 0.86 points, to be expected as the outright buying was so limited. A push back up through the 18.50’s later in the afternoon was eroded ahead of the close with MOC selling leaving the front month settling at 18.47. Overall it was not a disastrous performance and shows that the specs understandably do not want to let go of things though if the macro continues to disappoint then a further retreat back towards 18c seems likely.

Sugar #5 Oct’21

The recent recovery from the lower $440’s has been dictated by the raws market and without that support the whites may well have continued to flounder. Starting the new week we looked to see if this pattern would continue however for the early part of the day we headed back down into the mid $450’s basis Oct’21 with very limited buying and a backdrop of a weaker macro (No.11 included). With parts of the Far East on public holiday and August representing prime holiday season in Europe today was a good example of a quiet summer day with prices holding a sideways pattern for several hours, with even the start of the US morning failing to draw out any interest. When the market did widen its range it was to the lower end as the inherent weakness of nearby whites was reaffirmed by Oct’21 recording a low at $450.50 against a backdrop of weakening spreads and white premiums. Both of these continue to send negative signals with Oct/Dec’21 touching new lows at -$19.80 while the headline Oct/Oct’21 white premium was trading down at $44 late in the afternoon. A flat price recovery during the last couple of hours was eroded ahead of the close and we concluded the day by trading beneath $450.00 with a weak looking Oct’21 settlement value of $450.20.

The weak close sent white premium values down to further new lows on the call and we ended the day for Oct/Oct’21 at $43.00, March/March’22 at $58.70 and May/May’22 at $76.90.

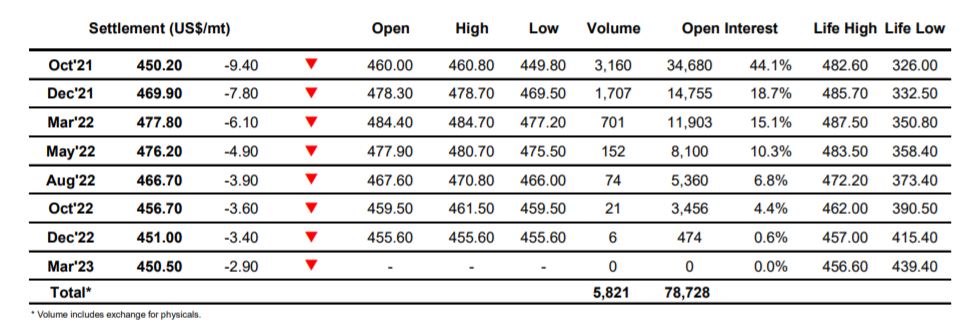

ICE Futures U.S. Sugar No.11 Contract

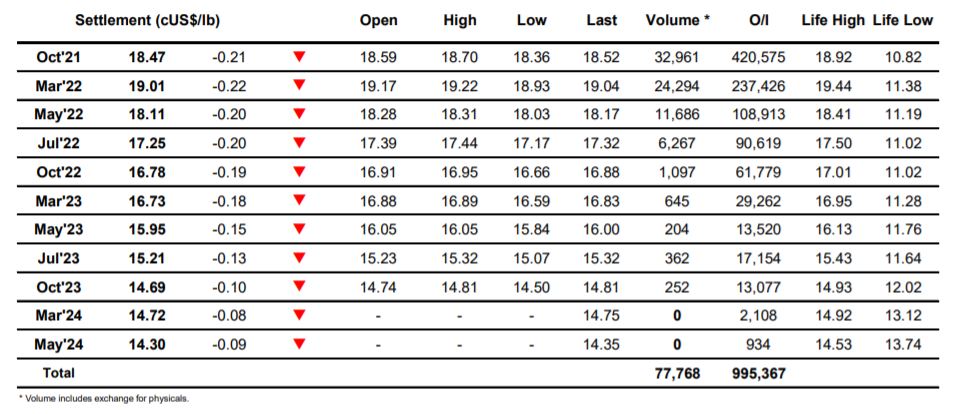

ICE Europe Whites Sugar Futures Contract