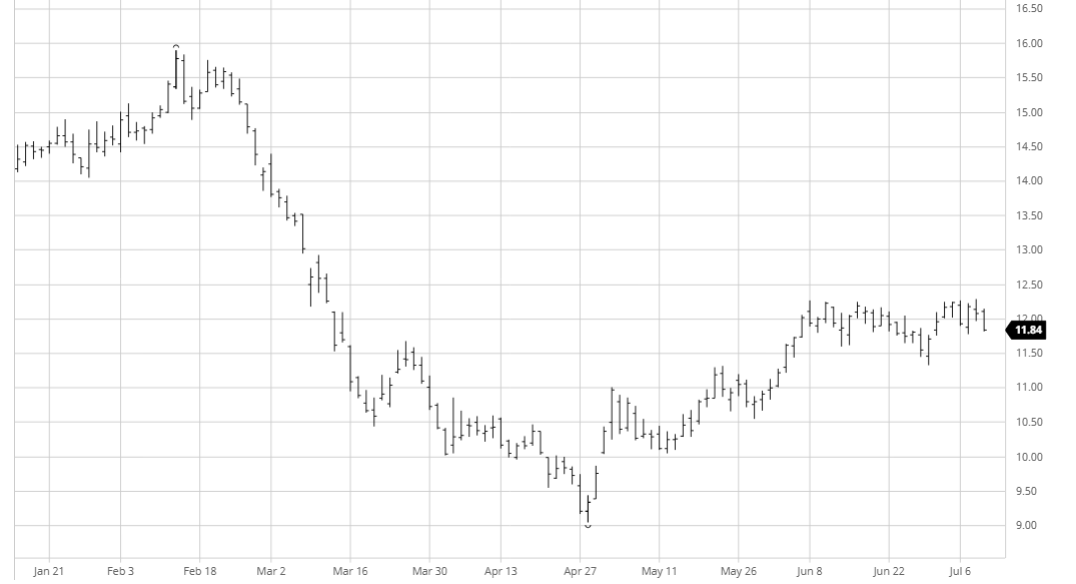

The now usual slow start to the session was soon brought to an end as an early burst of spec selling/liquidation sent Oct’20 tumbling down to 11.87. This rather unexpected burst of selling was short-lived and values soon climbed back north of 12c, however having seen another failure at the 12.25/12.34 congestion area yesterday there seems to be a lack of impetus to push all the way back up once again. Macro weakness was also beginning to show some influence with the energy sector coming under pressure upon talk of increasing US crude stocks, and while we are not tied to crude there is no denying that it continues to have a degree of influence over daily spec and algo activity. October held around 12c until mid-afternoon when the publication of the Unica data for the second half of June brought some fresh selling, with 42.93m tons cane / 2.73m tons sugar both a little above the broad market estimates. Prices by no means haemorrhaged and a base was found at 11.83 with buying uncovered ahead of Tuesday’s 11.78 low, and though a new low was recorded at 11.82 on the close we remained within this week’s range to settle at 11.84. We find ourselves now back in the middle of the recent 12.40/11.40 range, and while there are negative connotations to be taken form the recent weakness of nearby spreads for both whites and raws the specs seem reluctant to change their long strategy meaning we are no closer to finding an end to the current stalemate.

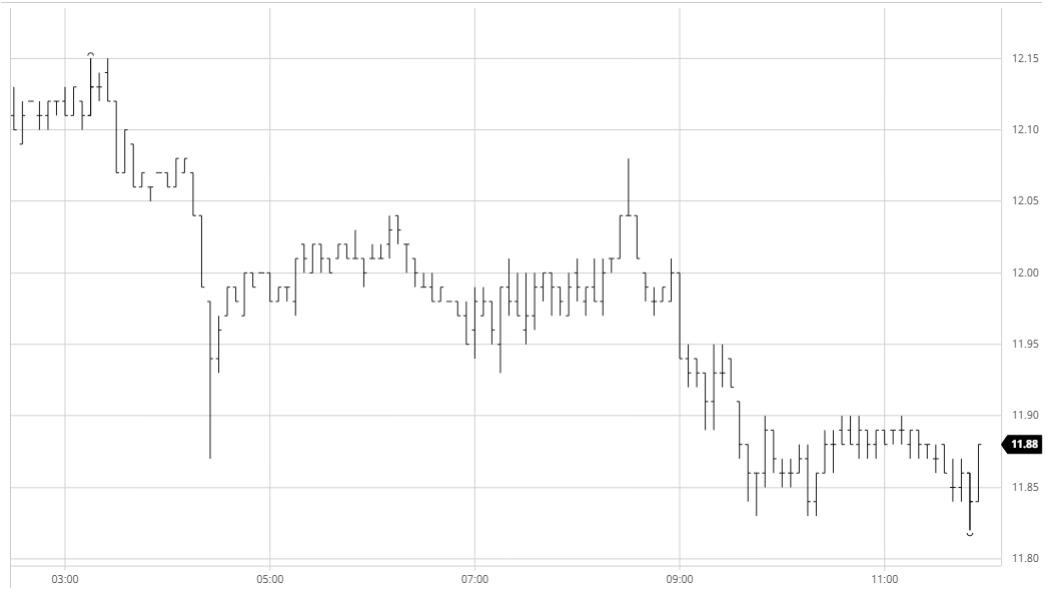

SB Oct – Sugar No.11

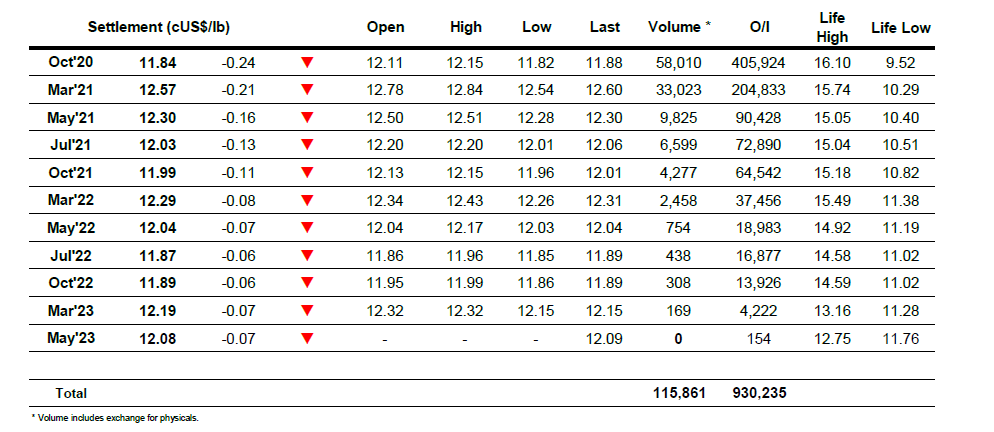

ICE Futures U.S. Sugar No.11 Contract

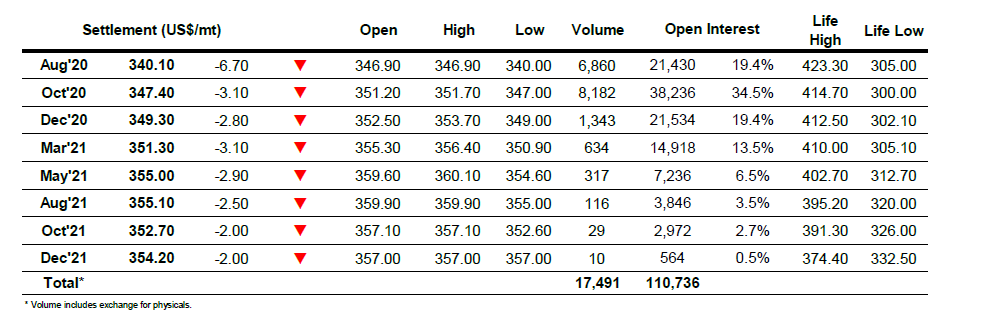

ICE Europe White Sugar Futures Contract