Mar 21 – Sugar No.11

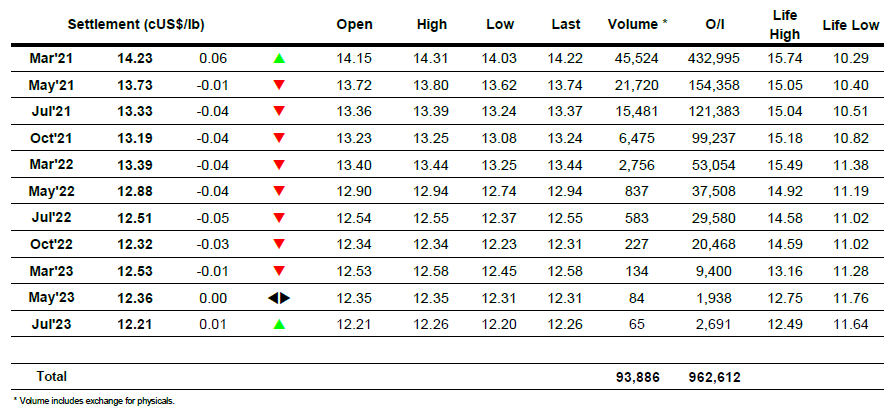

The latest CFTC report indicates another increase in the speculative long position, from the previous 201k to 220k lots, which boosted No.11 prices in the past sessions. As the bulk of their position is concentrated in the first prompt (H1, March’21), today’s session marked a shy gain for the technical players. But this only came in the final hour, as sugar traded on the negative throughout half day. Prices began a sideway stroll in the park with very few volumes being traded. After a few hours, small orders in volume made the commodity go down to the lowest of 14.03c/lb – pointing to the first resistance barrier. As if changing their minds, order volumes increased on the opposite direction, beginning a long hike towards the top of the day at 14.31c/lb. And in the final hour, large volumes were traded on both ends, however settlement was still positive: +6pts. The week closed at 14.23c/lb.

ICE Futures U.S. Sugar No.11 Contract

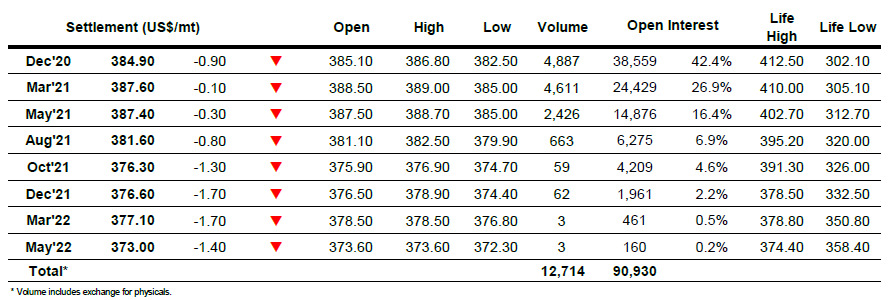

ICE Europe White Sugar Futures Contract