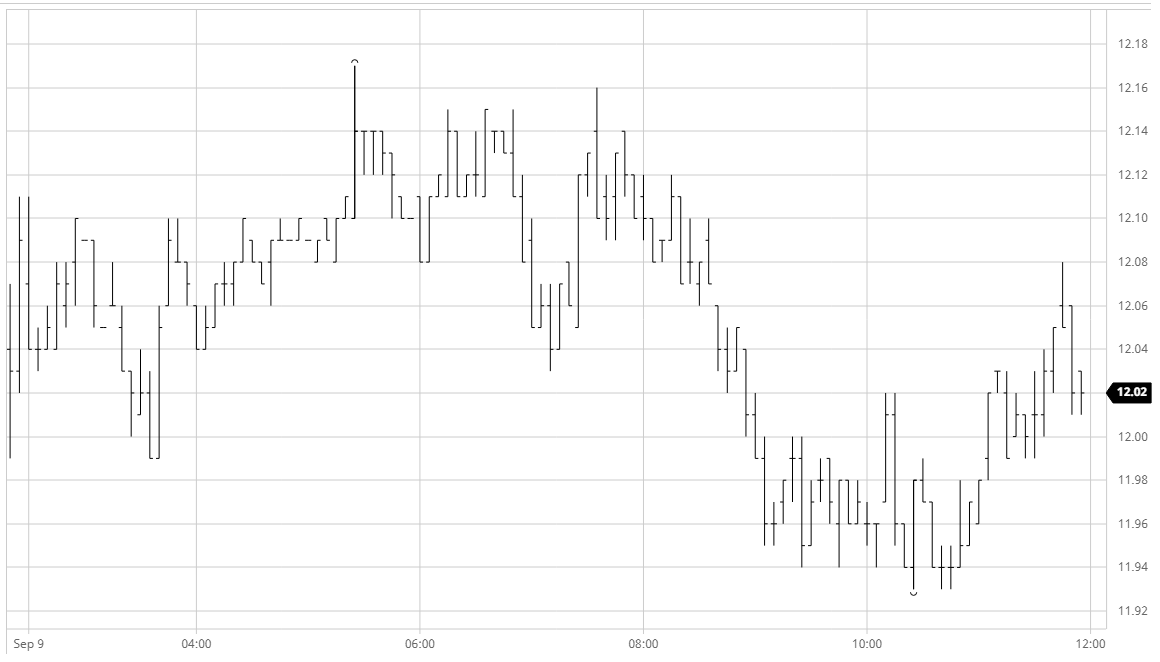

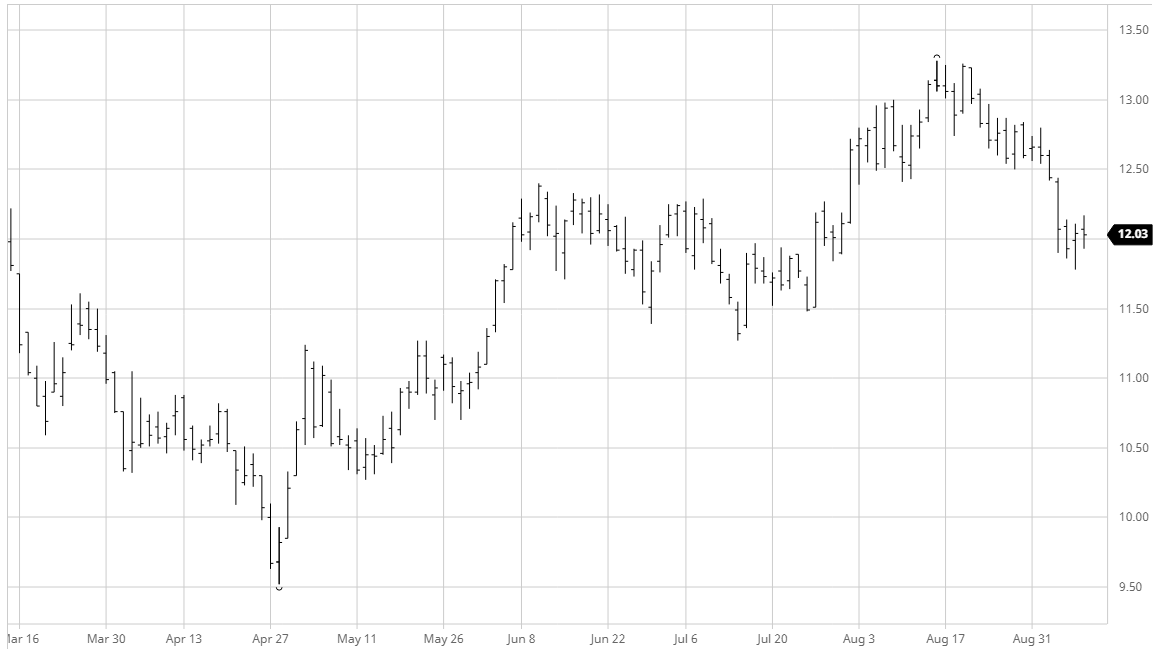

Buoyed by the recovery back above 12c yesterday this morning saw nearby values putting in a steady performance on limited activity with sellers proving limited. This lack of selling allowed prices to remain firmer into the early afternoon with the bulk of the volume again being seen for the Oct/March’21 spread as the index roll moved into its second day. As with yesterday it was the shorts who were making all the early running, leading the spread upwards again to session high of 0.59 points before eroding back to unchanged levels during the afternoon as more sizable index and fund selling came to the fore. Outright values remained in a slumber and slipped back beneath 12c for much of the afternoon although defensive buying emerged late on to ensure a settlement level just a single point lower to conclude a rather non-descript day.

Oct – Sugar No.11

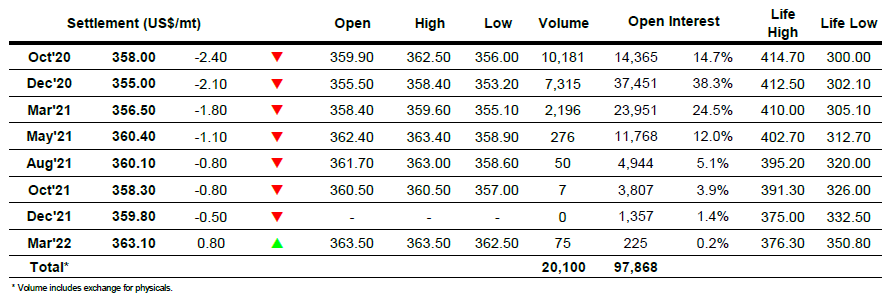

ICE Futures U.S. Sugar No.11 Contract

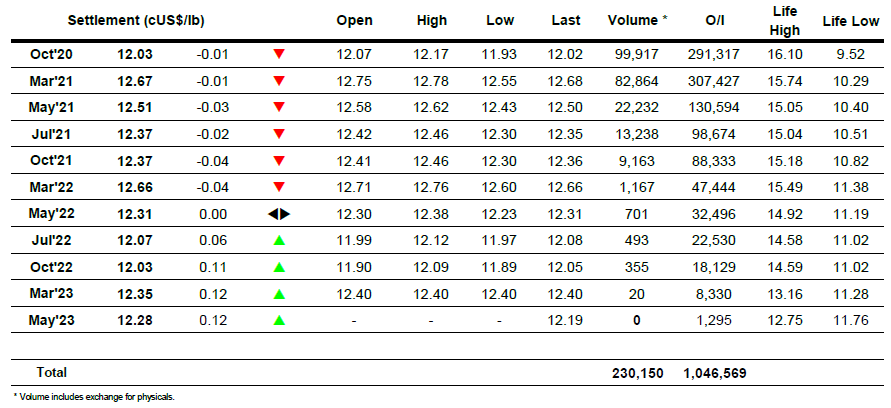

ICE Europe White Sugar Futures Contract