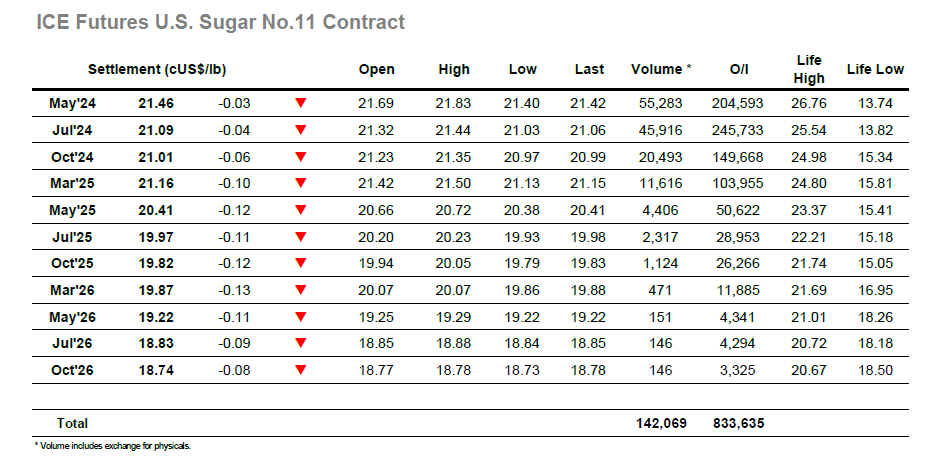

The lower levels had clearly drawn out some physical activity, which in turn had a positive impact upon the market as hedge lifting drove an early move upward. Despite the market soon passing back the gains it was not long before prices were again moving higher with smaller specs now getting involved from the long side once again, pushing through the thin environment and taking May’24 up to 21.83. A period of consolidation followed before matching the session high around noon, though the early afternoon served once more to provide disappointment. With no signs of buying from the larger US based specs the market slipped back against long liquidation / algo activity with the retracement extending back to the opening lows over the next two hours. The index roll was now back underway, but it was having little impact on the spot month with the May/Jul’24 spread trading higher at 0.40 points despite the spot month dropping again to a new session low 21.49. The rest of the afternoon saw the flat price continue to drift, the only real buying coming through consumer scales and so removing the possibility that we may rally. Lows were recorded at 21.40, 0.02-points above yesterday’s mark, while settlement was at 21.46 to suggest additional near term “sideways” activity.

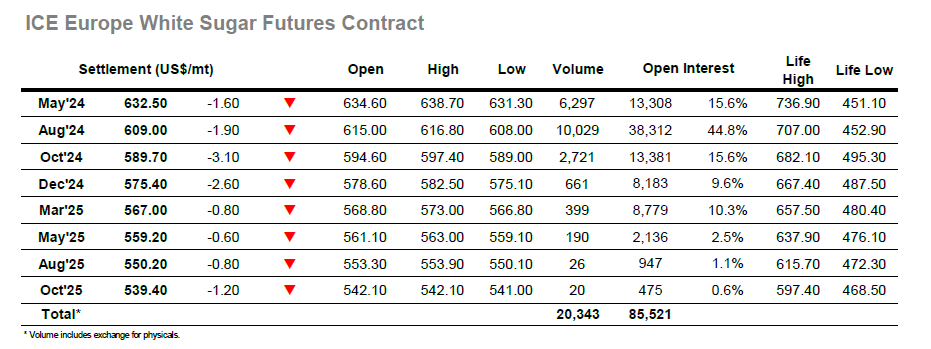

Aug’24 saw a $4.5 opening range as initial gains were swiftly erased, though despite on light buying being seen the market soon looked to move back into credit. With little more than an hour gone we had broken fresh ground with highs recorded above $616.00, and while this simply reversed yesterday’s fall it was providing a level of comfort for smaller traders who always seem happier when playing the long side. The market sat comfortably around the highs through the rest of the morning with a session top at $616.80 recorded, but again the lack of substance paid for the move and by early afternoon the price was tracking back down through the range. The lack of any long spark from larger specs/funds will continue to hinder the market going forward and so the afternoon being spent around the lows was expected with the market seemingly unable to escape the malaise. Maybe the May’24 expiry will change things, though here too everything is rather staid with another day of May/Aug’24 rolling leaving the spread at $23.50, while with May open interest reduced to 13,308 lots all seems to be in hand for an orderly expiration. Sitting just ahead of the lows for the close we saw Aug’24 end at $609.00 with the Aug/Jul’24 arb at $144.00, and with session lows on the post close we may well see continuing rangebound / sideways tedium for the coming days.