A higher opening saw May’24 trading up to 22.31, however activities were mixed, and it was not long before we were trading back down to a small deficit. Last week had ended relatively positively and with the COT report subsequently showing a moderate growth in the net spec long ton 18,338 lots there was reason to believe the specs/smaller traders would continue to play the long side where possible. Over the next couple of hours, they drove the May’24 contract up to 22.35, but lacking the continuation activity needed to maintain the higher path the market then saw a late morning correction into the range and was trading at 22.04 ahead of the US morning. Physical news remains sparse and so as smaller traders dominated, they again tried to drive higher, but this latest effort suffered from the same constraints and so the market stalled a few points shy of the morning highs before again correcting. This latest decline extended further with a drop beneath 22c and lows at 21.94, however there was a feeling that traders were still keen to protect the structure and pick things up into the final hour. By 4h30 pm, recovery was seen, at that point, market was trading higher than 22 and more aggressive buying followed near settlement pushing market up again to the 22.20 and closing at 22.17. Settlement price was 22.16, up 4 points from Friday’s settlement. Volume traded was 42k lots and HK spread weakened 2 points settling at 0.34.

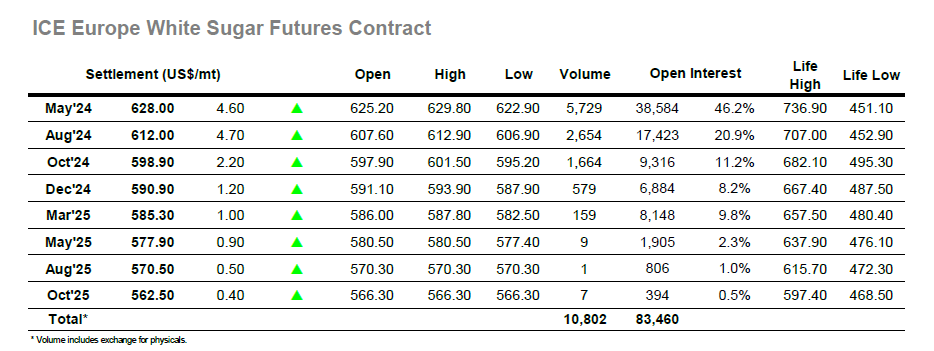

The market was back on the front foot as we resumed the new week with some steady early buying proving sufficient to push the price higher into fresh ground. With selling still thin on the ground the May’24 contract reached $629.80 before stalling, though some persistence from buyers meant the market banged its head against the same levels for the next hour or so. Smaller traders were again those trying to drive the narrative and so some liquidation was to be expected with the market retracing back through the range late in the morning before finding a new wave of support from the Americas. The recovery extended to again touch at $629.80 however this price was proving to be the immovable rock as once again the May’24 contract topped out. Alongside these flat price moves there were steady advances being made for the white premiums with May/May’24 building through towards $140.00 and Aug/Jul’24 filling some scale selling in on its way towards $130.00. This was not sufficient to hold the flat price up though and through the afternoon it became clear that the market still lacks the necessary spark to break convincingly clear of recent parameters and returned to the lower $620’s against more day trader position squaring. Daily lows were registered just after 4pm at $622.9 and was followed by a decent price recovery to $625. Prior closing market saw some more aggressive buying leading a close at a positive territory. May’24 settled at $628, up $4.6. Volume traded was 5.7k lots.