There was a leap upward as the week got underway with Jul’24 moving from 19.66 to 19.89 across the first 30-minutes before calming and looking to consolidate the gains. Fridays COT report had shown a significant change in the spec position which moved to a net short for the first time in more than a year at -23,076 lots, representing a change of 56,000 lots over a 5-day period. This may well have been encouraging some of the buying as traders look to see whether new shorts will look to stop back out of positions and the market remained solid over the next few hours with highs recorded at 19.92. These levels proved unsustainable moving through the early afternoon and the price slipped back to the 19.70 area, still showing solid gains but in calm conditions. Elsewhere May’24 was moving through its final full week of trading a little more solidly following Fridays spread recovery, and the gains were largely maintained until the afternoon when May/Jul’24 slipped back by a few pips to a low at 0.17 points. Aside from a small dip to close the intra-day chart gap the afternoon proved slow and sideways trading prevailed, with the only activity of interest arriving with the close. End of day liquidation and MOC selling combined to send Jul’24 downward on the call and leave settlement at 19.61, a small net gain day-to-day but a disappointing conclusion in light of the day’s range/movements.

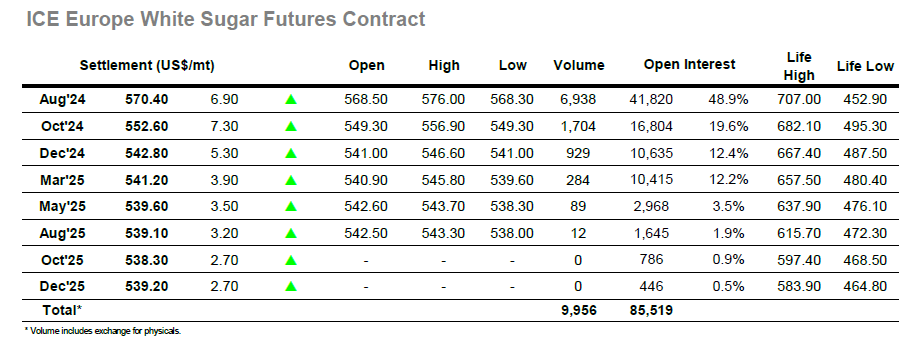

There was a surge higher when trading got underway with Aug’24 gapping upward on the intra-day chart and continued along to reach $574.20 before pausing. A period of consolidation ended with a late morning push to new session highs as Aug’24 reached $576.00 and recorded a third successive higher high as the market looked to continue its recovery of April losses. These efforts to keep the market firm were having a positive impact upon nearby spread values with Aug/Oct’24 trading up to $19.90, while for the arbitrage there was a larger impact as Aug/Jul’24 moved back toward the upper $130’s from a morning low at $133.00. The gains were not fully sustained as we moved into the afternoon, however with consumer buyers still keen to pick away and price below the market the market remained solid and comfortably maintained above the early session lows. The sideways trend continued right the way through until the end of the session, and while the closing call did see some interest from sellers to drop the price back by a few dollars the Aug’24 settlement was made at $570.40. This leaves the intra-day chart gap in place down to $565.00, a possible near term target as the market looks to find some fresh direction.