Yesterday’s recovery positioned the market well to potentially try and work through the scale selling and challenge 19.94 again, however an extremely tedious morning unfolded with saw March’23 holding a narrow 19.67/19.78 range on very low volume and showing no intent to push ahead. This changed a little as the US specs arrived on the scene and a small push up to 19.87 followed, however there seemed little interest from the hedge funds in continuing the push so leaving prices to ease back down into the range once more despite the strength of the structure which had seen March/May’23 out as far as 1.22 points. There was very little activity taking place through the afternoon with the World Cup action seeming to have temporarily having removed Brazilian interest from the market, though the lack of the producers made no discernible difference with the market continuing to slide as specs stood aside. Efforts were made to hold on to the morning lows, but the final hour saw them breeched with some pre-weekend liquidation sending March’23 down to settle at 19.60. Tonight’s COT is not expected to see any significant change from last week and so we seem likely to continue crawling towards year end within the 19c/20c range.

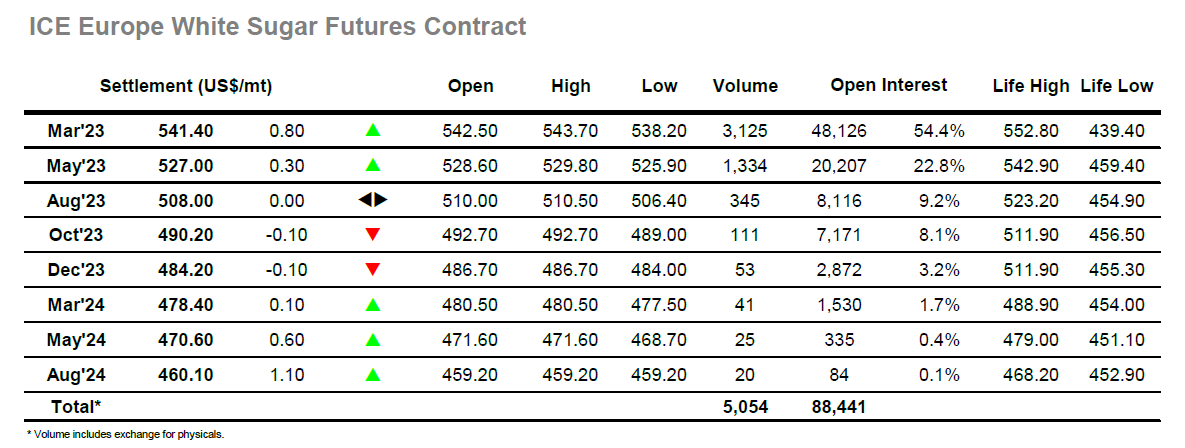

The market started by chopping around in higher ground, though things then settled to leave March’23 holding around $541.50. There was little to get excited about in the wider macro though we still saw prices chop around due to the illiquidity of the current environment, with morning lows recorded at $538.20 to narrow the March/March’23 white premium back towards $104.00. These losses were soon redressed, and the market resumed a firmer footing as we headed into the afternoon with specs no doubt looking to maintain a positive slant ahead of the weekend. Despite the best efforts of small specs/day traders the market continued to lack the substance required to produce any meaningful gains even allowing for the lack of resting orders, and so despite reaching $543.70 the price kept slipping back. By the close we were back within touching distance of unchanged, and while the premium had recovered all its earlier losses to be sat back at $109.00 March’23 saw a muted end to the week with settlement at $541.40 leaving the market still entrenched in the range.