Insight Focus

Europe’s carbon market has become a “price taker” rather than a “price maker” when it comes to driving the EU’s decarbonisation efforts. Carbon prices are now broadly tracking the EU gas market. This means they may be volatile in the future.

Low Natural Gas Price Reduces Emissions

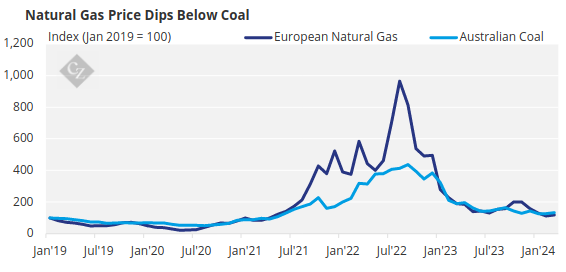

The relative prices of coal and natural gas at present mean that gas is heavily favoured as a fuel for power generation, and this is lowering the region’s greenhouse gas emissions without the need for a strong carbon price, analysts told an emissions trading conference last week.

Source: World Bank

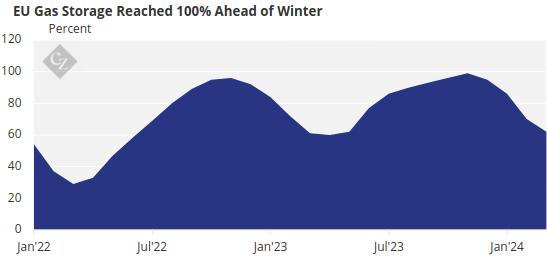

Europe’s efforts to replace Russian pipeline gas with other international sources – mainly in the form of liquefied natural gas – have been successful to the point where stockpiles of the fuel are at their highest ever for the time of year, even after the winter season.

Source: AGSI

This has capped gas prices at relatively low levels since the start of the year, incentivising more use of gas in power generation and marginalising coal.

Carbon emissions in the EU ETS fell by more than 15% in 2023, EU data show, underpinning the market’s months-long decline and the more than 20% drop in coal-fired generation highlights the growing role that gas has played in the power sector.

As a result, carbon prices are now tracking the gas market. The broad assumption is that if gas prices rise, then coal becomes relatively more competitive (or less uncompetitive), and demand for EUAs should increase as more coal is used at the margins.

In this way, carbon permit prices are no longer setting the agenda for fuel use but are reacting to the ebbs and flows in gas prices and consumption in the region.

Weak Fundamentals Trickle into Carbon

As a result, carbon itself is also experiencing weak fundamentals. As demand shrinks due to lower power generation and industrial output, so the net surplus of allowances in the market is weighing more heavily on the market.

Furthermore, the injection of EUR 20 billion worth of additional EUAs to fund the REPowerEU programme has not helped restore the market balance. The European Commission is selling the extra allowances to fund energy transition measures across the EU, and the programme of sales is scheduled to run through to 2026.

To date the Commission has sold EUR 4.3 billion of EUAs – 60 million allowances in total – and at current prices of around EUR 66, that suggests a further 230 million permits will come to market, over and above the regular allocation and auction volumes, in the next two years.

For this reason, among others, analysts expect EUA prices to remain flat until 2026 when the REPowerEU sales are complete.

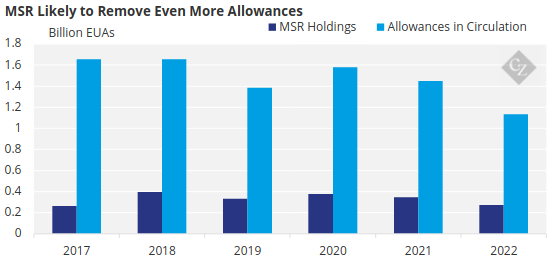

The market is now awaiting the Commission’s annual calculation of total available supply, which in turn will determine how much of the surplus will be removed from the market the market stability reserve between September and August 2025.

MSR Likely to Drive Prices Higher

The MSR removes 24% of the total surplus – any volume over 833 million EUAs – each year to maintain a degree of tightness in the market.

Source: European Commission

This adjustment to supply is unlikely to materially change the short-term outlook, analysts say, but it will point the way towards a tighter market from 2026, when the REPowerEU sales end and the market balance tightens significantly.

This is because the EUAs sold under REPowerEU do not represent a net addition to market supply, but instead are allowances that were originally scheduled to be sold between 2027 and 2030. This “front-loading” means that market supply will drop by an equivalent amount in the final three years of the current phase.

Analysts generally agree that this shift in the supply profile will drive prices sharply higher from 2026, with price forecasts topping EUR 100 by that year.

In the meantime, however, price forecasts for 2024 remain stubbornly low, with predictions generally falling in the EUR 60s. This prolonged period of low prices may encourage some industrials to enter the market to buy for future use, while the entry into the EU ETS of the maritime shipping sector is also expected to provide a modest bump to demand.