Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.

For those seeking more than just analysis of the Dollar Index as a benchmark for currencies as a whole, this report looks at 8 major spot Forex pairings that make up the lions’ share of the vast global FX marketplace while ensuring that critical diversity key to the successful investor.

For more information please contact Michael here.

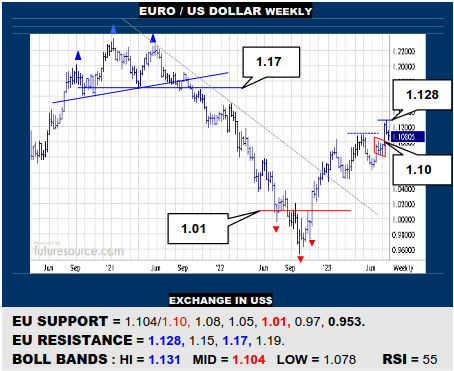

EURO / US DOLLAR WEEKLY

The EU’s escape over 1.11 was intercepted by the Fib retracement (1.128) of the prior big ‘21/’22 decline. If able to gather up on the 1.10 flag edge, the EU could still make another try to exceed that hurdle. If 1.10 gave way however, a false breakout topside would signal a more enduring crest to open a significant hole back down towards 1.01.

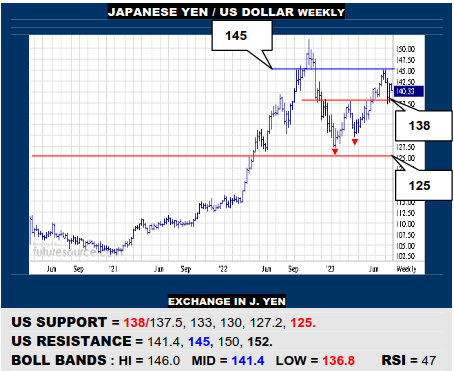

JAPANESE YEN / US DOLLAR WEEKLY

The US setback from 145 has been buffered by the 138 dual bottom border but the subsequent try higher is being impeded by the mid band (141.4). Bust beyond and another run at 145 could well punch through to the 150’s again. It will take a clearer cut breakdown under 138 to seriously undermine the footing and open a path back to 125.

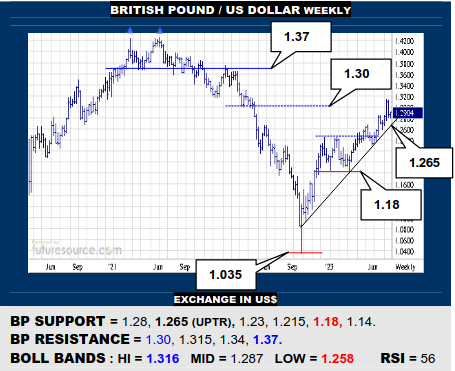

BRITISH POUND / US DOLLAR WEEKLY

Nearby support in the 1.28’s has retrieved the backlash from the low 1.30’s but the BP must rally across 1.315 to downplay this recent flinch and resuscitate its climb towards 1.37. If 1.28 failed to endure, beware a test of the mid term uptrend (1.265), the demise of that then giving warning of a deeper retracement to the 1.18 ledge.

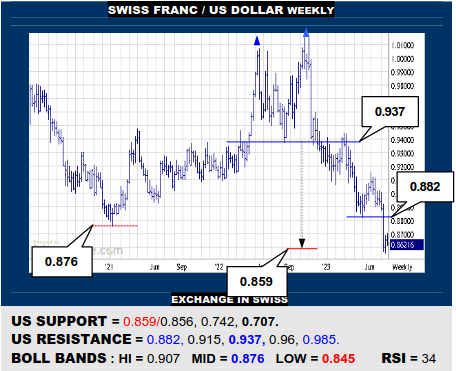

SWISS FRANC / US DOLLAR WEEKLY

Breaking through 0.876 to 8-year lows can’t possibly look good but the US did just meet a projection from the large ’22 double top at 0.859. That doesn’t ensure lasting support so a cleaner break could expose a cavern down to 0.74. However, always keep 0.882 in mind as the escape hatch to claim a false breakdown and really alter the landscape.

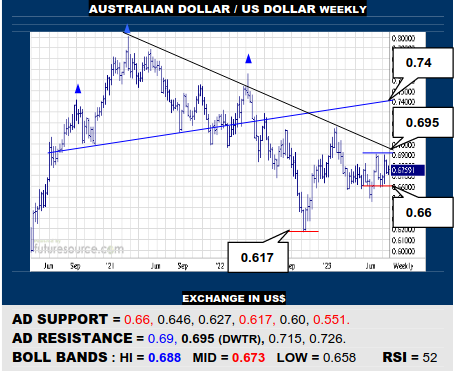

AUSTRALIAN DOLLAR / US DOLLAR WEEKLY

A small Q1 top has blunted stabs higher by the AD at 0.69 and those peaks now have a broad weekly downtrend drawing in behind (0.695). Must vault the 0.69’s then to really shake it up and target the former large H&S neckline (0.74). Meantime beware any swat through 0.66 reaffirming the downtrend and tripping a dive to 0.617 or deeper.

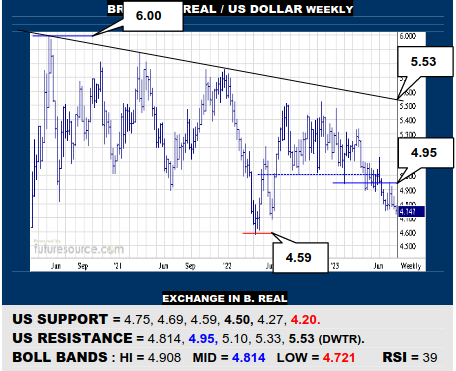

BRAZILIAN REAL / US DOLLAR WEEKLY

A bounce briefly probed the 4.90’s but the US has gouged back down from there to fray 4.75. If this break were verified in coming days, it would post a bear flag from Jun/Jly action and point on south to test the decade long uptrend presently at 4.50. Only hanging in near 4.75 and staging a reflex to pierce 4.95 would herald a more reliable turn.

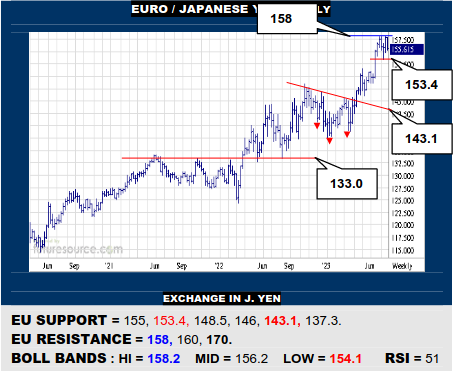

EURO / JAPANESE YEN WEEKLY

Resumed obstruction at 158 is creating risk of an inside week and the interim uptrend is also close by at 155. The EU duly looks frail here, a trend break threatening to compound into a nearby double top if 153.4 gave way to steer back towards the inverse H&S (143). Must blow the hatch at 158 to regain some momentum and a view of 170 again.

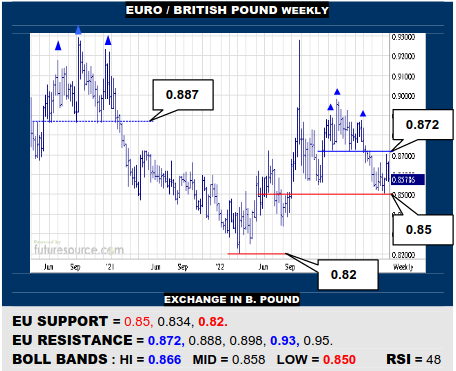

EURO / BRITISH POUND WEEKLY

A spike in the EU was promptly suppressed by the first half ’23 H&S above 0.872 and it has swerved lower again. Beware if this broke on through 0.85 a broader top emerging from the past year that would point on down to 0.82 and the danger of a colossal 7-year top. Must dig in aboard 0.85 and unlatch 0.872 to really stabilize this scene.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.