Insight Focus

- European PET resin demand strengthens with warmer weather and move into peak season.

- However, EU PET resin prices fell sharply in April, higher prices expected in May.

- Low-priced Vietnamese resin still most competitive option, import parity gap substantially.

Market Overview

Overall resin demand steadily improved through April and into early May. The beginning of peak season and warmer weather seen across Europe has brought about a greater level of optimism.

With import levels diminished, additional domestic supply from recent line restarts is being gradually absorbed by the market. However, lower prices once again placed pressure on PET resin margins as intra-regional competition heated up.

Nevertheless, European PET resin producers may be beginning to see the light at the end of the tunnel.

At least one major producer reports being sold-out for May; others with greater exposure to the spot market have also increased production, although underutilization is estimated at around 30%.

Although the seasonal swing into peak season may be underway, most buyers continue to run on minimum stocks, focused on a lean, short-term buying strategy due to the high level of demand uncertainty. This strategy is likely to persist for the remainder of 2024.

Recent corporate results from several major food and beverage brands paint a mix picture for Europe.

Demand for bottled water rebounded with strong volume growth in core European markets in Q1’24, whilst volume growth for CSD remained negative. Overall, flat-to-negative growth in total volumes.

Announcement, Potential Site-Closure of Indorama Rotterdam

On 5 April, Indorama announced that it “will enter into a consultation process with representatives of site employees to evaluate the possible future for production activities” at its Rotterdam site.

Statements such as these are often forerunners for site closure. The site has an annual capacity of 426k tonnes of PET and 700k tonnes of PTA.

Whilst Indorama will be able to reallocate volume from its remaining facilities in Poland, Lithonia, and Spain, the reduction in supply, and competition, could be a game-changer for overall industry health.

Indorama has also recently idled its PTA plant in Portugal and announced plans to scale back its global PET resin capacity and raw material production by 10%, as part of its ‘IVL 2.0’ strategy.

Domestic European Prices Drop in April Pressuring Producers

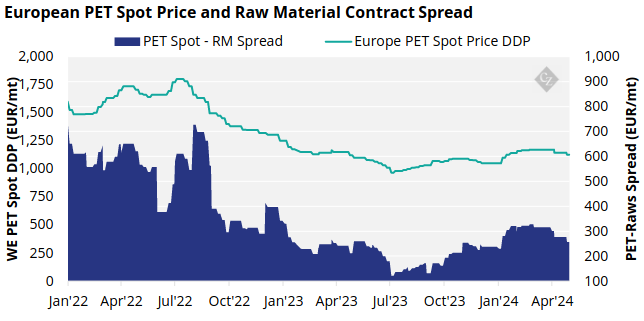

Anticipated lower domestic European spot prices arrived in April, squeezing margins, and pressuring those producers with the greatest spot exposure.

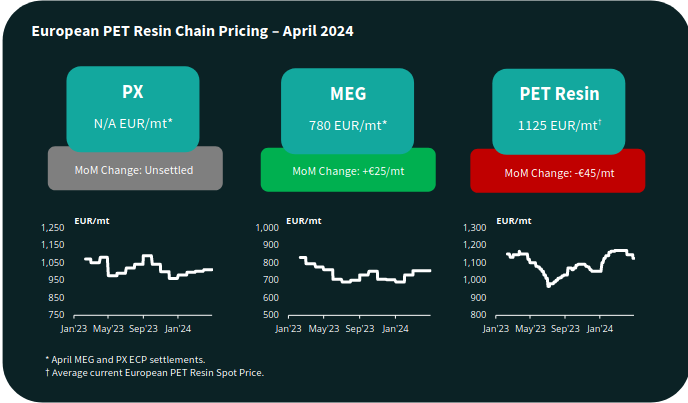

The current full market price range is assessed at EUR 1100-1140/tonne, with an average price of EUR 1125/tonne, a decline of EUR 45/tonne versus the last month’s report.

Low-end offers at EUR 1100/tonne were also heard on the market, with levels in Italy and South Eastern Europe also towards the lower end of the range.

At the time of writing the PX European Contract Price for April remained unsettled; the first MEG ECP settlement increased in April to EUR 780/tonne, EUR 25/tonne higher than the previous month.

Although Asian PTA prices averaged slightly higher in April than March, landed costs were initially offset by lower freight rates to Europe.

However, freight rates experienced a rebound in late-April, with several carriers also imposing peak season surcharges on a multitude of routes out of Asia.

Higher production costs, for those producers importing PTA, and increased imported resin prices are expected to act as a driver for higher domestic values in May.

EU PET Resin Imports Slow in February, Significantly Down on 2023

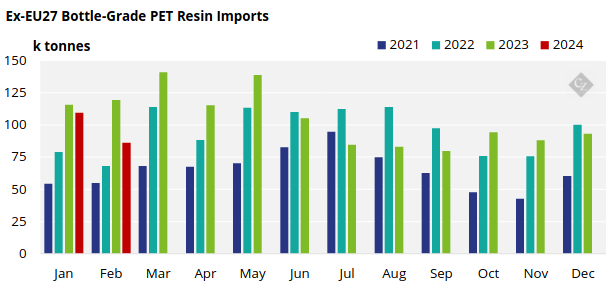

According to the latest PET resin trade data (HS 390761), the EU27 block of countries imported around 86k tonnes in February, down 21% on the previous month, and 28% down on Feb’23.

The largest origins remained relatively unchanged, with Vietnam being the largest import origin in February with 27k tonnes, followed by Turkey and Egypt on 24k tonnes, and 15k tonnes respectively.

Despite ADD against Chinese resin being confirmed early April, Chinese producers exported nearly 34k tonnes of PET resin in March destinated for the EU in April/early May, up from an average of 10k tonnes in Jan and Feb.

As a result, March and April EU PET resin import volumes are expected to rebound back over 100k tonnes per month but still fall below levels seen last year.

Is it cheaper to import?

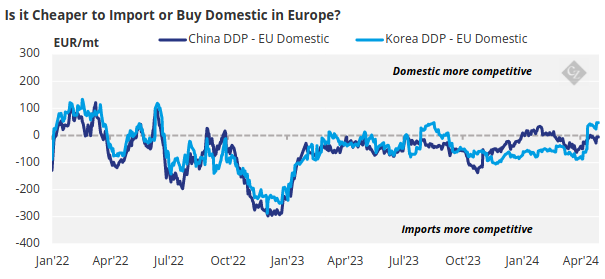

Asian PET resin export prices have faced a steady decline through April. At the time of writing, average Chinese resin export prices averaged USD 895/tonne, down USD 20/tonne versus late-March levels. (Please read our Asian Weekly report for further insight)

On average, domestic resin has increased in competitiveness through April, with import options remaining limited and fragmented.

Indicative import prices typically range EUR 1055-1065/tonne CIF NEW (duty paid), equating to an average of EUR 1095-1020/tonne DDP.

The gap has also narrowed with Vietnamese resin, with prices from one producer now at just a EUR 20/tonne discount to average European prices on a delivered basis.

Imports into Italy and Southern European were heard at around EUR 1065-1075/tonne CIF, with Turkish imports increasing in competitiveness, closing the gap themselves on cheaper Vietnamese product.

South Korean resin remain all but absent from the market, with South Korean producers continuing to primarily target the US.