Bulk Shipments

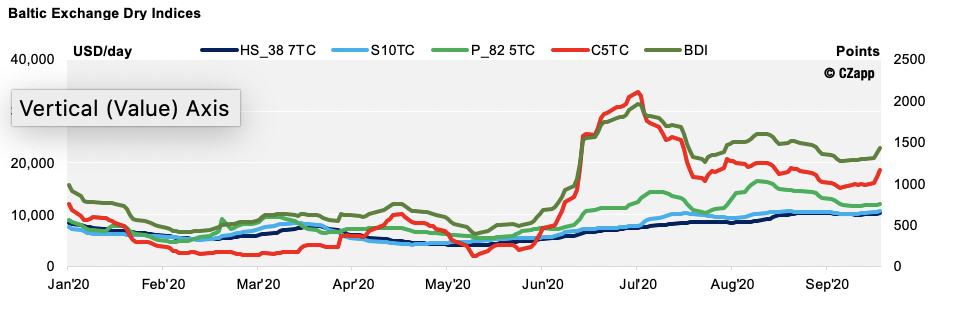

The Baltc Dry Index settled at 1426pts on 23rd September, up 11%in a week.

Prices rose for vessels of all sizes. This was driven by the Cape 5TC average index price climbing 18.7% in the space of seven days. The Cape 5TC is now averaging around $11,500 per day (year-to-date). They barely averaged $5,000 per day during the first five months of the year!

Traditionally, some of the strongest months for the dry bulk market come in the second half of the year. As US grains traders continue to find homes for their products in China, demand out of the US Gulf for Panamax stems is likely to gain momentum over the coming weeks.

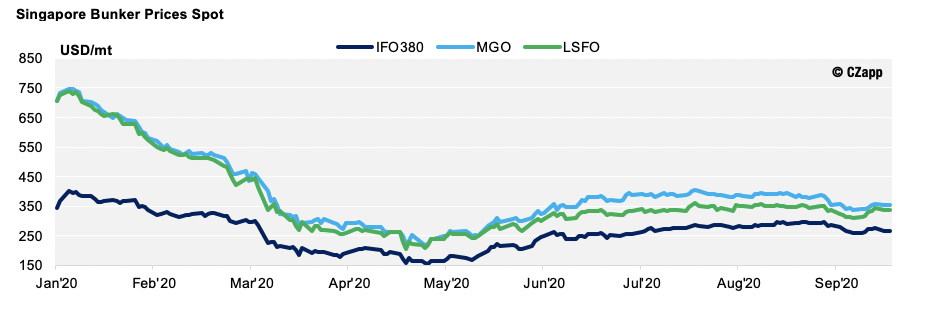

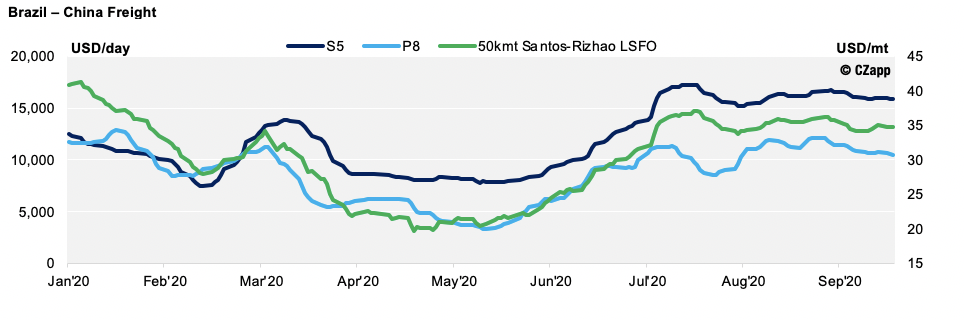

Elsewhere, waiting times for sugar loaders to berth in Brazil started to reduce last month. The front haul freight from East Coast South America to Asia also weakened. The spot price on the P8 Panamax route from Santos to Qingdao has fallen from $33.214pmt at the end of August to $30.743pmt last Wednesday. Singapore’s LSFO and MGO prices have been relatively stable, with LSFO averaging close to $340pmt over the last three months.

Containerised Shipments

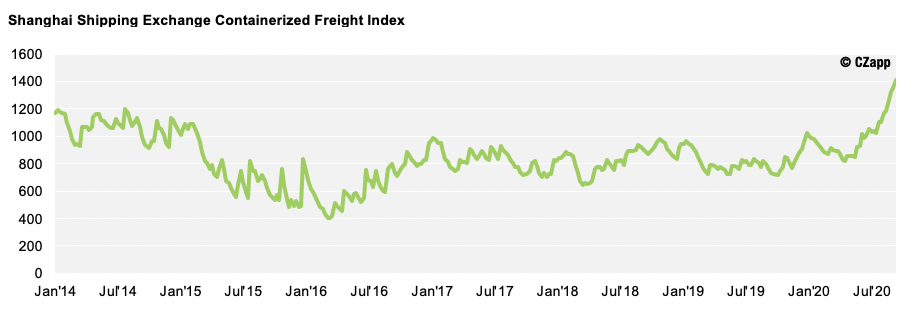

The Shanghai Containerised Freight Index (SCFI) continued on its upward trajectory over the last month as rates reached record highs. This is despite a drastic drop in blank sailings and many carriers introducing extra loaders on some routes. Of particular note was the eastbound transpacific lane to the US west coast, for which spot rates broke records for eight consecutive weeks reaching a level of US $3,867 per 40’ for the week ending 18/09/2020.

With global GDP growth poor, many are confused as to how there has been such a rebound in container demand. This sudden shift is largely being attributed to an increase in consumer spending on goods vs. services as people adjust their lifestyles to new ‘normals’, as well as many industrial manufacturers restocking materials following periods of shutdown. Amongst the hardest hit products in terms of container volume, however, have been apparel and automotive part volumes, which have seen significant declines, while furniture, machinery and chemicals are showing rapid container volume growth.

The impact of higher spot rates can already be seen on increasing long-term contract rates as carriers’ proven ability to manage supply is not looking likely to just be a short-term strategy.

With many hauliers having let staff go during the peak of lockdown as demand dropped, they are now scrambling to accommodate booming import demand with reported driver and chassis shortages in many regions of North America and Europe.

Despite the year-on-year volume being down, low bunker prices, combined with strong capacity management and high utilisation levels, has led to many carriers reporting considerably strong first and second fiscal quarter results.

Other Opinions You May Be Interested In…

· Brazil Sugar Line Up: T-12A Plugged, Others at Risk

· How Much MoreCorn Will China Buy?