193 words / 1 minute reading time

Bulk Shipments

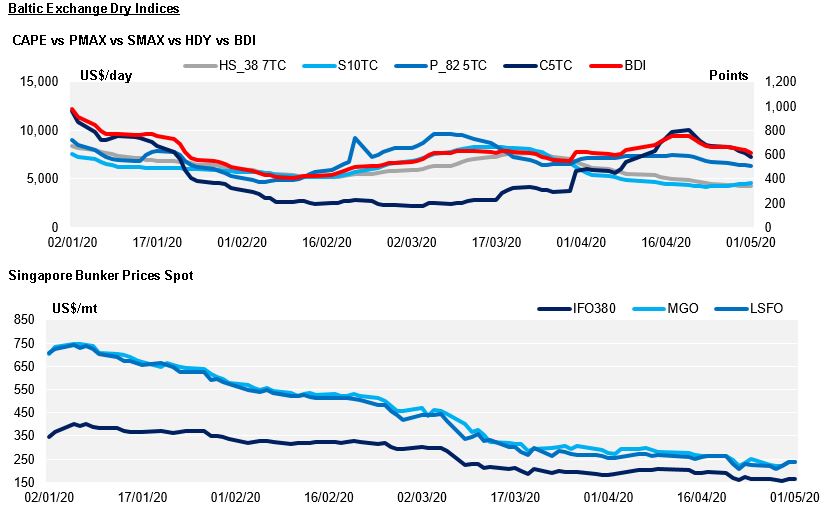

The Capesize 5TC recorded a 23% gain during April maintaining some of the momentum which emerged in this sector at the beginning of March. The smaller sizes came under continued pressure, with the Supramax 10TC and Handysize 7TC both losing more than 20% in April leaving the Baltic Dry Index looking rather flat when it settled at 617pts on May 1st.

Sentiment in the forward prices for Supramax vessels remains negative with Q3-20 FFA prices falling by a further 10% in the last month. Q4 prices held up better, however that may only be a matter of time, considering the ongoing impact of Covid-19 restrictions on the shipping industry.

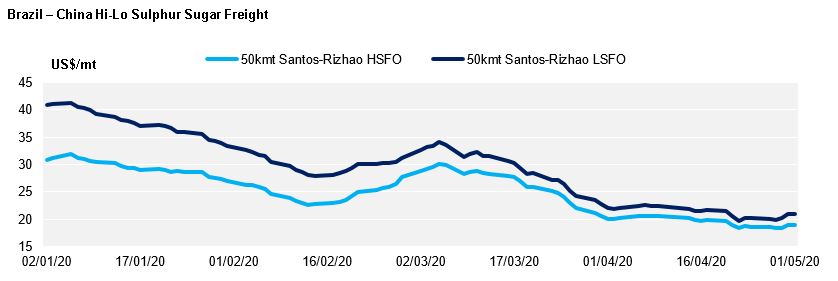

Whilst the May 2020 Western Texas Intermediate crude futures contract price grabbed all the headlines, unfortunately vessel owners are still required to pay for the bunkers that fuel their ships. Singapore bunker prices continued to soften over the month, leading our LSFO Santos – Rizhao spot rate voyage assessment to temporarily fall below $20pmt. At the beginning of the year, the spot rate exceeded $40pmt on the same route.