Bulk Shipments

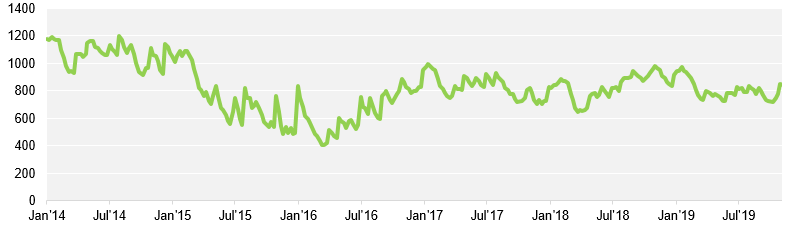

- The BDI continues to lose ground, settling at 1364pts on Thursday, 403pts lower than it was in our last update. The current level represents a fall of more than 45% since the beginning of September when the index peaked at 2518pts.

- The Capesize, Panamax and Supramax indices have been hit hard by this correction, recording losses of between 45% and 50% in average time charter earnings in the last 11 weeks. In contrast, the smaller Handysize vessel index has fared much better, only recording a 26% reduction in average time charter earnings in a similar period.

- Even after taking into account the higher cost of the IMO-2020 Low Sulphur Fuel requirements, the cost of freighting 50kmt of sugar from Brazil to China today has reduced by ~$10pmt since September.

Baltic Exchange Dry Index

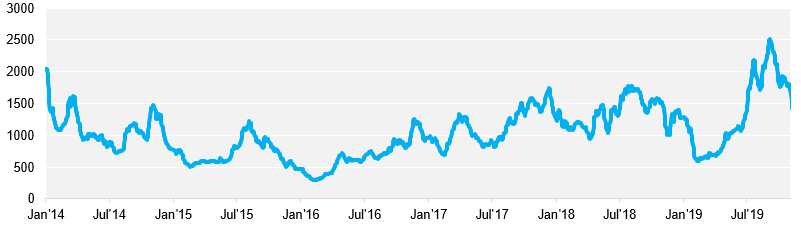

Netherlands Bunker Fuel 380cst Rotterdam Spot

Containerised Shipments

- Approximately 4.5% of the total container fleet was not being utilised as of the first week of November. This is largely due to the steady implementation of blank sailings by the lines, in addition to an increasing volume of capacity being taken out of service, in order to be fitted with scrubbers ahead of the implementation of IMO 2020. It is this tightening in supply that has largely attributed to the recent recovery in rates.

- In preparation for IMO 2020, most lines will be rolling out low sulphur surcharges from December. For this reason, increasing rates are expected to continue through to the New Year.

Shanghai Shipping Exchange Containerized Freight Index