Insight Focus

- Chinese import demand drops, particularly from New Zealand, EU.

- Demand from Southeast Asia partly offsetting fall in Chinese imports.

- US dairy exports robust, driven by cheese.

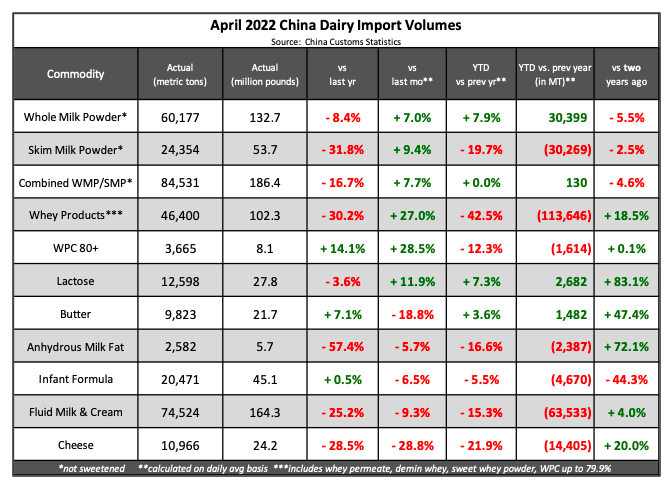

China:

Once again, China’s imports were unable to keep pace with 2021’s historical highs. The steepest drop in volume was from fluid milk & cream, followed by whey, skim milk powder and whole milk powder. New Zealand and the EU experienced the largest drops while imports as well as market share increased from the US. High protein whey, infant formula and butter were the only commodities where there was growth compared with 2021. European exporters experienced the strongest uptick in market share of WPC80+ and infant formula, while New Zealand continued to dominate butter. The slowdown in demand for

fluid milk, milk powders and whey powder were much stronger than growth in other products from either region. It was always going to be difficult to replicate 2021, with widespread lockdowns last month slowing demand. There are enough whole milk powder inventories to work through after the record start to imports earlier this year. Through April, imports are close to 2014’s, which marked a record high back then (419,364 tonnes). Whey imports moved counter-seasonally higher from March to April but remain well below 2021’s strong demand, when China was aggressively rebuilding its hog herd.

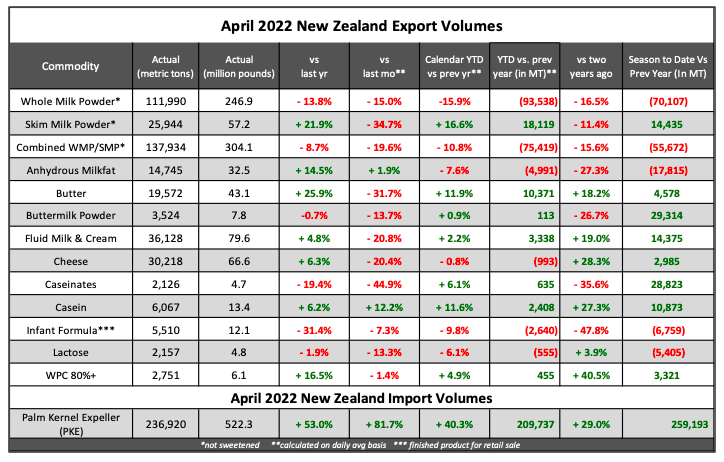

New Zealand:

In line with trends at Global Dairy Trade auctions this year, New Zealand’s exports to China dropped year on year but there was impressive growth in exports to Southeast Asia and the Middle East. Whole milk powder (WMP) exports were the weakest in five years for April driven by a 19% or 23,815 tonne drop into China. Slightly offsetting lower Chinese volumes, shipments to Southeast Asia jumped 29% or 5,816 tonnes from a year earlier. China has recorded strong demand for butter this year, which extended into April. Year-to-date, NZ has shipped 35,443 tonnes to China, the highest on record for January-April. By volume, skim milk powder (SMP) exports posted the largest year-on-year gains, which was also led by demand from Southeast Asia – Indonesia (up 2,070 tonnes) most notably but also Malaysia (up 1,303 tonnes). As China attempts to re-open, imports from New Zealand should grow as pent-up consumer demand should prevent inventories from getting too large. China’s economy is struggling so premium goods may take a back seat as quick service restaurant (QSR) needs ramp up.

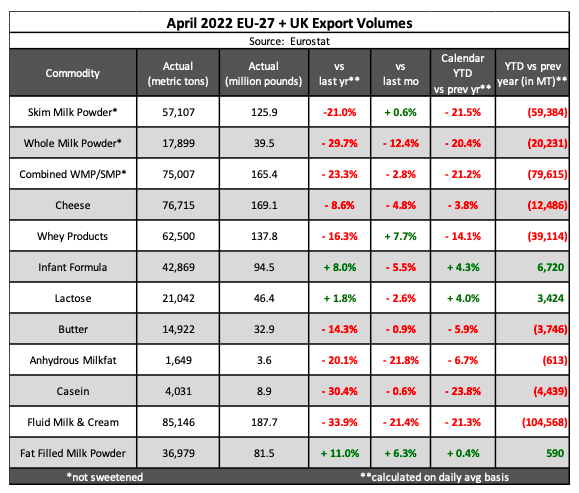

EU27+UK:

The fall in liquid milk and cream exports continued to be sharp in April, hitting December 2019’s lows. The primary culprit for weaker demand is China with shipments amounting to 36,192 tonnes, a drop of 51% or 37,700 tonnes on the year. The drop in shipments to Libya was also notable, 92% or 6,558 tonnes from a year earlier to 561 tonnes. Conversely, exports into Southeast Asia grew 49% or 3,045 tonnes to 9,287 tonnes – the highest on record into the region. Skim milk powder (SMP) shipments are at eight-year lows. Once again, this is being driven by lower demand from China, but also Algeria as they source less and less powder from the EU each year. The EU shipped 24,563 tonnes to China in January-April, 13,672 tonnes less year on year and the lowest since 2018 while exports to Algeria of 21,108 tonnes, down 10,629 tonnes were the lowest since 2007. The destination market with the highest year-on-year growth in April was Egypt, which only accounted for 2.9% of total market share of the commodities listed above and primarily in the form of SMP (6,107 tonnes, up 2,500 tonnes. The United Arab Emirates recorded the second strongest growth as shipments of whey (1,262 tonnes, up 985 tonnes and fat-filled milk powders (3,180 tonnes, up 656 tonnes) grew slightly.

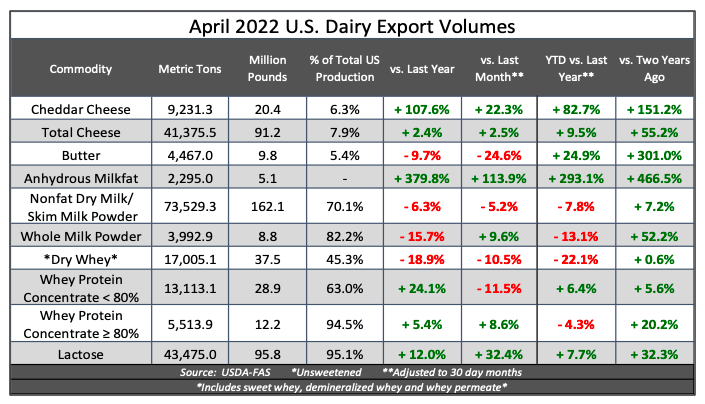

US:

Exports across most products impressed in April, with total volume setting a record high for the month. Cheese shipments remained strong, rising year on year for the tenth consecutive month, even against an impressive 2021. Robust cheddar shipments contributed to the strength in total cheese, with cheddar volume climbing to the second highest monthly volume on record. The rise was driven by demand from Japan and South Korea. Nonfat dry milk exports remain unable to surpass last year’s impressive volume. Shipments were weaker to Mexico, yet again, but were firm into Southeast Asia. Butter exports slipped, but the US was a net exporter of butter for the fourth consecutive month. AMF imports surged, but with a 31c/lb unit value in volume from India, it is likely miscategorized product. Against all odds, including the grim shipping challenges and the difficult-to-exceed prior year comparable data, US exports remain impressive. The global need for dairy products continues, while supply remains tight, even though Chinese demand has weakened, HighGround expects robust volumes will continue to depart US ports in the next few months, underpinning most product prices.

For additional dairy market analysis, request a free trial at highgrounddairy.com/free-trial