Insight Focus

- An unexpected corn rally was driven primarily by short covering.

- Wheat fundamentals are still weak as Russia continues to export.

- China also cancelled US purchases.

Forecast

The market respected the carry of the March/May spread after the expiry of the March futures contract in Chicago, creating gains. European grains also rallied.

We continue to believe that we have seen the lowest point of the corn market. Russia continues to discount its wheat price, which is the major downside factor.

We are now entering the planting season in the northern hemisphere. Progress and weather will dictate price action. But despite volatility we don’t expect to be surprised by higher supply announcements.

There is no change to our Chicago corn forecast for the 2023/24 crop (September/August), which averages in a range of USD 4.15/bushel to USD 4.4/bushel. The average price since September 1 is running at USD 4.6/bushel.

Dry Weather Supports Corn Prices

We suggested last week that we may have seen the lowest point for corn prices but were certainly not expecting this week’s rally in Europe. This did make sense as it was mostly driven by short covering.

In the US, the March futures contract expired. There is now a question mark over whether the market will now try to close the gap between the March/May spread.

Concerns of dry weather are now giving support to the market. By the middle of last week, the USDA said that temperatures in the US Corn Belt remain at record high levels and dryness is becoming more apparent in the upper Midwest.

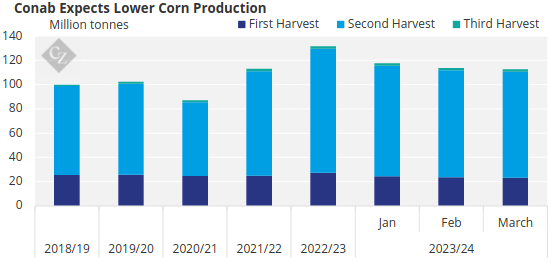

This is not only the case in the US, but also in South America. Brazil’s Conab lowered its soybean production forecast for a third consecutive month by 2.5 million tonnes to 146.9 million tonnes. It also reduced its corn production forecast by 1 million tonnes to 112.7 million tonnes due to dry weather since last October.

Source: Conab

The latest WASDE report still estimates Brazil’s corn production at 127 million tonnes so it is likely the USDA will reduce its projections in the April WASDE report. The first corn crop is 32.9% harvested compared with 26.3% last year. Safrinha corn planting is 86.2% complete versus 72.5% last year.

In Argentina, corn harvesting is 3.2% complete. Its condition deteriorated to 25% good or excellent — four points lower week on week.

In the US, drought conditions have worsened with 36% of the corn area impacted, up from 32% last week. Warm weather is expected again this week with normal or above normal rainfall. Brazil is expected to receive rains in the north and warm and dry weather across the rest of the country.

China Cancellations Pressure Wheat

Wheat started the week positive with a better-than-expected export inspection data out of the US but rumours of another cancelation of Chinese purchases pressed the market lower last Tuesday. Then on Thursday the USDA reported the lowest value of the year in weekly exports sales.

The USDA has already reported cancellations of 504,000 tonnes of wheat bought by China and the rumour is for a fresh cancellation of more than 150,000 tonnes to be reported soon.

Russian prices also continued to fall, increasing pressure on the whole wheat complex.

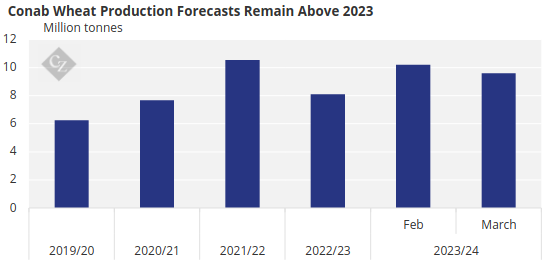

Brazil’s Conab lowered its wheat production forecast to 9.58 million tonnes — 600,000 tonnes lower than its previous forecast. Still, the new projection is 18.4% higher than last year’s volumes.

Source: Conab

In Germany, the cooperative association DRV forecast 2024 wheat production of 20.4 million tonnes – a decline of 6.5% year on year due to lower acreage that was also hit by too much rain. The wheat condition in France also worsened by two points to 66% good or excellent compared with 95% last year.

This week, Europe is expected to receive some rains in northern and central Europe while the south is expected to be dry.