- Brazilian govt proposes more tax cuts to lower fuel prices

- Proposed changes could be implemented next month

- The move could put downward pressure on ethanol, sugar prices

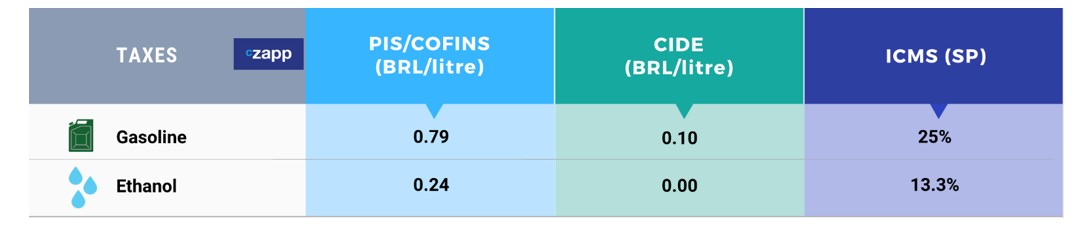

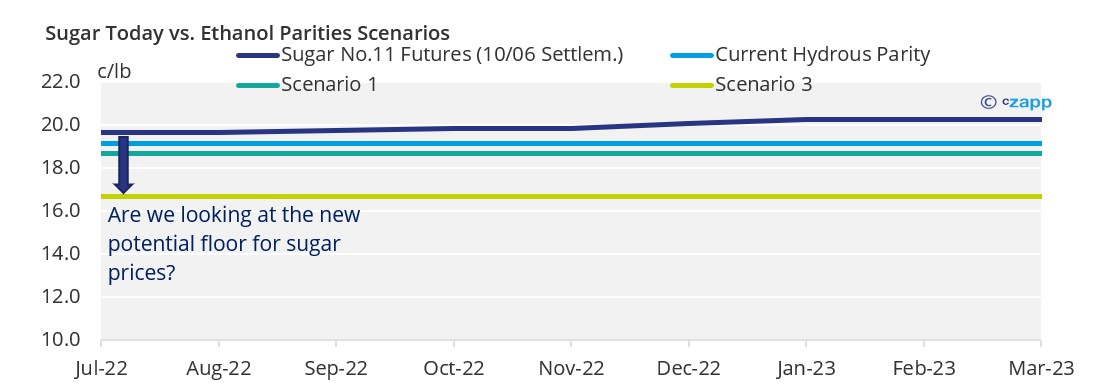

The Brazilian government is proposing a Cide and PIS/COFINS tax exemption on gasoline and ethanol until the end of the year. The move comes on top of a cap on the ICMS tax on motor fuel, which we see as potentially bearish for sugar and ethanol prices . Regardless of whether you see the latest proposals as an anti-inflationary tool or President Jair Bolsonaro making an early start to his re-election campaign, the fact is they could put additional downward pressure on ethanol, and in turn, sugar prices.

Source: Czapp

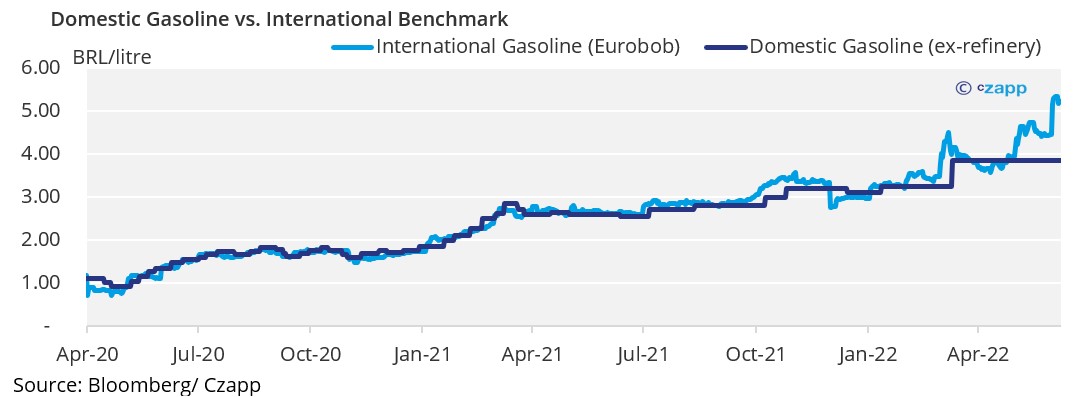

The domestic price of competitor fuel, gasoline, is key to any discussion of the Brazilian ethanol market. Any increase in gasoline prices would undermine the anti-inflationary goals of the proposed tax cuts.

The gap between domestic and international gasoline prices has been over 20% for the past week. In March, the last time this happened, state-controlled oil company Petrobras raised gasoline prices by 18% taking the ex-refinery price to a record high of BRL3.86 (USD 0.79) a litre. Since, then Petrobras has left prices unchanged.

Under normal circumstances (i.e., without rampant inflation and political pressure) we would expect an increase in gasoline prices by the end of this week.

Although high fossil fuel prices are usually bullish for ethanol because they allow its price to rise without losing competitiveness, this time Petrobras might not have the political will to continue its market-oriented price policy or could be waiting for the implementation of the tax cuts before raising prices.

Changes Proposed

In addition to the ICMS tax change, senators aligned with the sugar and ethanol sector are trying to propose a constitutional amendment (PEC) that aims to maintain the “competitiveness of ethanol”. This would mean that if gasoline taxes were lowered, then ethanol taxes would also need to be. In that case, an ICMS tax increase for ethanol in São Paulo state is no longer a risk.

The pressure from sugar and ethanol industry body UNICA and millers for the “ethanol PEC” has been strong, according to sources. It remains to be seen if it will be effective.

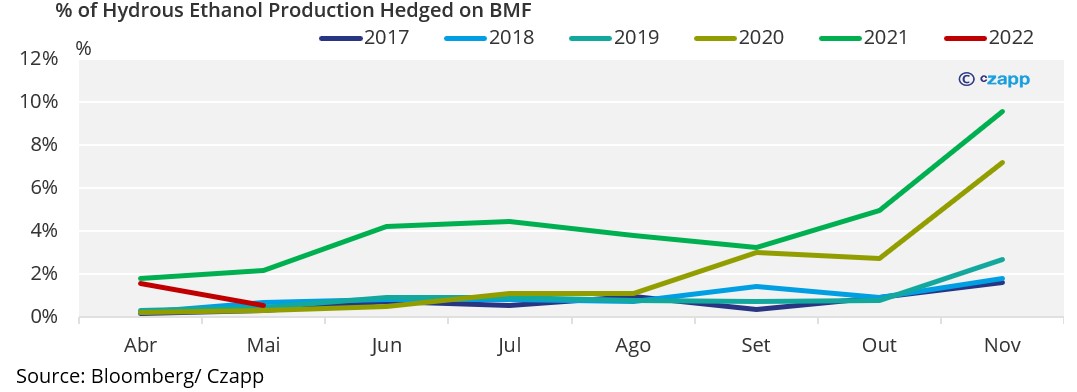

Uncertainties over the changes in fuel taxes are dividing millers, with some remaining bullish on ethanol prices while others are looking into hedging ethanol – not a common practice due to low liquidity and the prices being lower the further they are along the BMF ethanol curve.

Additionally, the federal government has proposed to zero the PIS/COFINS and Cide (federal taxes) on gasoline and ethanol to contribute to lower fuel prices.

Federal taxes could be zeroed from 1st of July, while the ICMS tax changes could be voted on by the Senate Today.

New Possible Scenarios

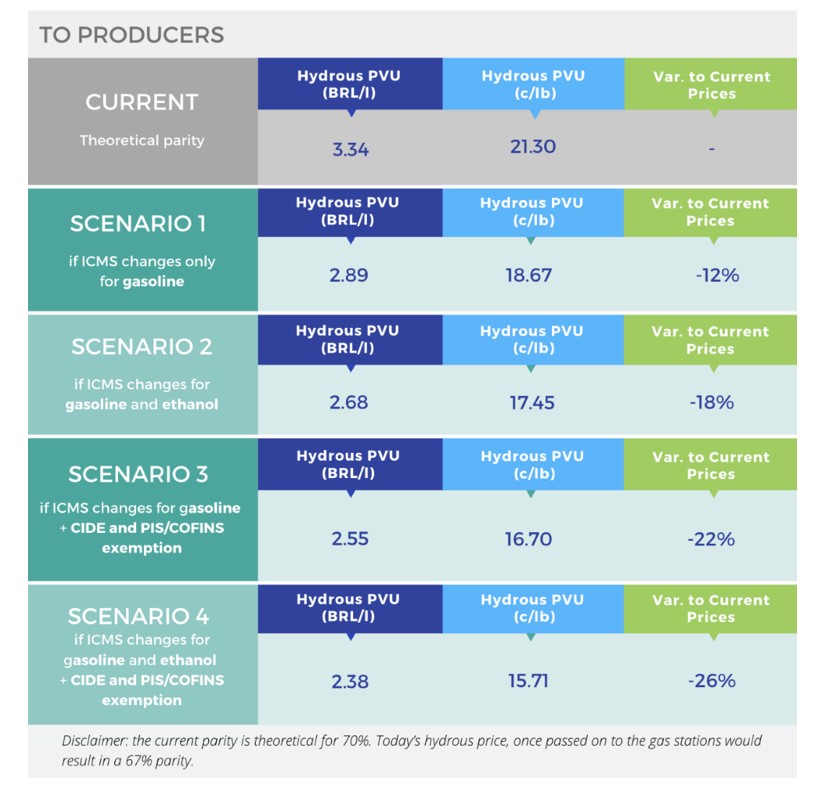

If the tax changes are approved, then prices at the pumps could fall by between 11% and 25% (in Sao Paulo state), depending on which scenario unfolds.

As for producers, with the additional tax reductions for the federal taxes, we ran two other scenarios. And both are bearish for ethanol. Comparing current ethanol prices with the proposed changes the ethanol floor for the sugar price could be 400 points lower.

Source: Czapp

This is does not take into account any potential intervention by the government on Petrobras fuel prices, which could make market sentiment even more bearish. A simple thing as a tax change in Brazil has brought a whole new level of downside risk to the sugar market

Other Insights That May Be of Interest…

- What Would a Brazilian Fuel Price Hike Mean for Sugar?

- How the Brazilian Fuel Price Adjustment Hits Sugar and Ethanol

- Ask the Analyst: The Impact on Brazil’s Ethanol Import Tariff Removal

Explainers That May Be of Interest…