Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.

For more information please contact Michael here.

NEW YORK SUGAR #11 OCTOBER 2023

Having toughed it out near the mid band in prior sessions, NY jabbed back upwards Tuesday as it again seeks to dispel the Q2 double top. With the upper Bollinger in the low 25’s, this effort must still be given some room and actual conquest of 25.30 would really get back on the horse. Mindful that Dollar gains are making life hard for the B-Berg though so this highwire act might not have much of a net if something goes wrong and Mondays’ trough (23.84) shows as a possible H&S trigger point, any reflex beneath there hence liable to lead to another dive like late Jun.

LONDON WHITES #5 OCTOBER 2023

There can be little doubt that Whites are the driving force just now as London fed off its preceding inside day and hustled back up to the low 700’s Tuesday. If this boost could be shored up via a close over 705, action since late May would acquire a slightly sketchy inverse H&S profile that would propose reach to the 800 vicinity. Well ahead of Raws though as a Premium storming the $160’s proves and one suspects to sustain 705+ will need NY to keep well clear of that 23.84 pivot or else this situation would be far more prone to implosion.

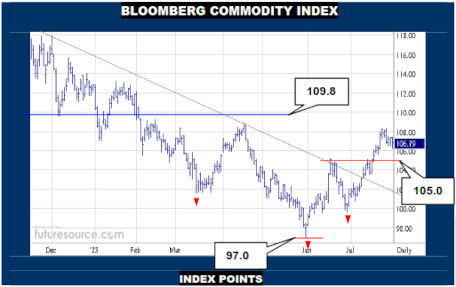

BLOOMBERG COMMODITY INDEX

With the Dollar pushing by its former 101.60’s gap and out into the 102’s now to enhance impressions of the prior 99’s dip being a false breakdown, the B-Berg has lost the upside scent and has veered back towards the initial 105 support shelf. This marks the preliminary border of the inverse H&S shape that ’23 has acquired and is just being intersected by the mid band. It is thus an important brace. If a dip was steadied there, it would remain in the corrective category and a further push for the next main hurdle at 109.8 could yet come. If the Dollar continued to recover and 105 gave way here however, make room to 102 or even deeper as the commodity bubble deflated.

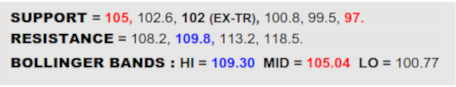

NY SUGAR #11 IN THAI BAHT

First stop around Asia is the Baht, which is staying out ahead of its ’23 uptrend (8.12) but still needs to decisively overhaul the 8.50’s to make a useful impact into the Q2 double top to get a look towards 9.20. Be cautious of another flinch at 8.50 instead as early Q3 would then start to assume H&S qualities to threaten a trend break and dive to 7.25.

NY SUGAR #11 IN INDONESIAN RUPIAH

The Rupiah has made more impression on its dual top already and is trying again this week beyond the 3625 border. This effort must pierce 3760 to hail a more persuasive breakthrough however that would then dial in sights on the 3965 peaks. Meantime any swat back under 3600 would tilt towards a toppier event and put the uptrend (3430) on alert.

NY SUGAR #11 IN CHINESE YUAN

An initial stab into the 1.74+ top was rebuked but Yuan priced Raws are having another go. This time will entail entry into the 1.80’s to make the effort stick where the uptrend could truly claim victory and new highs beyond 1.89 would beckon. Support at 1.71 looks all the more pivotal meanwhile as a tripwire to unlock the trend (1.65).

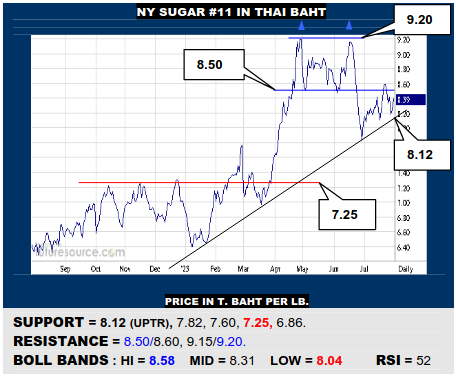

NY SUGAR #11 IN INDIAN RUPEE

A prior prod into the Rupee double top over 20.15 was reeled back and it will now demand popping 20.50 to make a reliable impression to dispel the top and hail success for the uptrend. Mind the mid band otherwise (19.80) as an early warning herald of a small H&S forming instead that would swivel focus back onto the trend (18.90).

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.