Insight Focus

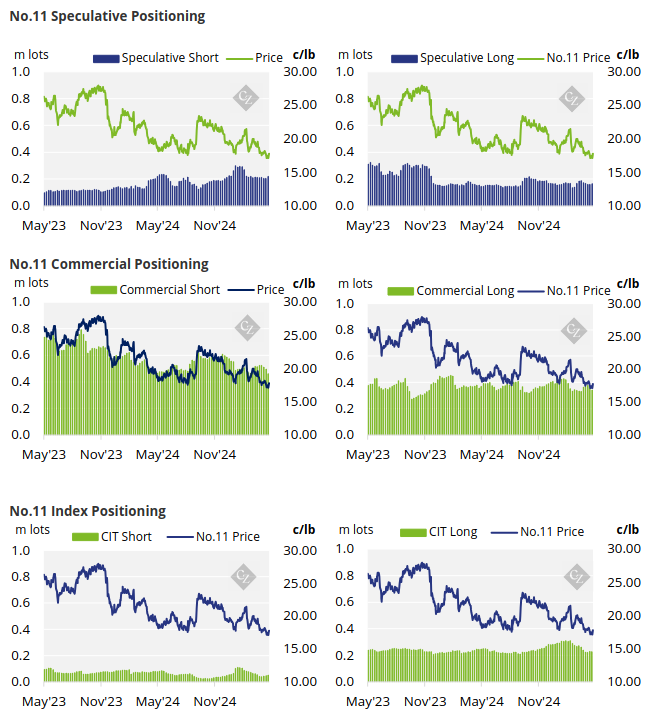

Raw sugar futures have rallied back above 18c/lb after hitting 4-year lows. Speculators hold the largest net-short position since March. Commercial participants have closed out a large number of positions.

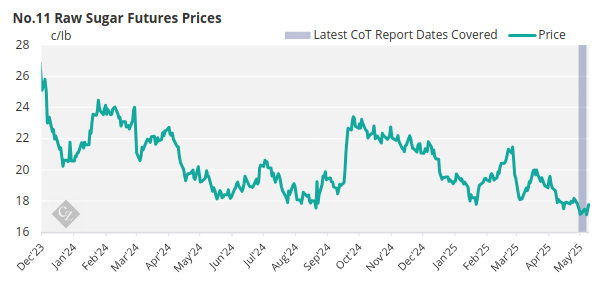

New York No.11 Raw Sugar Futures

The raw sugar futures continued trading below 18c/lb, hovering around 17.5c/lb for most of last week before closing at 17.8c/lb on Friday.

The CFTC data is submitted on the Tuesday of the previous week and since then the raw sugar futures have rallied back above 18c/lb, hitting those who shorted at 4-year lows near 17c/lb.

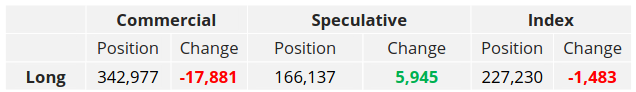

Speculators added heavily to their short positions, opening 14.9k lots of shorts. They have also opened just under 6k lots of long positions.

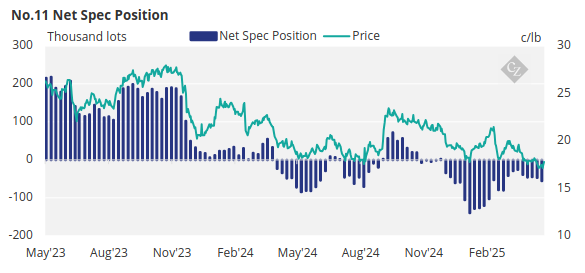

No.11 Commitment of Traders Report (May 6, 2025)

The net-short position currently stands at -55.5k lots. This is the highest net-short position since March when the net-short position was at around -80k lots.

On the commercial side, both producers and end-users have closed out a significant number of positions with producers closing out 34.4k lots of shorts and end-users reducing their position by 17.9k lots of longs.

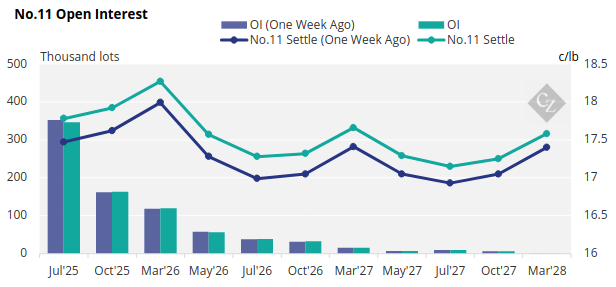

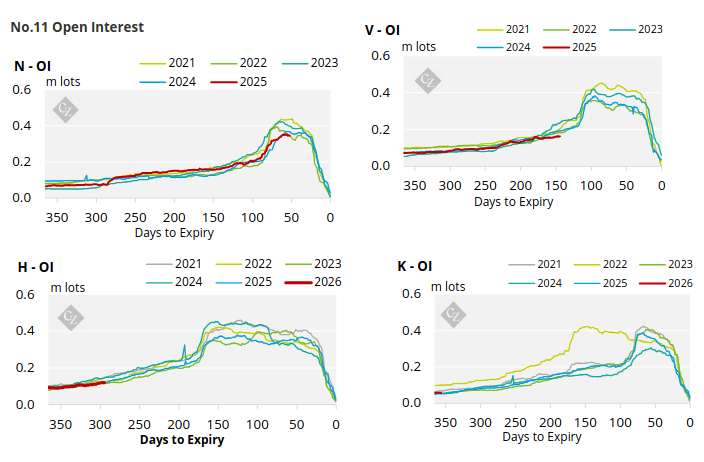

No.11 Open interest

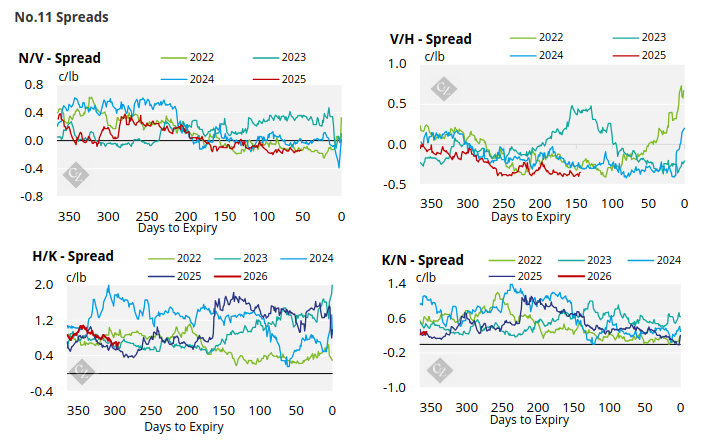

The No. 11 forward curve has strengthened across the board.

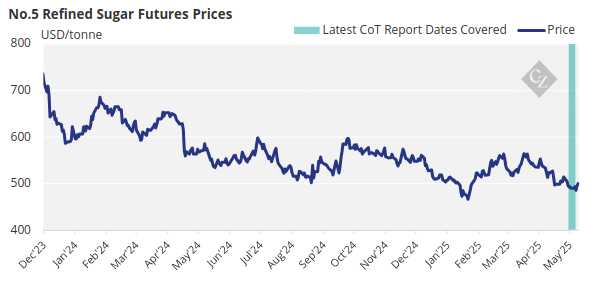

London No.5 Refined Sugar Futures

The refined sugar futures started trading at USD 489.7/tonne on Monday, before hitting a mid-week low of USD 485.4/tonne on Wednesday and eventually closing higher at USD 499.9/tonne on Friday.

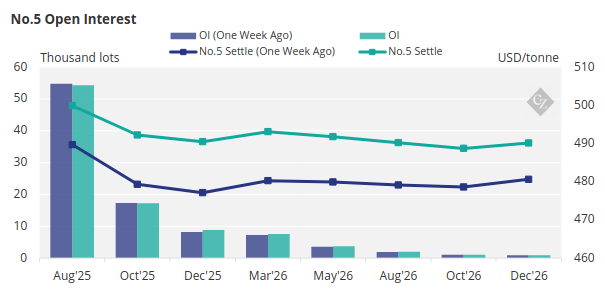

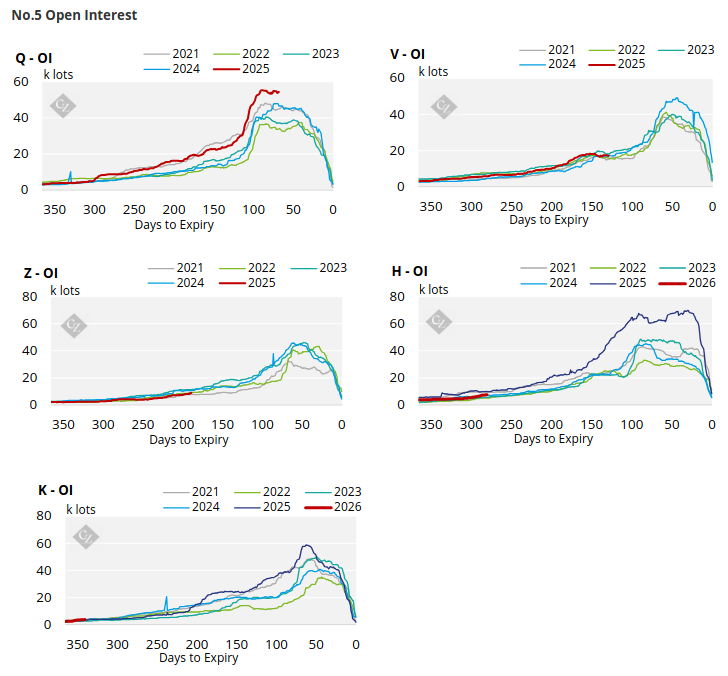

No.5 Open Interest

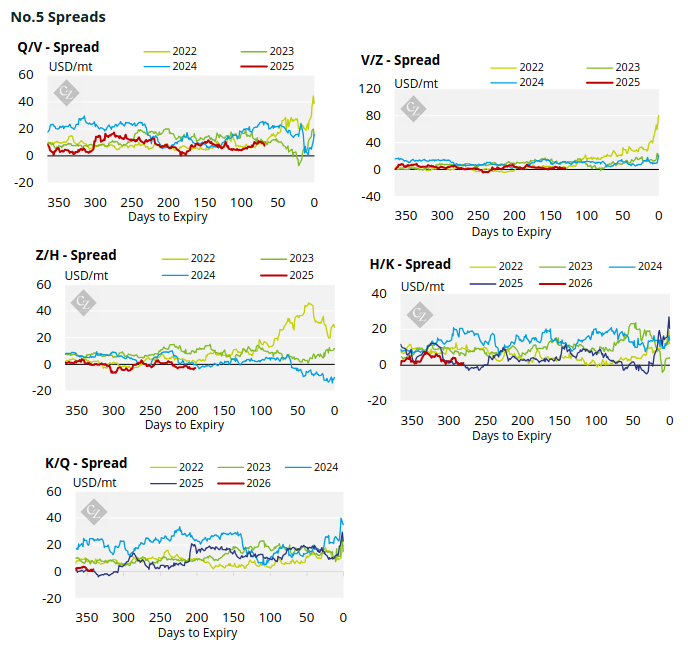

The No.5 refined sugar futures curve has strengthened across the board.

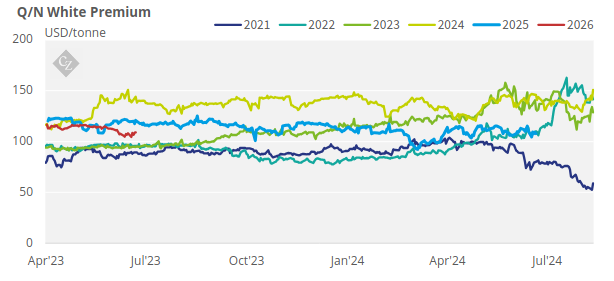

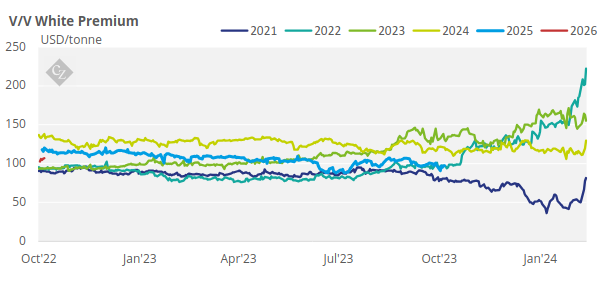

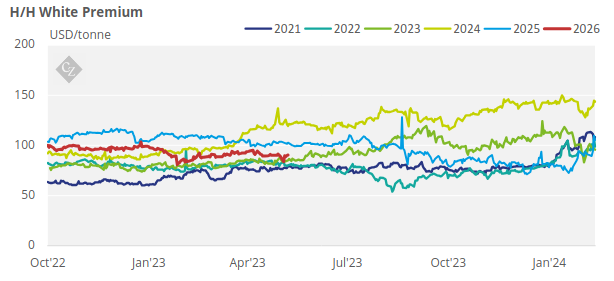

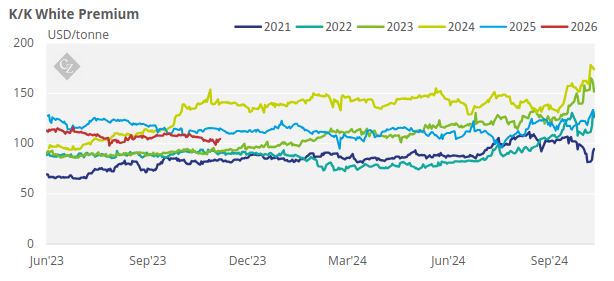

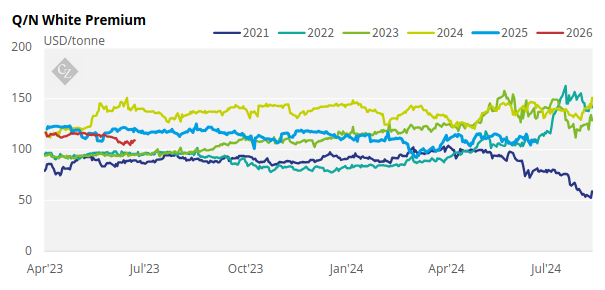

White Premium (Arbitrage)

The Q/N white premium traded higher over the past week between USD 104.5-109.3/tonne and closed at USD 107.9/tonne on Friday.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix