Insight Focus

Raw sugar futures have declined and are trading below 18c/lb. Speculators have added to their long position. The No.5 refined sugar futures curve has weakened across the board.

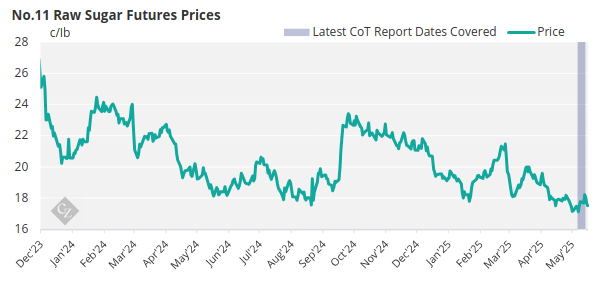

New York No.11 Raw Sugar Futures

The raw sugar futures started trading at 17.7c/lb on Monday before trading above 18c/lb until Wednesday as it then settled below 18c/lb during Friday’s close at 17.5c/lb.

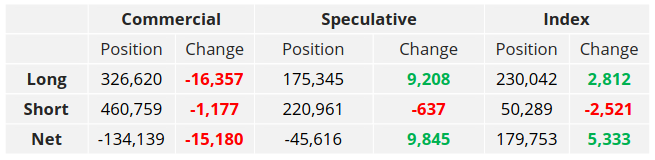

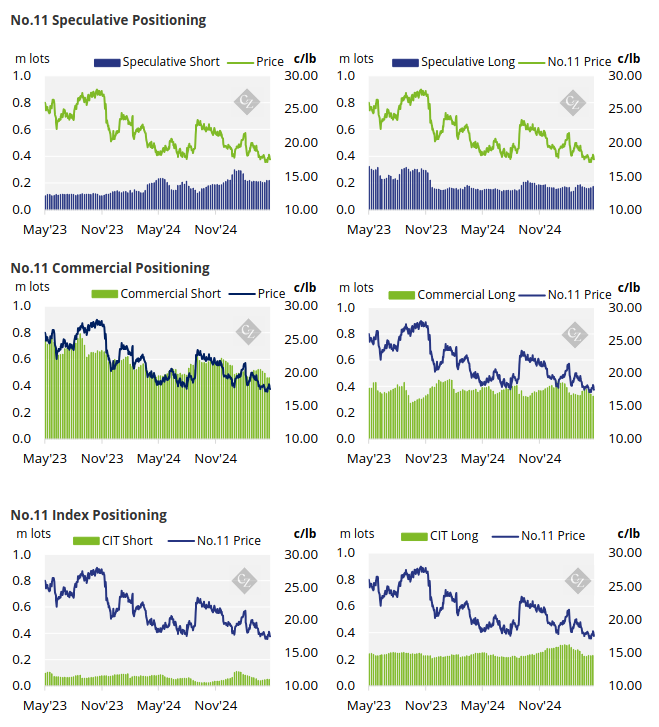

On the commercial side, end-users have closed out a large number of long positions at 16.4k lots of longs, while producers have closed out 1.2k lots of short positions.

No.11 Commitment of Traders Report (May 13, 2025)

The commercial short position is the lowest in absolute terms since October 2022. In plain English, sugar producers are not hedging very aggressively.

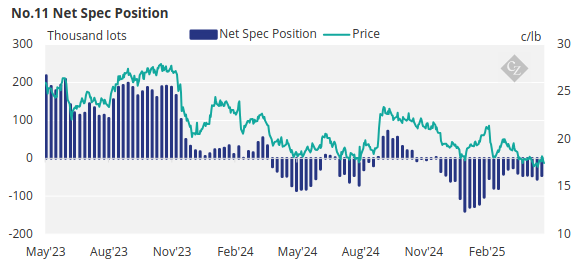

Speculators added to their long position by 9.2k lots of longs, likely when the market rebounded to 18c/lb in the past week. However, CFTC data is submitted on Tuesday of the previous week and since then prices have declined again.

The net-short position now stands at -45.6k lots.

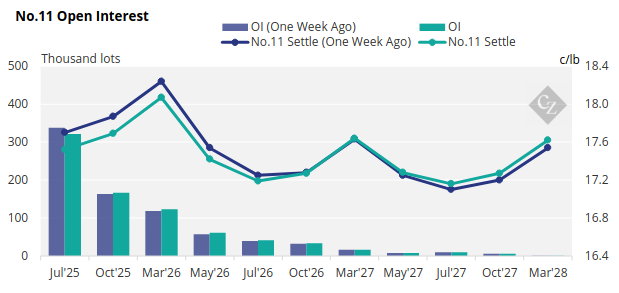

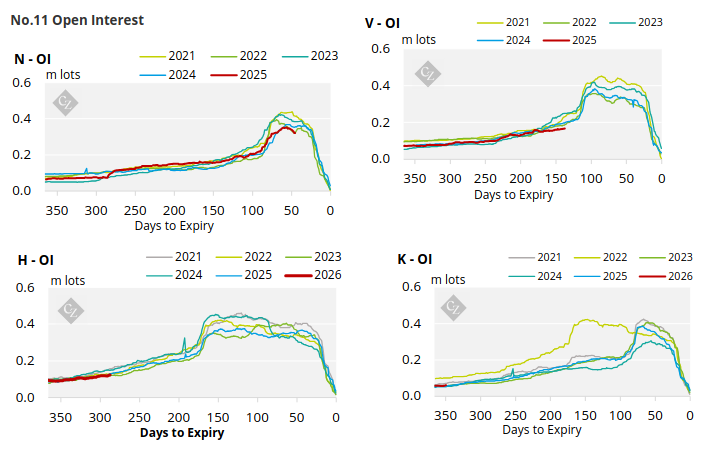

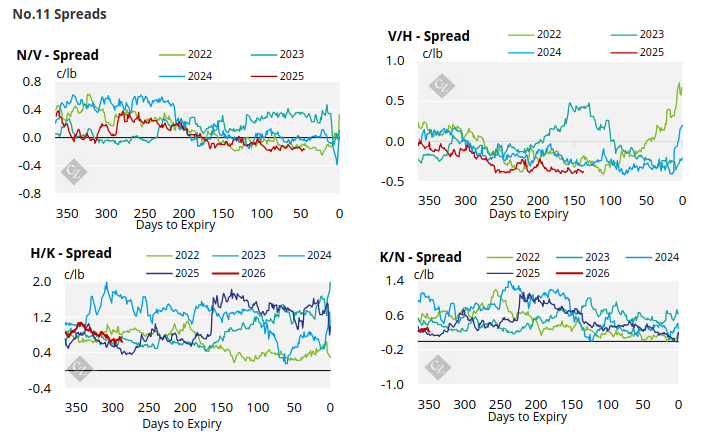

No.11 Open interest

The No. 11 forward curve has weakened between July’25 and October’26 but has strengthened towards the back of the curve from March’27.

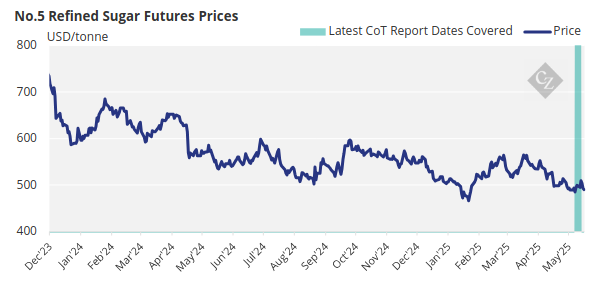

London No.5 Refined Sugar Futures

The refined sugar futures mirrored the raw sugar futures in its movements as it started trading at USD 495/tonne on Monday, before trading between USD 503.9-509.8/tonne until Wednesday and eventually drifted lower settling at USD 490.1/tonne by Friday’s close.

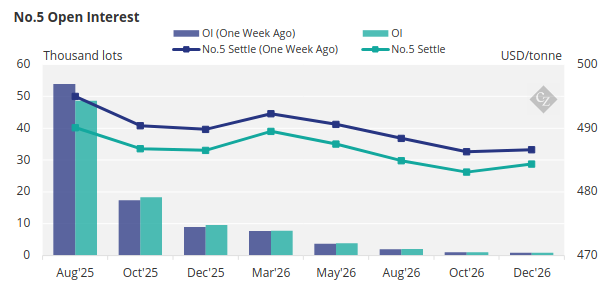

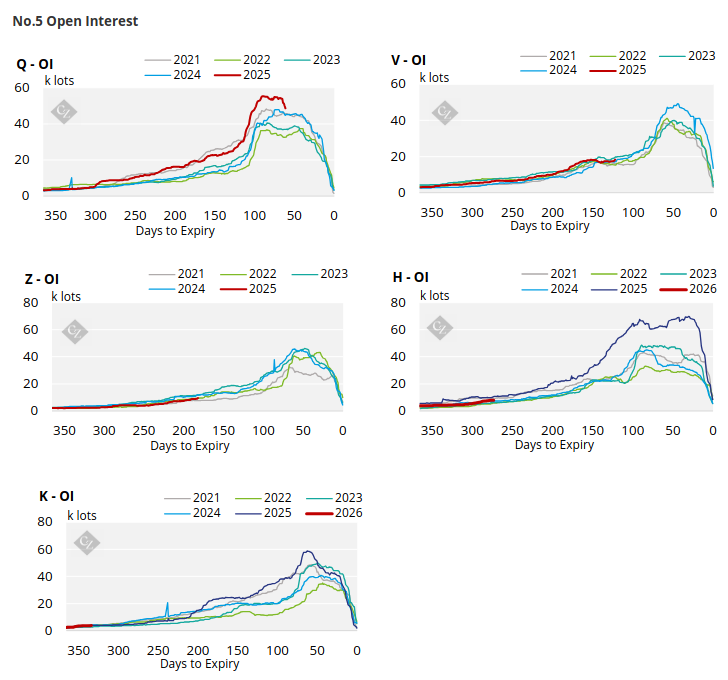

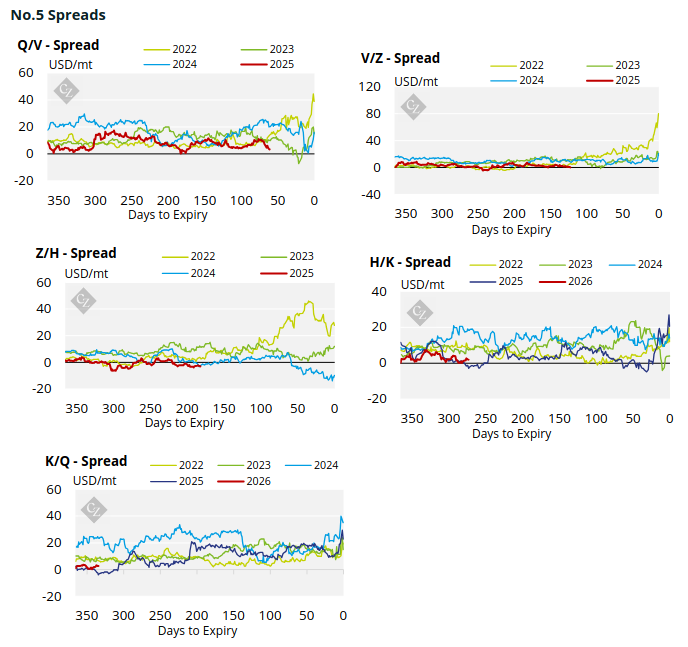

No.5 Open Interest

The No.5 refined sugar futures curve has weakened across the board.

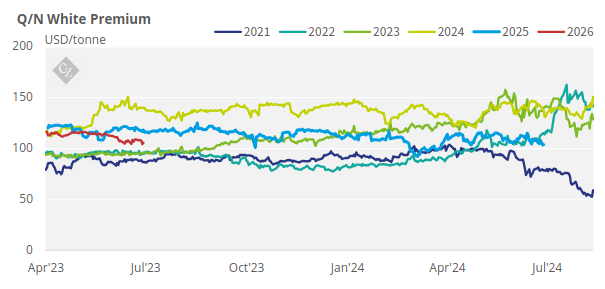

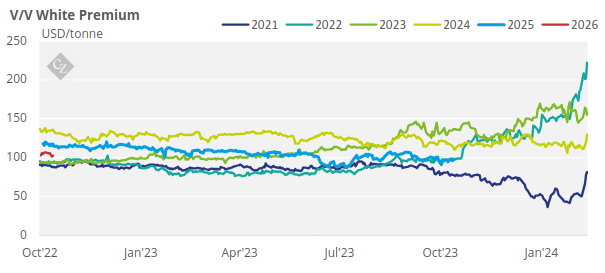

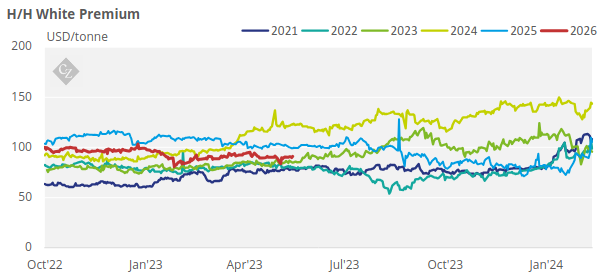

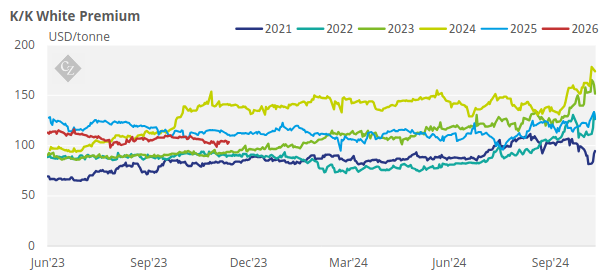

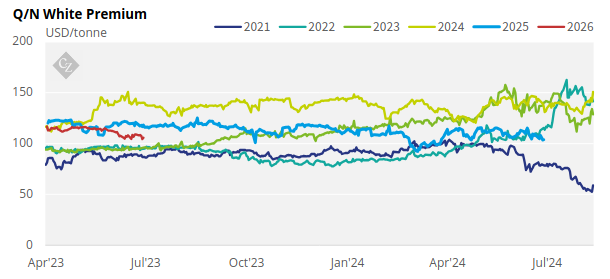

White Premium (Arbitrage)

The Q/N white premium hit a high of USD 108.1/tonne on Tuesday but traded between USD 103.4-105.8/tonne for the remainder of the week.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix