Insight Focus

- Refined sugar prices make gains, whilst raw sugar prices slide over the last week.

- Refined sugar speculators add to their long positions for the 4th week in a row.

- Meanwhile raw sugar speculators are at their most neutral since December last year.

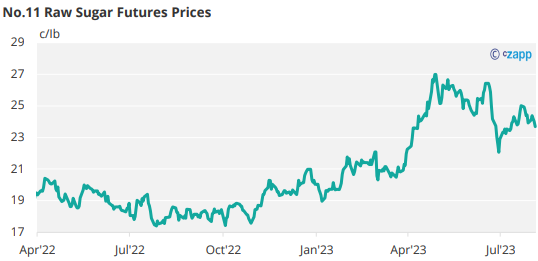

New York No.11 Raw Sugar Futures

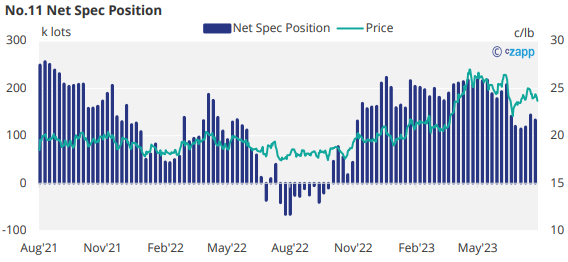

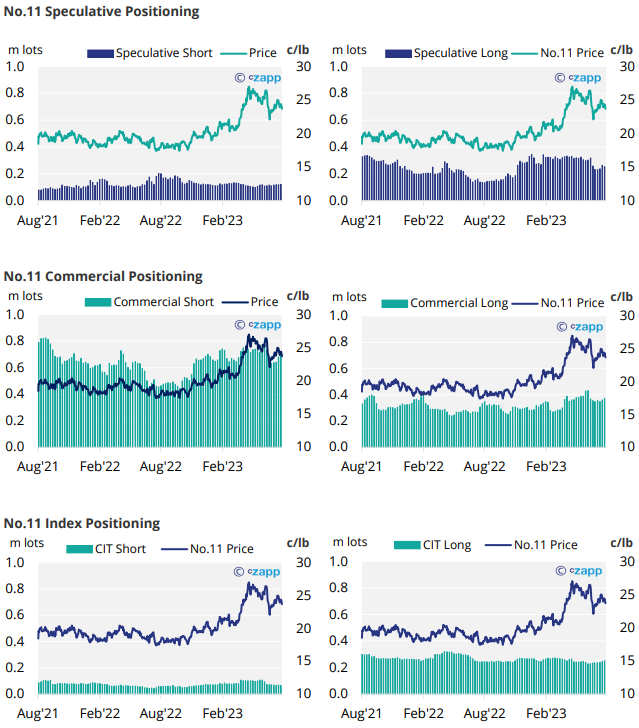

No.11 raw sugar futures prices continued to fall away over the last week of trading, closing at 23.7c/lb by Friday.

As of the most recent CFTC CoT report (the week preceding the 1st of August), speculators lifted over 8k long positions, largely reversing gains made in the previous report.

As such the net spec position now stands at 134k lots, toward the lowest it has been since December last year.

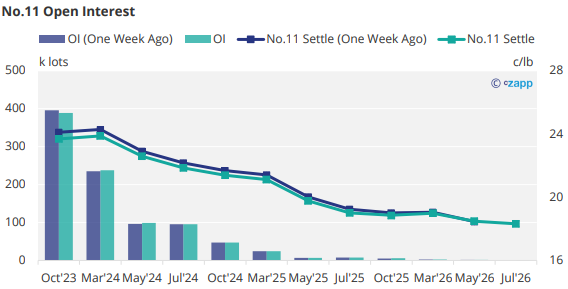

Both raw sugar producers and consumers again were able to slightly advance their hedging. Producers extended their short position by 7k lots, whilst consumers added over 10k lots of new positions.

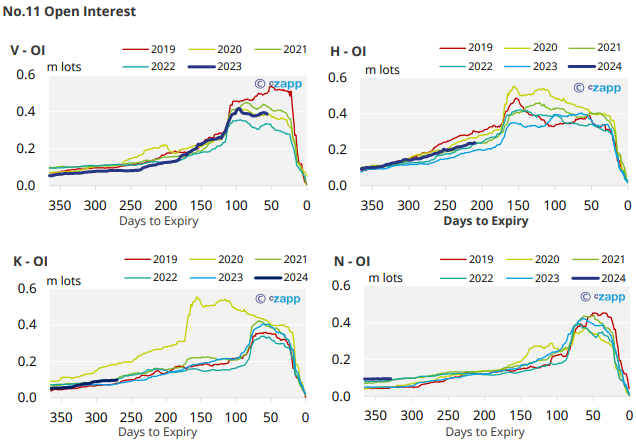

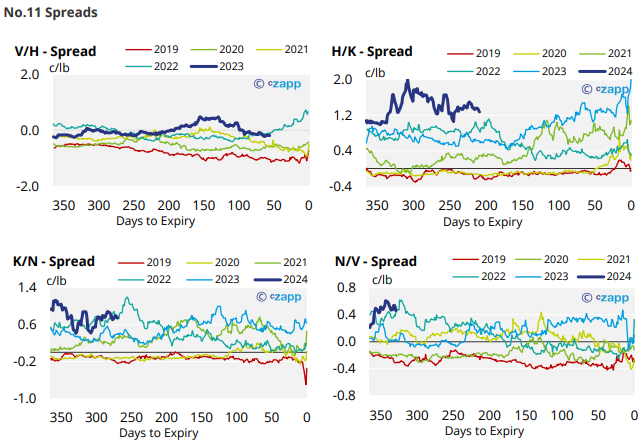

The shape of the No.11 raw sugar futures forward curve remains fairly similar to last week, with contracts down the board weakening slightly. This means the V/H spread remains in contango whilst the rest of the curve maintains a strong backwardation.

London No.5 Refined Sugar Futures

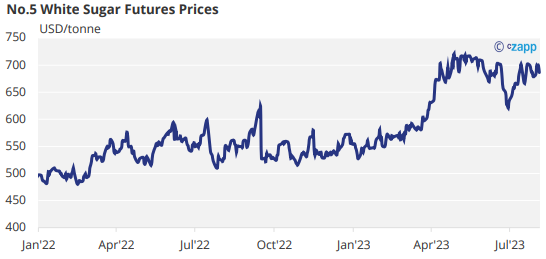

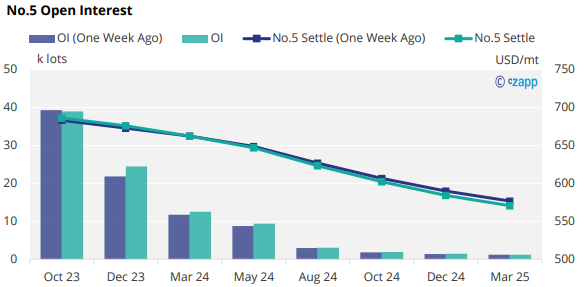

No.5 refined sugar futures were more turbulent over the last week, trading up to over 700USD/tonne on Monday, before retreating back toward 685USD/tonne on Friday.

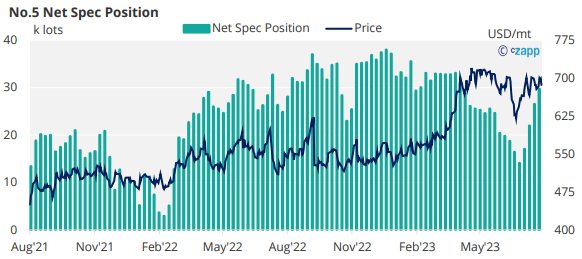

Refined sugar speculators continued to extend their long position for the 4th week in a row, the net spec position rising by a further 3k lots by the 1st of August.

Now at almost 30k lots long, this is the largest the net spec position has been since the start of April.

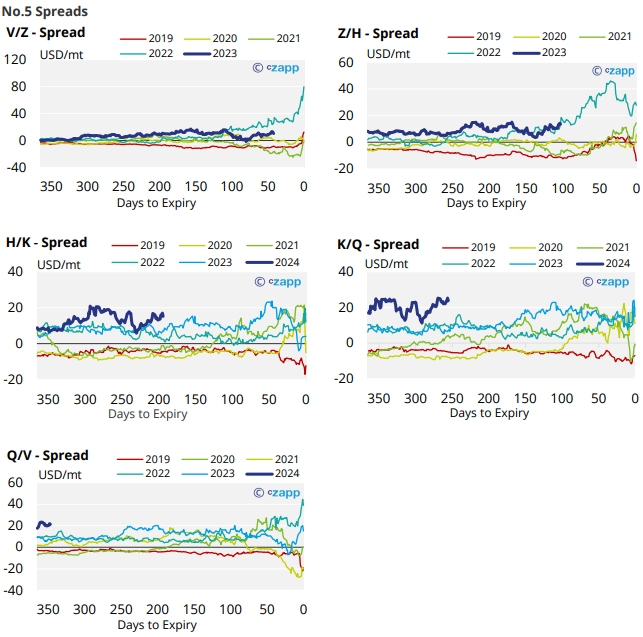

The refined sugar forward curve is mostly unchanged from the previous report, and is still strongly backwardated out as least as far as the 2025 contracts.

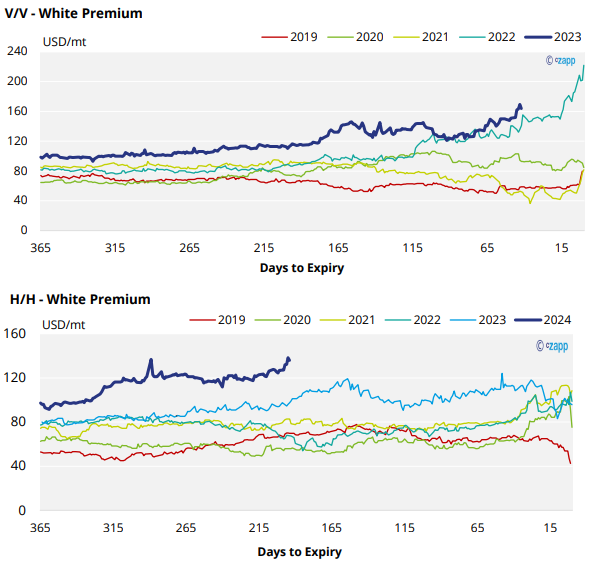

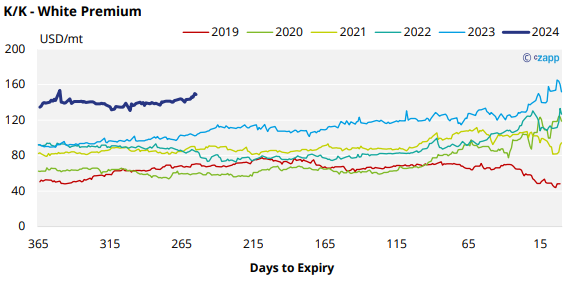

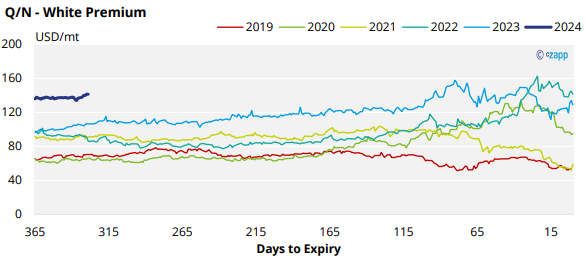

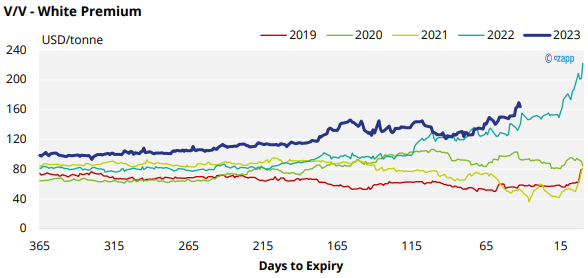

White Premium (Arbitrage)

With raw sugar prices sliding, and refined sugar prices making slight gains, the sugar white premium has grown further.

Now at almost 165USD/tonne this is the highest it has been since October last year.

We think many re-export refiners require at least 105-115USD/tonne over the No.11 to operate profitably, this means the spot white premium offers comfortably enough for these refiners to be maximising their throughput.

At this level we could see higher-cost or discretionary refiners begin to consider re-exporting too, rather than just serving their domestic markets.

Whilst not quite as strong, the proceeding H/H, K/K, and Q/N white premium’s also comfortably offer enough margin over the No.11 for re-export refiners to be incentivised.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

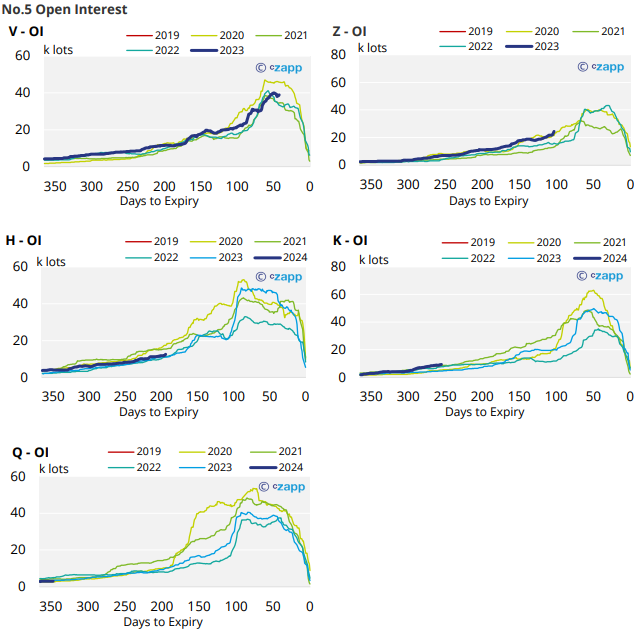

No.5 (White Sugar) Appendix

White Premium Appendix