Insight Focus

- The No.11 and No.5 rallied sharply at the end of last week.

- The white premium is now above 105 USD/mt.

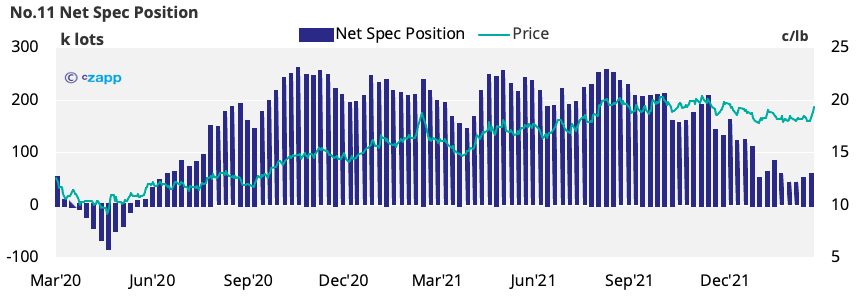

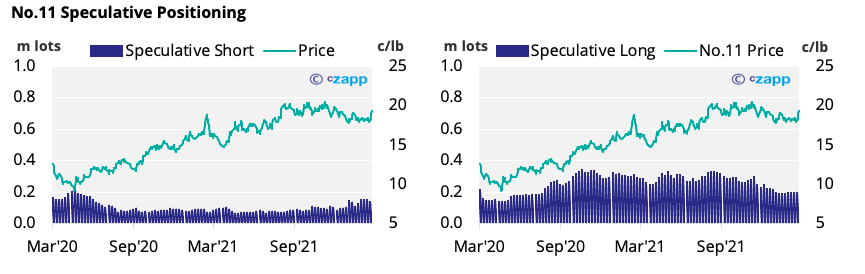

- The specs reduced their exposure to the No.11 at the start of March.

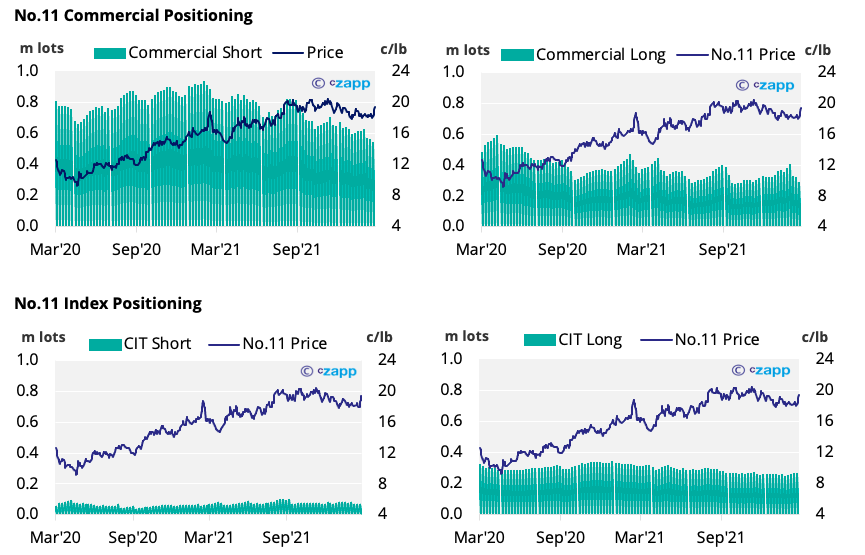

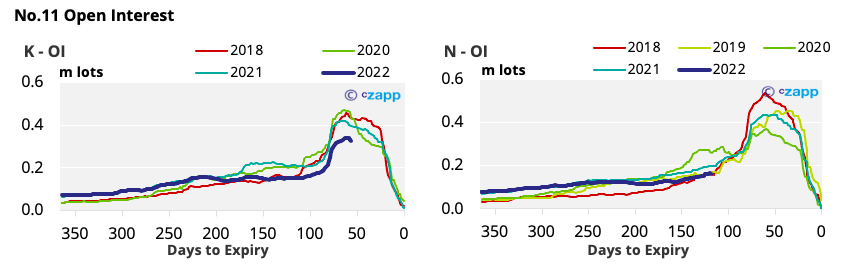

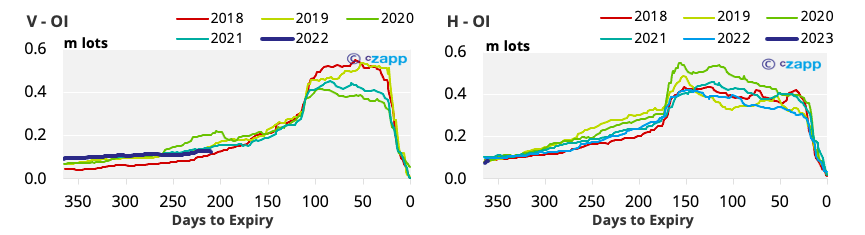

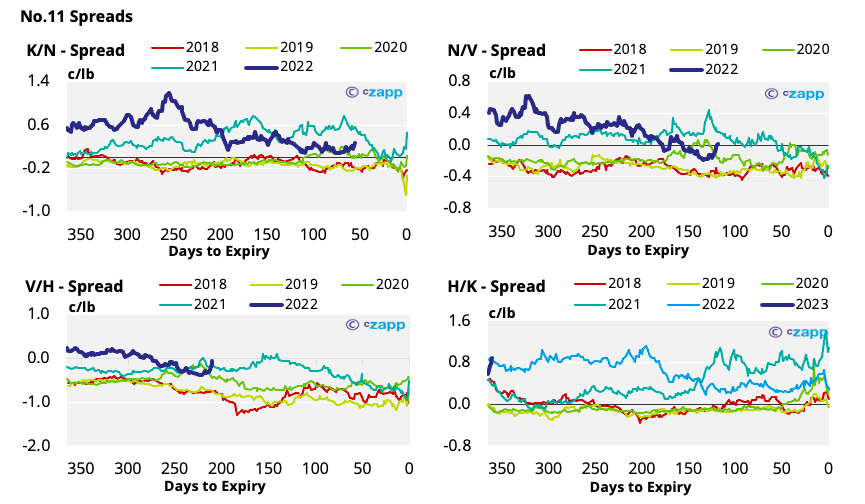

New York No.11 (Raw Sugar)

- The war in Ukraine seems to have spilled over into sugar as the No.11 has quickly strengthened towards 20c/lb for the first time since mid-December.

- We’ll see the effects of this in the next CFTC release due on Friday.

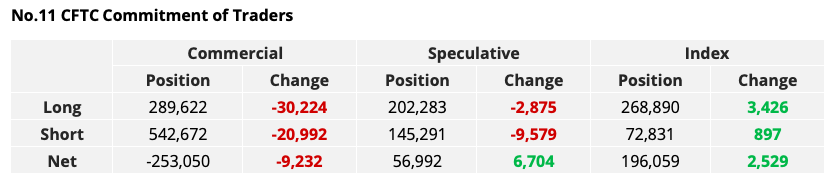

- As of the current report (1st March), speculative interest in sugar decreased by over 12k lots.

- Since more shorts were closed, the net spec position rose to above 56k lots, still low by recent standards.

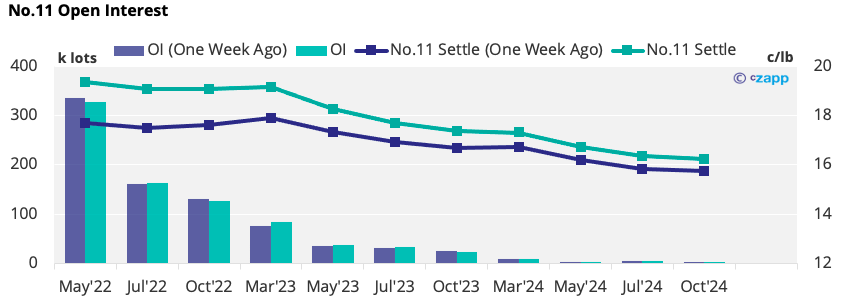

- The No.11 forward curve has flattened towards the end of 2022 as the V’22/H’23 spread moved sharply towards neutral.

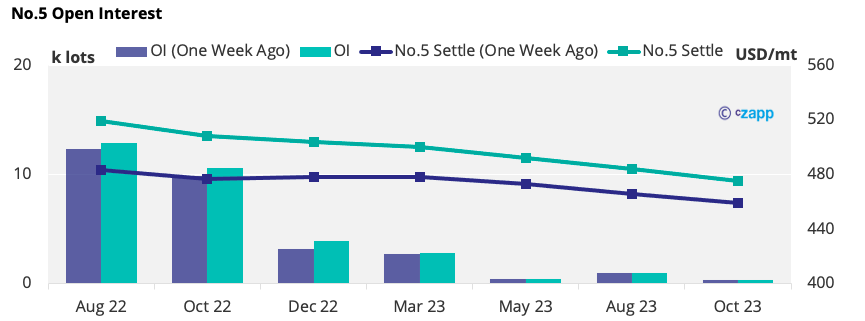

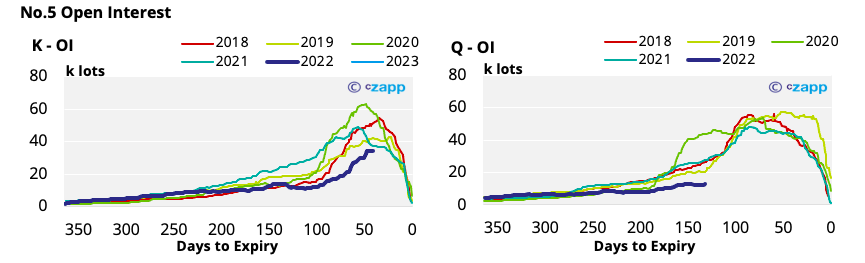

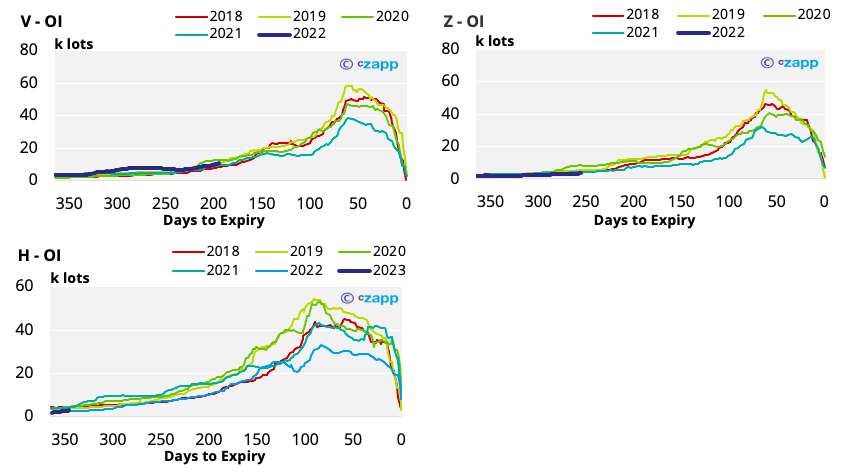

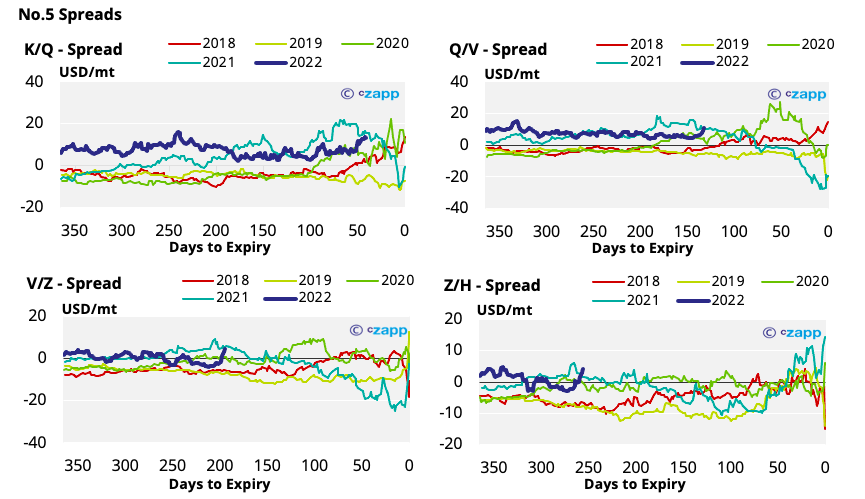

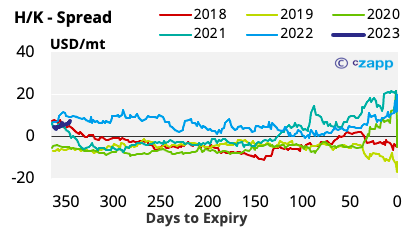

London No.5 (White Sugar)

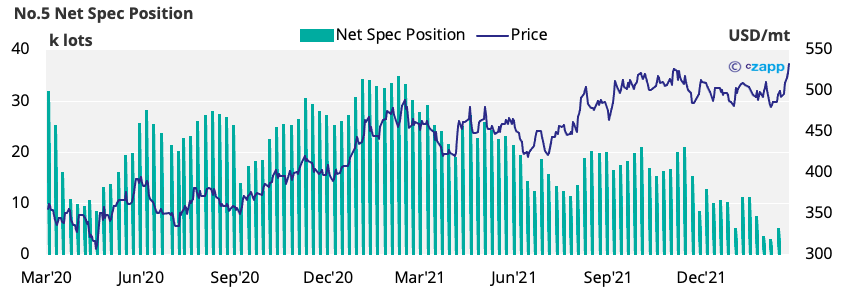

- The No.5 rallied to above 530 USD/mt by Friday last week, a five-year high.

- With the K’22 and Q’22 seeing most of the buying, the whites forward curve has become increasingly backwardated through 2022.

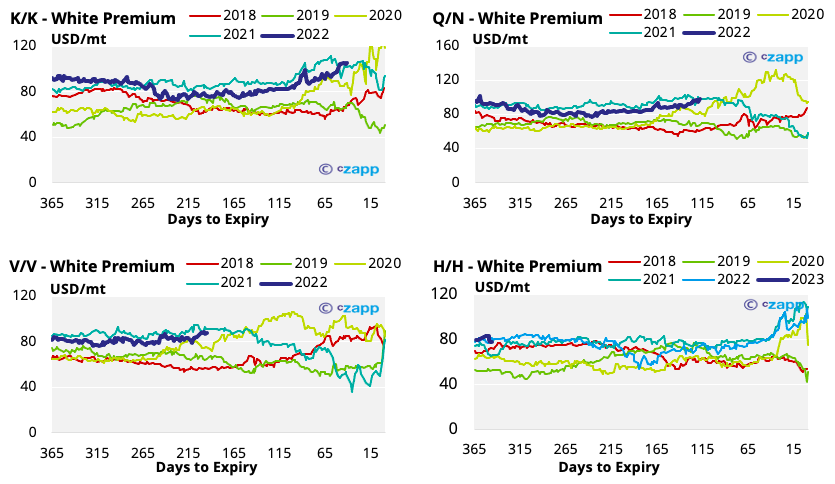

White Premium (Arbitrage)

- With the No.5 outstripping gains in the No.11, the white premium has widened to above 105 USD/mt.

- This is good for re-export refiners who could see their margins improve.

- The oil and energy price rallies complicate this once freight and processing costs are factored in.

- With the No.5 futures curve becoming more backwardated the white premium could weaken further into 2022.

For a more detailed view of the sugar futures and market data, please refer to the data appendix below.

No.5 (White Sugar) Appendix

White Premium Appendix

Other Insights That May Be of Interest…

Black Sea Sugar Freight Suffers Little War Disruption

Is ‘Fortress Russia’ Self-Sufficient in Sugar?

Explainers That May Be of Interest…