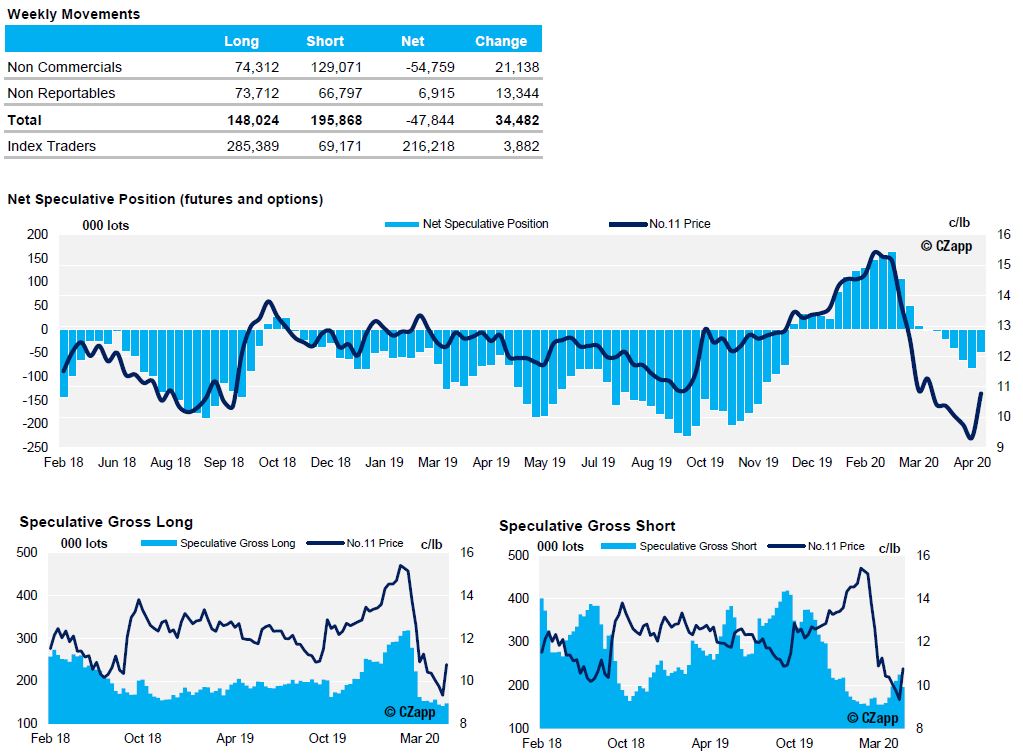

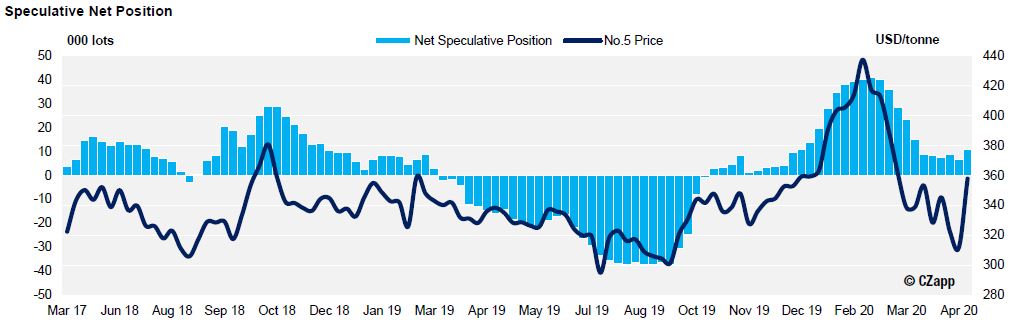

- For the first time since Coronavirus uncertainty hit markets, the specs in raw sugar appeared to reflect bullish sentiment by reducing the size of the net spec short by 35k lots.

- This, however, is misleading – as it was driven by specs withdrawing from short positions, rather than opening new long ones, presumably those who were squeezed by last week’s small price rally.

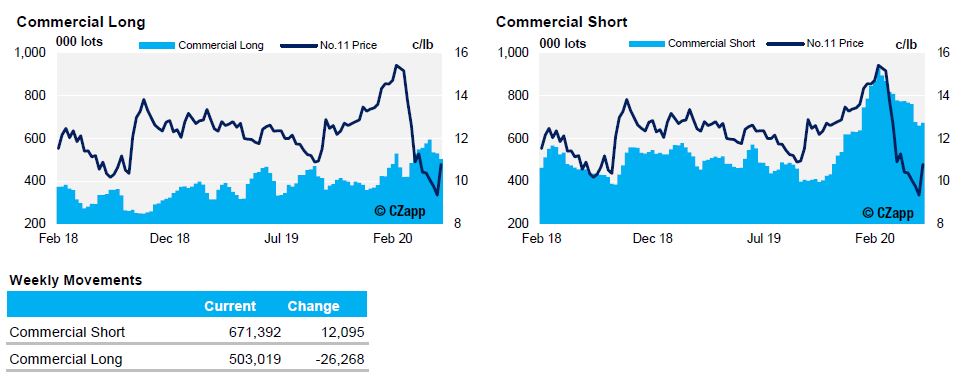

- Commercials sold to specs to facilitate this withdrawal, with gross commercial long position reducing and gross commercial short position growing.

ICE No.11 Futures Speculative Positioning (values as of 5th May 2020)

ICE No.11 Futures Commerical Positioning (values as of 5th May 2020)

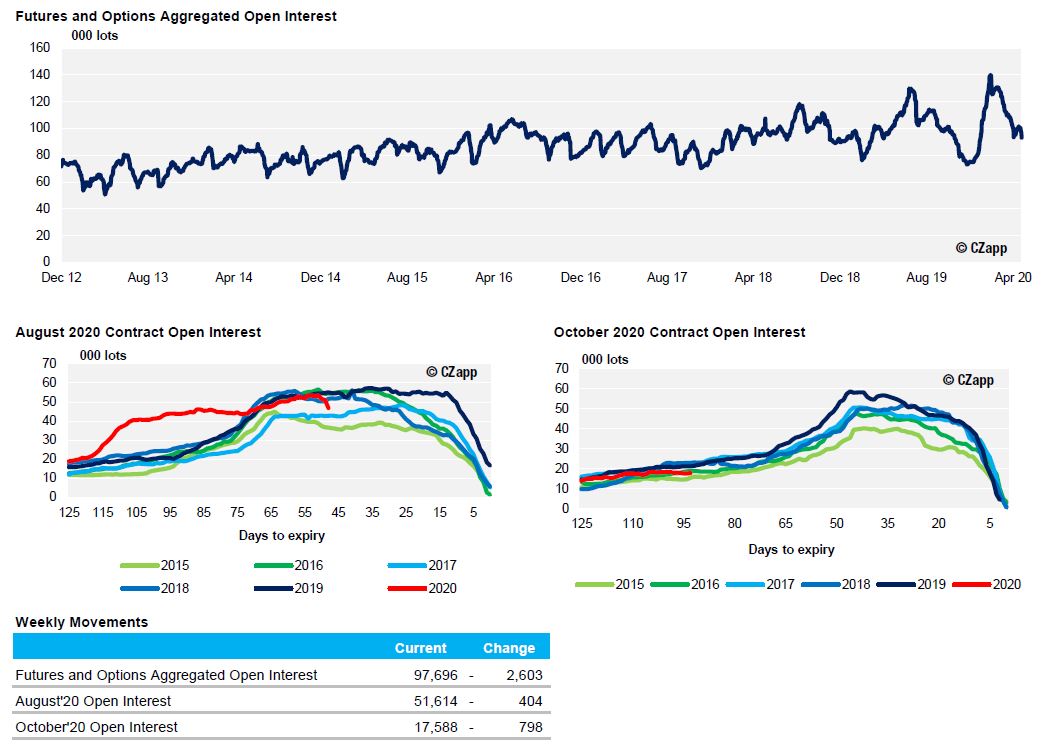

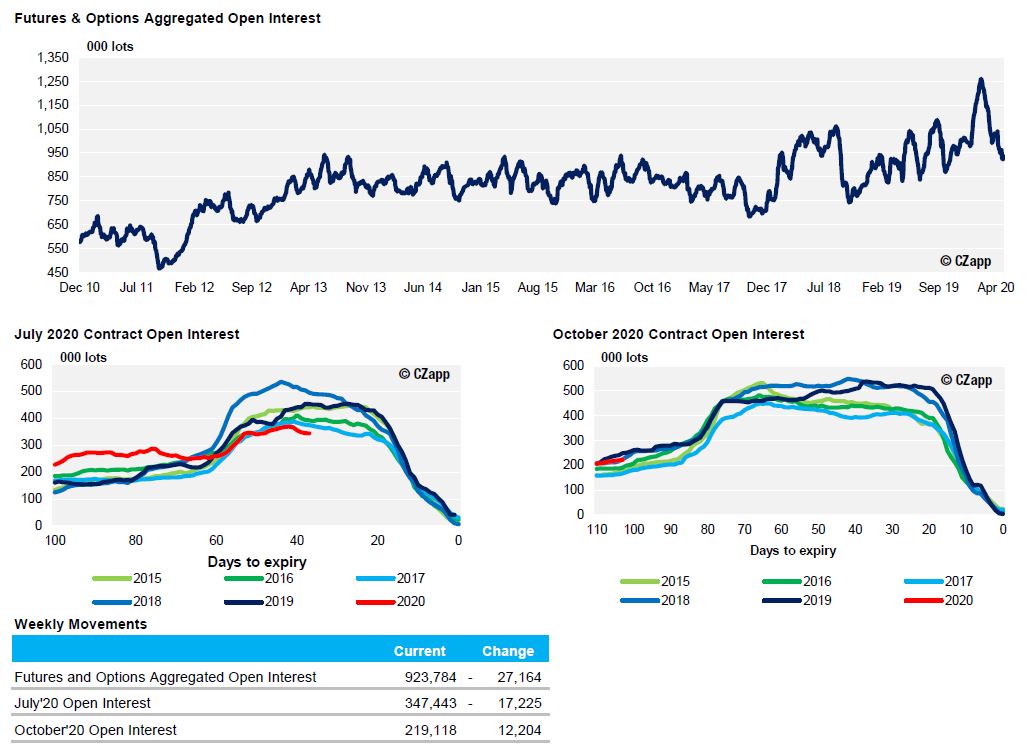

ICE No.11 Futures Open Interest (values as of 5th May 2020)

ICE Futures Europe (No.5) Speculative Positioning (values as of 5th May 2020)

ICE Futures Europe Open Interest (values as of 5th May 2020)