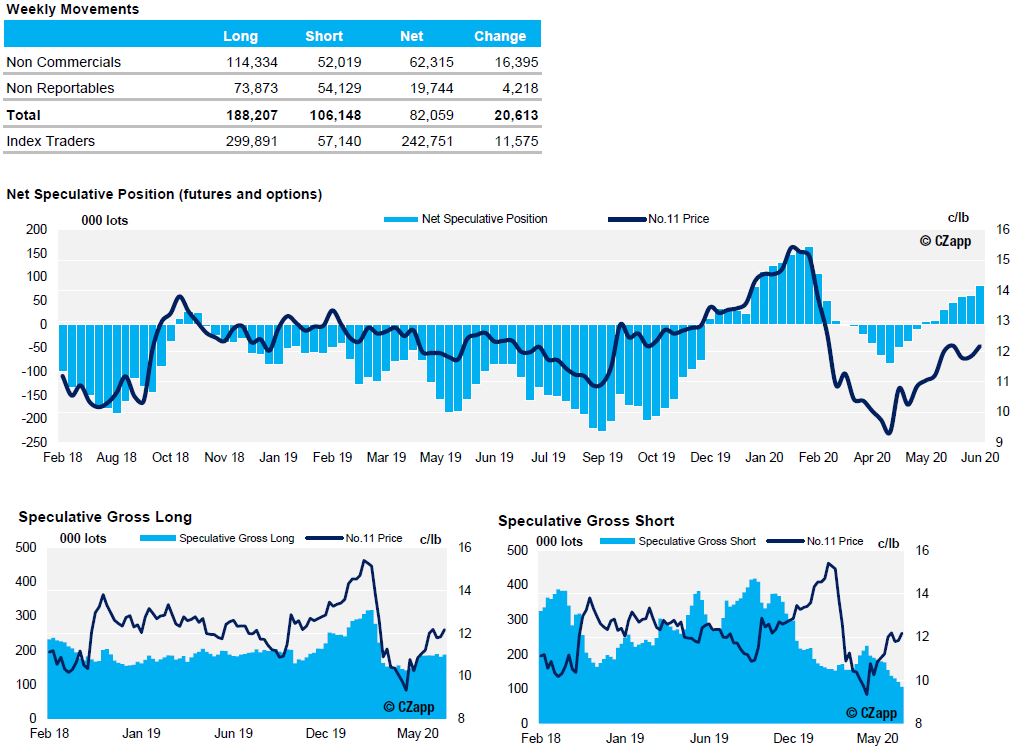

- After two slow weeks for spec activity, the No.11 net spec long grew by 20k lots, driven by significant spec buying on the day of the report – which saw price rise by 25 points.

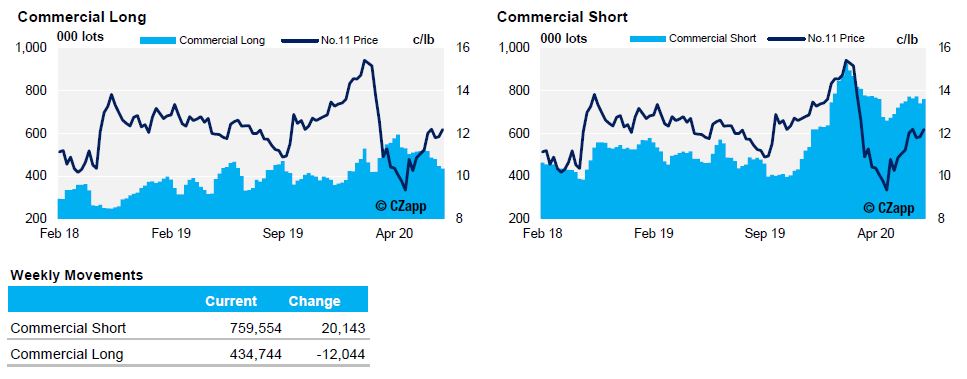

- This spec buying was facilitated by commercials, who were happy to sell as price surpassed 12c.

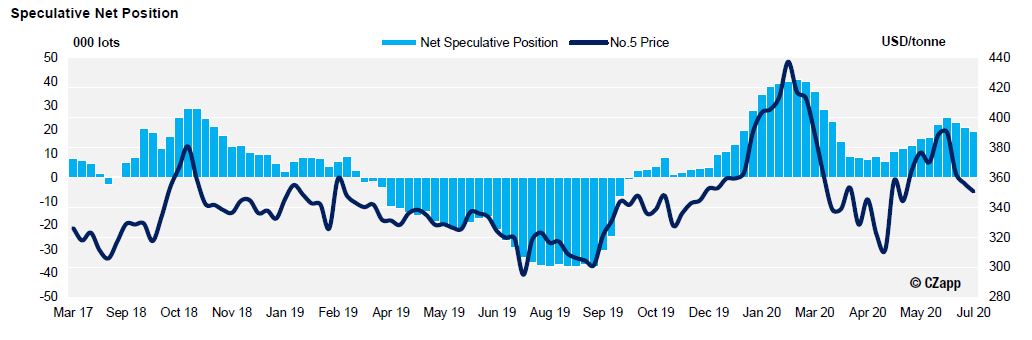

- In White Sugar the net spec long continued its gradual downward trend, mirroring the price as demand falls worldwide.

ICE No.11 Futures Speculative Positioning (values as of 7th July 2020)

ICE No.11 Futures Commerical Positioning (values as of 7th July 2020)

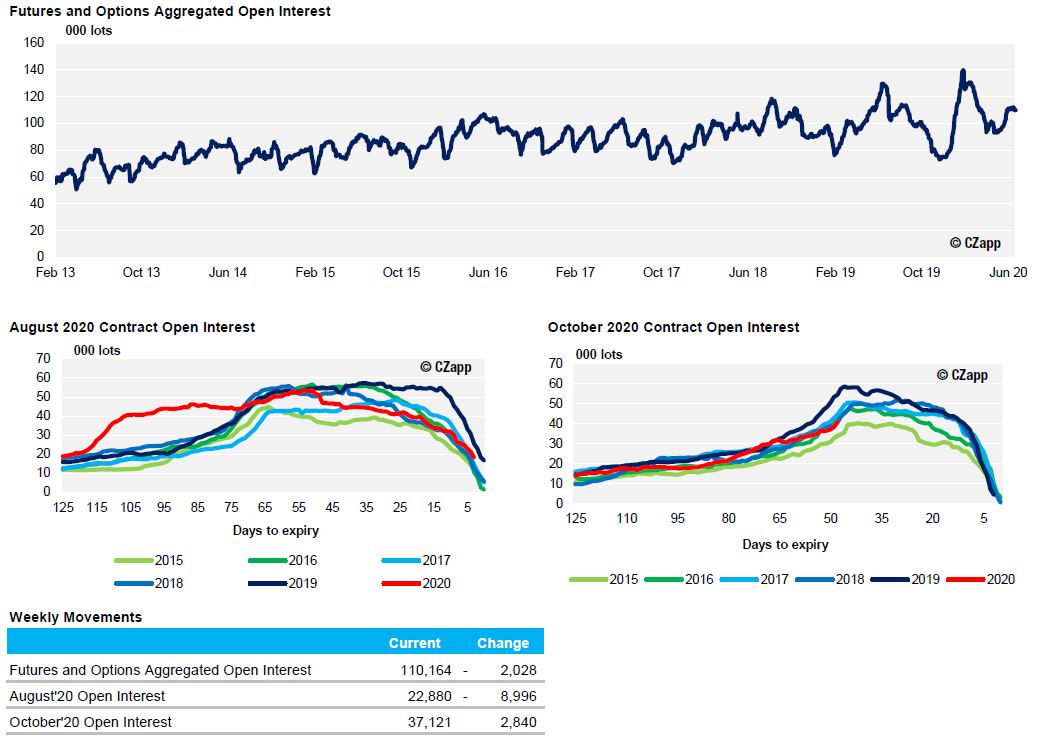

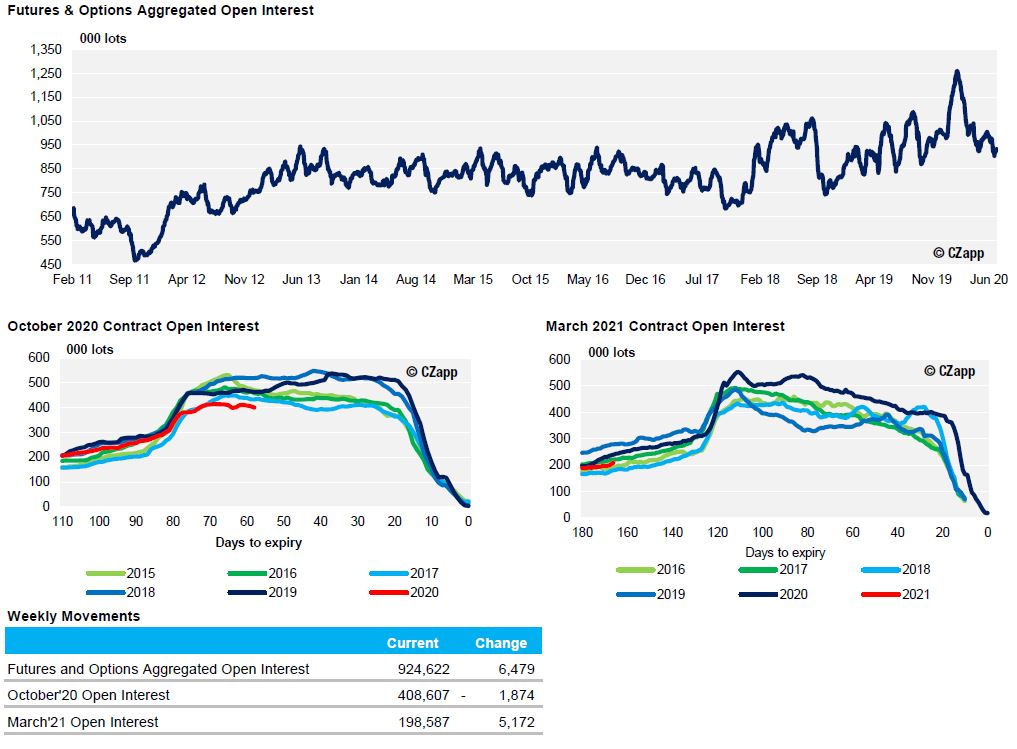

ICE No.11 Futures Open Interest (values as of 7th July 2020)

ICE Futures Europe (No.5) Speculative Positioning (values as of 7th July 2020)

ICE Futures Europe Open Interest (values as of 7th July 2020)