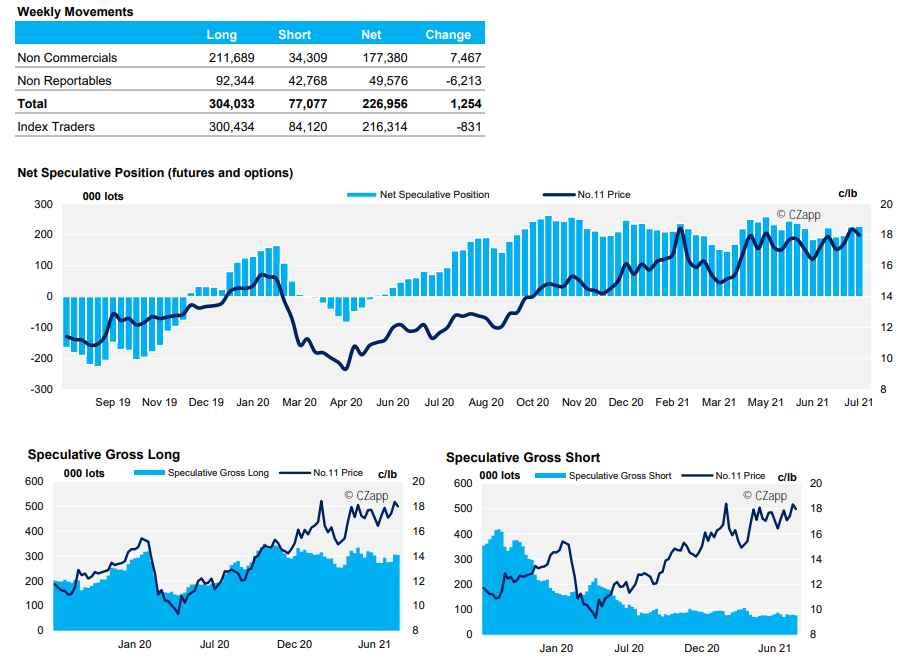

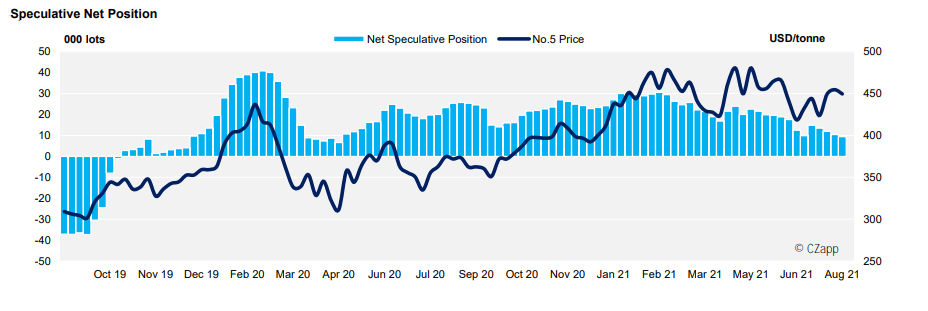

- The net Spec long position in Raw Sugar grew by a modest 1,254 lots in the week up to the 3rd of August

- The price rose to 18.61c/lb, before falling down to below 18c and stabilising in the week – suggesting that waves of spec buying continues to be the source of bullish price spikes in the market.

- The No.11 price has risen again since the data was captured, which suggests specs are buying but are again unlikely to maintain momentum as the lack of physical demand in the market is leading to underwhelming futures buying from consumers.

ICE No.11 Futures Speculative Positioning

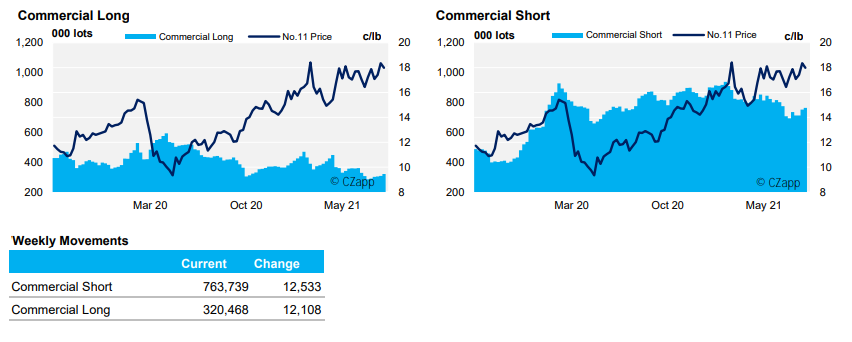

ICE No.11 Futures Commercial Positioning

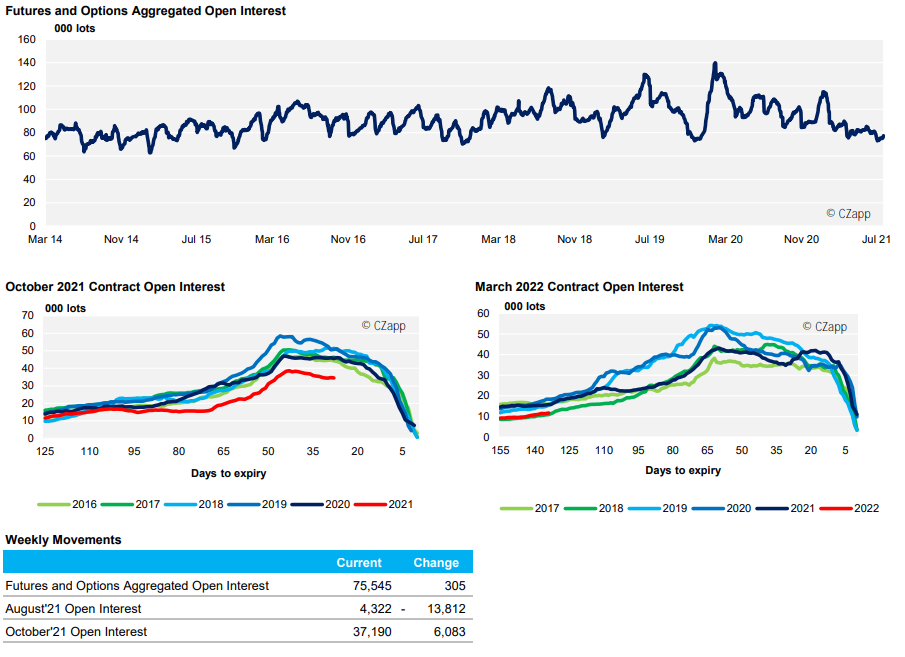

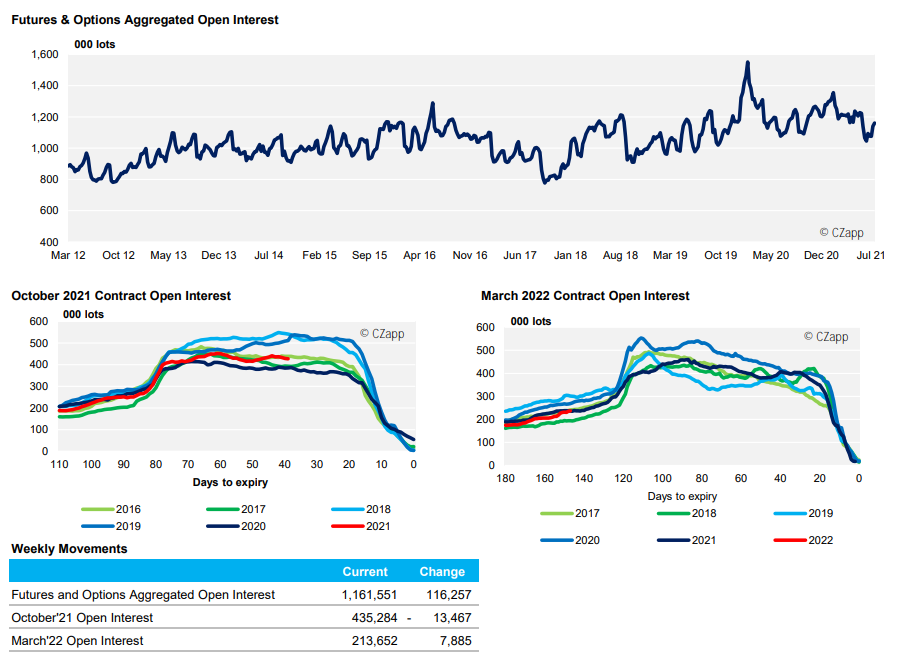

ICE No.11 Futures Open Interest

ICE Futures Europe (No.5) Speculative Positioning

ICE Futures Europe Open Interest