Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.

For more information please contact Michael here.

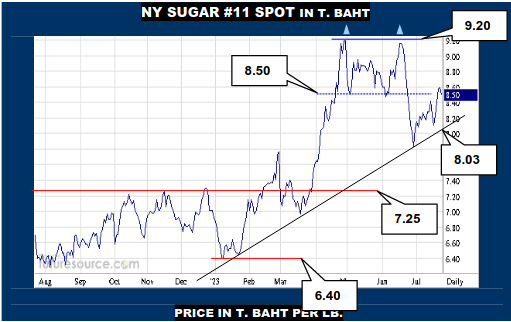

NEW YORK SUGAR #11 OCTOBER 2023

Refused by the 25’s the day before, NY let off the gas a bit more Tuesday. For now this still equates to just a near term breather in the upper 24’s and since the B-Berg is adjacently hunting a next major 109.8 hurdle, there seems no cause for doubt here yet and a further leg north towards 26.43 remains plausible. However, if the Dollar bust beyond its 101.60’s residual gap sliver and this market swerved back beneath 24.35, then a warning light would come on, in that case suggesting another encounter with the 23.70’s where the post-Jly resuscitation could genuinely unravel.

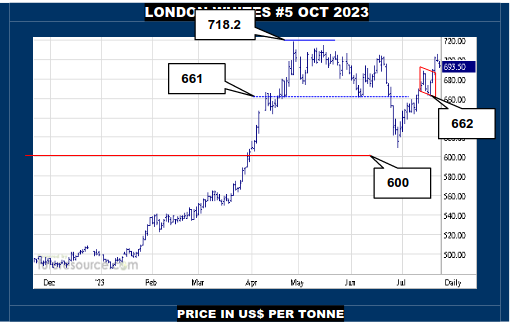

LONDON WHITES #5 OCTOBER 2023

As with NY, London initially just appears to have exhaled slightly after there wasn’t much traction to be found in the 700’s. Nonetheless, as long as it can mop up this breath aboard 687 to ostensibly balance on the previous flag, all would look well and the remaining path to 718.2 would keep calling. Be that much more wary though if 687 cracked here alongside 24.35 in Raws, concerned then that the ground could turn crumbly and bring the pivotal 662 figure back into action where the balance could teeter dangerously.

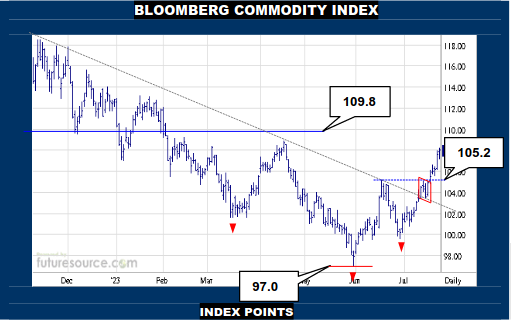

BLOOMBERG COMMODITY INDEX

With a downtrend escape, a flag and a rather loosely phrased inverse H&S base under its belt, the B-Berg has been on a roll in Jly as it stretches its legs towards the next main boundary at 109.8. Meantime there is an important event going on in the Dollar as it tests its 101.60’s gap but, provisionally at least, it is being blunted there. If that became a clearer cut rebuke of the Dollar, look for the commodity index to actually attack 109.8 and potentially score a breakthrough that would loudly echo the turn already witnessed to bring the 120’s into legitimate range. Only if the greenback smashed through the 101.60’s would there be far greater concern for a backlash here.

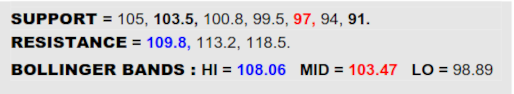

NY SUGAR #11 IN THAI BAHT

Deciding moments (well, hours perhaps) as Baht priced Raws lunge at the Q2 double top above 8.50. The question is can the market make this stick with further progress beyond the 8.50’s to dispel that previous top formation? If yes, it would give ₵/lb. added endorsement in its recovery, just then needing Real priced NY beyond 1.20 for a full house and a bugle cry for the cavalry to charge as one, retargeting 9.20 next here. A tense spell meantime though because if unable to hammer in some hooks north of 8.50 and instead swatted back under the mid band (8.24), the top would prevail and call the Jly swell just a temporary reaction to that prior Jun dive, whereupon the uptrend itself could then be in dire straits (8.03) for a full (sultans of) swing back to the downside.

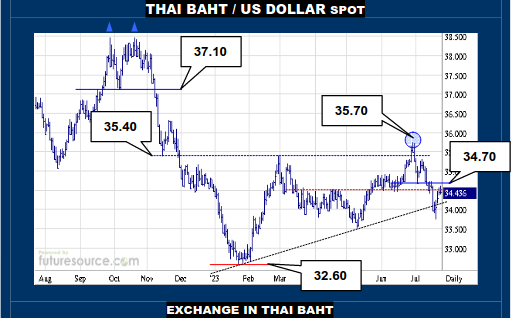

THAI BAHT / US DOLLAR SPOT

VALUE : 34.47

The haste with which the Dollar reversed a late Jun stab to 35.70 suggested a false breakout and subsequent loss of a 34.50 shelf seemed to endorse that view but it has bounced back lately to ask a few questions. Would duly be watching a 34.70 resistance in the coming day or two as it so happens to be hosting the mid bands’ arrival while of course adjacently the Dollar index is patching its 101.60’s gap. If both fail at those thresholds (34.70 and 101.65), there would be suggestion of quick corrective breaths ending and a new gouge through 34 here would warn of a more enduring breakdown towards 32.60 or deeper. Must bust decisively over 34.70 to propose a more enduring comeback.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.