Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.

For more information please contact Michael here.

NEW YORK SUGAR #11 OCTOBER 2023

NY may still be just about balancing on its mid band (24.13) but it hasn’t been able to swerve abruptly higher again this week in spite of Londons’ coaxing as the Dollar is meantime weighing adversely on the macro and forcing the B-Berg to attack an important 105 support shelf. This warns to be quite careful here as the past few weeks are duly showing somewhat H&S qualities and so the recent 23.84 trough marks a potential tripwire where the efforts to resuscitate after the Jly contract would essentially end and a new dive towards 20.50 could ensue.

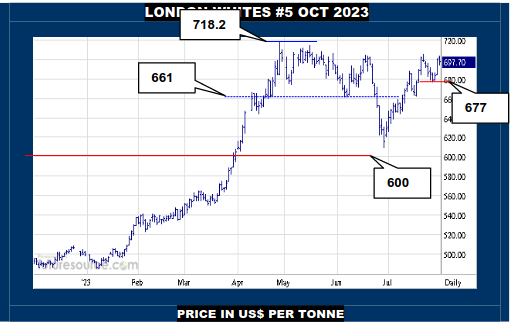

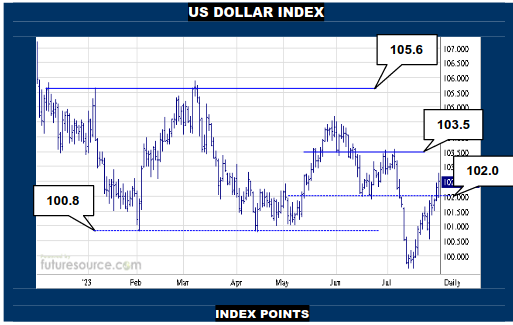

LONDON WHITES #5 OCTOBER 2023

No harm done but London was being held at bay shy of the 705 hurdle Wednesday as the macro and Raws just aren’t doing anything to assist at present. If this changed and a clean exit across 705 did occur, the past couple of months would assume a much more base-like profile that would buoy prospects to exceed the 718.2 peak and undertake a significant new leg up to around 800. Eying 23.84 stateside meantime for growing signs of distress however, in which case 677 would look far more vulnerable here as a tripwire into the low 600’s.

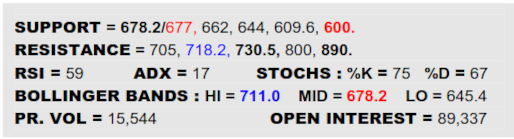

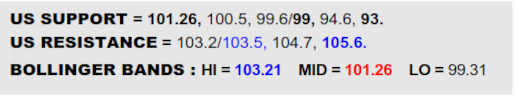

US DOLLAR INDEX

The Dollar has bust into the 102’s to underscore its prior 101.60’s gap conquest and generally hone the comeback from a near Fib retracement false breakdown to the 99’s, which is taking its toll by pressing the B-Berg back to a key 105 mid band pivot. That Fibonacci factor enhances overall impressions that the previous three quarters were just a large scale correction then and that the US currency could be reorienting onto its ‘21/’22 track, whereby Elliot wave rules would imply a next mid term leg to 125 could be getting underway. To cool such daunting prospects for the commodity arena, the Dollar must flinch at the upper Bollinger (103.2) to 103.5 area and divert back under its mid band (101.26).

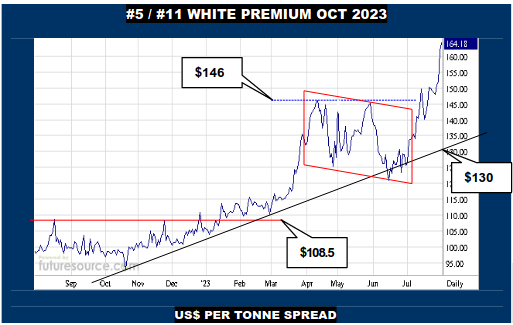

#5 / #11 WHITE PREMIUM OCT 2023

VALUE : $164.2

Londons’ relative advantage is very plainly highlighted by yet more gains in the White Premium this week as it has hastened its rally away from the big Q2 flag-like interlude. With a $93 to $146 prior run-up representing the flagpole of that pattern, the projected target destination is $174 ahead of the ’22 spot Premium peak of $186. Even so, though duly still looking further up the hill for the time being, must be mindful of the extra tension being built into Whites by recent exertions compared to Raws so beware any break of 677 on flat price being a forewarning of a prospective backlash that could trip off a sudden reset to the $145 flag edge here, if not then becoming a retracement to the uptrend ($130).

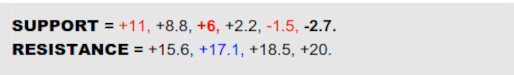

LONDON WHITES #5 OCT / DEC 2023 SWITCH

VALUE : +$14.3

Although the first half H&S initially blunted the Jly recovery of the Oct/Dec Whites, it then held +$6 support and has rallied again to carve further into that prior top. The quick dunk to +$6 duly plays in a sort of flaggish role therefore and this suggests the new leg up could match the $13 magnitude of the prior revival from -$1.5 to +$11.5. That technically measures on through the +$17.1 peak to +$18.5 so the high teens are presently the anticipated destination. Only if exterior influences like Raws or the B-Berg caused a quick doubling back under +$11 would it call into question the flag assertion and in so doing swivel focus towards +$6 again.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.