Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.

For more information please contact Michael here.

NEW YORK SUGAR #11 OCTOBER 2023

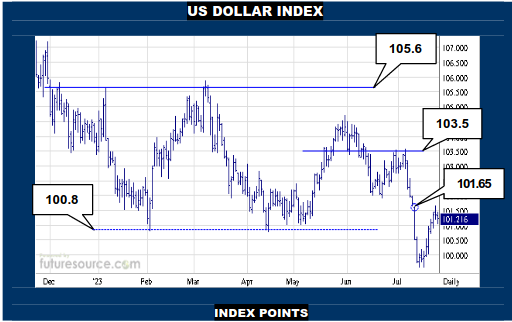

Creakier conditions in NY Wednesday as it needled through the 24.35 ledge, mindful that top frontiers at 1.20 in B. Real and 8.50 in T. Baht have thus provisionally blunted their respective Jly upswings. A bit of a wait and see for the next session or two then where either the footing on 24.35 is solidified to revive chances into the 25₵’s (and across 1.20 Real and 8.50’s Baht) or else further whittling beneath 24.35 could jeopardize the mid band itself (23.80), watching that feature in sync with the 101.65 gap hurdle on the Dollar as tripwires for more enduring damage.

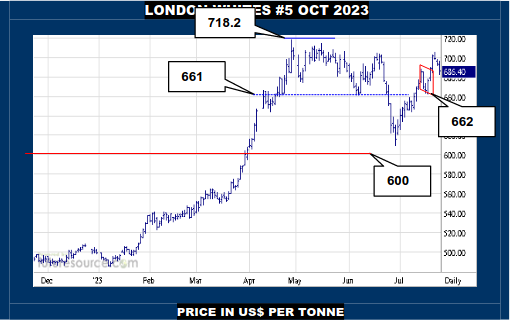

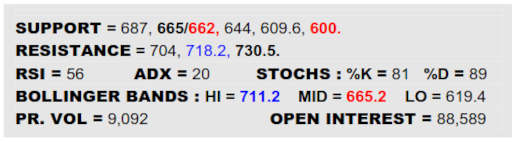

LONDON WHITES #5 OCTOBER 2023

As NY asked questions of its 24.35 bracing, London gnawed at immediate 687 flag support Wednesday. Can’t really call that prop entirely undone off this action alone but it is definitely under strain. If a clearer cut break were to occur while Raws broke the 24.30’s decisively and the Dollar popped 101.65, the idea of just a quick breather dip would fade and a serious dice with the lower 660’s would threaten to tip the broader balance south. Must otherwise show a firmer footing on 687 over the remains of the week to revive prospects to reach 718.2.

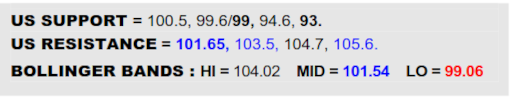

US DOLLAR INDEX

A flashpoint moment in the Dollar as it has patched all but a whisker of the 101.60’s gap but hasn’t been able to actually break beyond. Events here are liable to be pivotal. The catch made in the 99’s met a measuring gap target while also narrowly missing a Fibonacci retracement of the big ‘21/’22 advance (99). If the rebound now exceeded the 101.60’s while adjacently the Euro broke beneath 1.10 (having hit its own Fib retracement at 1.128), there would be deep rumbles across the Forex landscape of a key turning point to suggest the Dollar getting back in the saddle, ominous for commodities. However, if bluntly rebuked from triple digits again, it would signal a weaker Dollar phase down to 93.

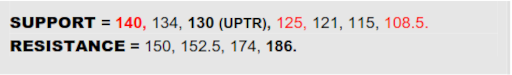

#5 / #11 WHITE PREMIUM OCT 2023

VALUE : $148.7

A brief duck back to $140 following new highs was capably gathered up and the White Premium has driven into new ground again with a bit more ‘stick’ this time up. As previously noted, this is giving the entire Q2 period the look of a major flag (more so viewing weekly/monthly charts) and, if indulging that argument for a while, it projects a target of $174. Having to give the upside path its chance for the moment then but only as long as that $140 trough is intact because, with the mid band just now arriving, any backlash beneath would alter the perspective, diluting the flag idea and posting a small new dual top, in which case the uptrend would then need watching ($130).

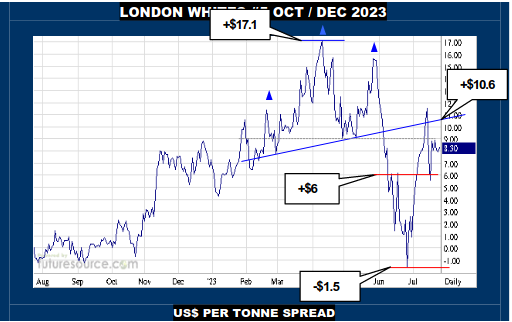

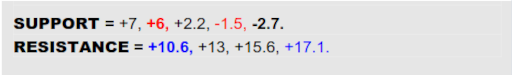

LONDON WHITES #5 OCT / DEC 2023 SWITCH

VALUE : +$8.3

An early Jly rebound from negative terrain was blocked by the first half ’23 H&S (+$10.6) but Oct/Dec Whites still then made a catch at +$6 to keep that top formation in the crosshairs. Duly minding the band between +$6 and +$11 therefore as a sort of temporary neutral zone, awaiting exit to signal what comes next. Busting on over +$11 would dispel the H&S and suggest the recovery could enjoy a second wind to stretch for the +$17.1 high again. Alternatively, dropping back under +$6 would instead reaffirm the authority of that H&S and threaten a new delve down into negative values.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.