Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.

For more information please contact Michael here.

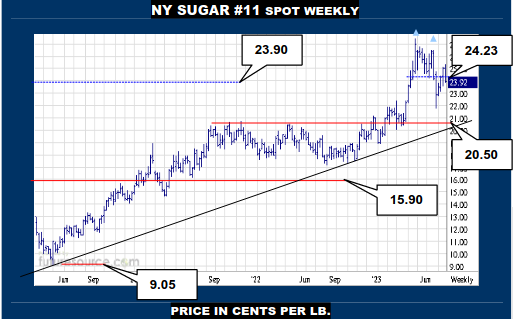

NEW YORK SUGAR #11 WEEKLY

As if determined to put it all on a razors’ edge, NY ended its week by fraying the mid band Friday. In continuation terms, this means a decent 1₵ lunge into the top above 24.23 met a 25.27 Fib retracement of the Q2 decline (and a 1.20 B. Real pivot) before the effort flinched to now be teetering at the mid band. If truly ousted from the 24’s early next week to confirm those failures, beware the ghost of the Jly contract returning and a new dive towards 20.50. Must hang tough near 24₵ and see the Dollar veer back out of the 100’s to create hope of surviving this wobble.

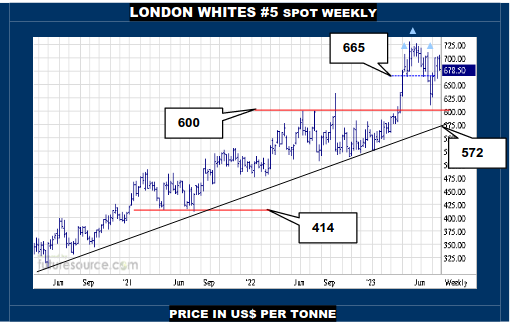

LONDON WHITES #5 WEEKLY

No Fibonacci values for London but a spell of wheelspin on the 700 border has also given the sense of wheezing despite the prior punch back up into the Q2 H&S shape. This doesn’t look quite as on the brink as NY for the time being but would indeed be minding the mid band (671) as a confirming tripwire if Raws were to meantime be ditched from the 24’s to suggest more serious exhaustion there, then fearing Whites taking a new dive towards the main bracing at 600. Whether the mid band here can save the day if NY broke the 23.90’s seems doubtful.

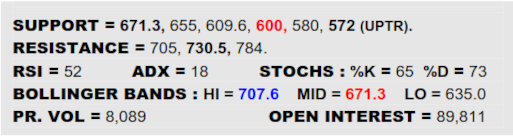

BLOOMBERG COMMODITY INDEX WEEKLY

Undoubtedly a hopeful start to Q3 for the B-Berg as it shook off the downtrend of the past year and a quarter to present ’23 in the light of a slightly distorted inverse H&S, action generally echoed by the two Crude markets. Even so, with the Dollar seemingly at a pivotal stage, there is plainly the need for the commodity index to pop that hefty next resistance cordon draped across 109.8 to shore up its basing claim and open a broader path into the mid 120’s. If the greenback meantime bust clear of the 101.60’s former gap area and swatted the B-Berg away from 109.8 back under its mid band (104.5), the promise of Jly would fizzle and shift context to just that of a failing mid-year correction.

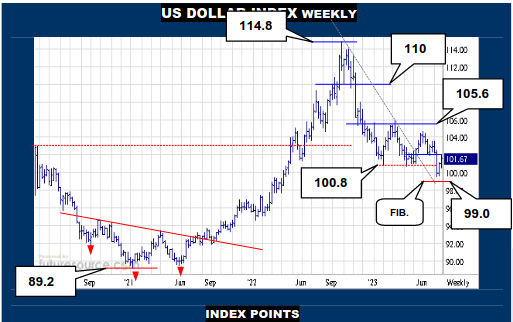

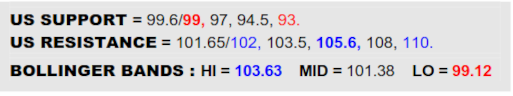

US DOLLAR INDEX WEEKLY

The Dollar managed a May downtrend escape of its own but fumbled and has lately delved down to a brief look at the 99’s. This got close to an actual Fib retracement of the big ‘21/’22 advance (99) before rebounding in the past fortnight to the tiny 101.60’s gap. If this reflex were now promptly suppressed, it would later look like just a quick gap-fill correction and loss of the 99’s would pave a more extensive decline into the bulk of a previous inverse H&S lying under 93. For now though the Fib catch sounds a warning for commodities and if able to cleanly escape across the 101.60’s gap into the 102’s, it would signal a pivotal shift in the broader macro detrimental to the B-Berg.

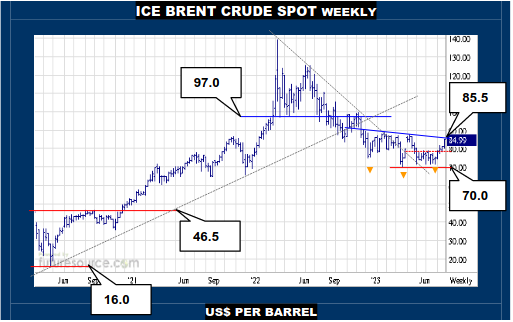

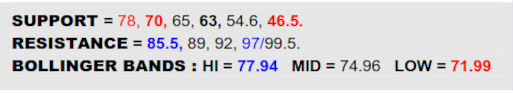

ICE BRENT CRUDE OIL SPOT WEEKLY

Championing the B-Berg’s Jly revival, Brent (and WTI) finally bust loose from a couple of months of 70’s congestion, leaving it as an underlying brace in the 78’s. As it now forays ahead in search of the 85.5 neckline to a potentially much bigger inverse H&S, the market has a chance to make a more persuasive claim to a turn higher, a getaway showing excellent prospects to go on and defeat 97 and enter triple digits again. The Dollars’ fate in the 101.60’s is liable to factor into the success or failure at 85.5 here though and if the currency swell gained traction, beware a twist back down would loom for Brent where breaking below 78 would warn of a correction cresting and a possible new threat to 70.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.