Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.

For more information please contact Michael here.

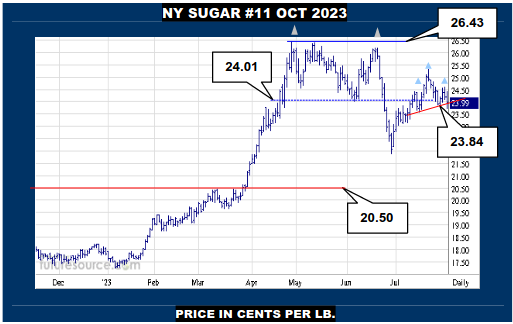

NEW YORK SUGAR #11 OCTOBER 2023

It may have scuffed a few pebbles over the 23.84 lip Thursday but NY ultimately clambered back aboard by the close to prevent a nearby H&S from forming. Wouldn’t consider it out of the woods yet however and the market will really need escape into the 24.60’s to better dispel the H&S notion and start dialing in the sights on 25.30 once more with a mind to giving the Q3 revival a sharper edge. Meanwhile the mid band has been breached so this looks a precarious perch still and a more emphatic break of 23.84 would signal a breakdown that could become severe.

LONDON WHITES #5 OCTOBER 2023

Not such a testing session for London, which held the 690’s and therein stayed well out ahead of its mid band (680.7) for just a little consolidation essentially. This still keeps the 705 hurdle well within strike range if NY can just pull itself together and breaking beyond there would develop the Jun-Jly action into a hefty base structure that would technically project as far as 800. A cleaner snap of 23.84 by Raws would be a concern though, the mid band here then looking vulnerable as a potential catalyst for a deeper dive.

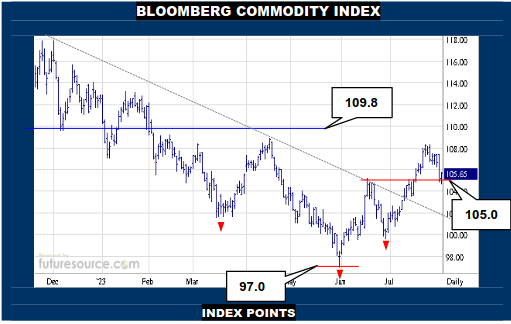

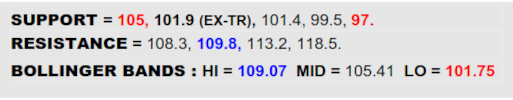

BLOOMBERG COMMODITY INDEX

It frayed the mid band and certainly gave the 105 support a good rattle but the B-Berg has thus far just about survived there. If it could go about shoring up the 105’s footing in the next few days while the Dollar peeled away under its mid band (101.2), the recent commodity dip could still wind up being tagged as a correction and the 109.8 longer term escape hatch would remain an enticing carrot hanging out there just overhead. There aren’t any obvious distress signals coming from the Dollar yet though so do keep a close watch on 105 here as a clear cut break would be more ominous, creating scope back to the ex-downtrend (101.9) and a 101.4 Fib retracement.

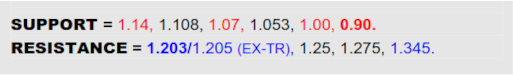

NY SUGAR #11 IN BRAZILIAN REAL

A slight dab through the 1.14 ledge was quickly retrieved but Real priced Raws are still buzzing around the mid band (1.16) with little room for maneuver. If a cleaner snap of 1.14 were to occur, a small Jly H&S would reiterate the low 1.20’s lid presented by the bigger Q2 top and there would then be a new threat posed to the 1.07 Fib retracement, which henceforth marks the neckline to an entire ’23 H&S pattern where things could look really bleak. Tops seem to be ‘ten a penny’ then and the only way to substantively change that perspective would be via a decisive getaway into the 1.20’s that would disperse the Q2 top and resurface over the formerly broken uptrend to indicate the market finding a much sturdier footing.

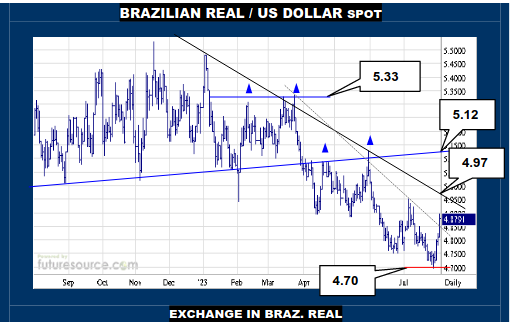

BRAZILIAN REAL / US DOLLAR SPOT

VALUE : 4.879

Having seen a rather meek step down to 4.70 last week that failed to impress the divergent RSI, the Dollars’ rebound this week wasn’t a huge surprise and has shed an initial downtrend to open passage towards the broader ’23 downtrend (4.97) that hails from peaks up around 5.50. Dispatching the 4.95/4.97 zone would qualify as a much more significant tip of the balance then, shaking off the summer malaise and installing a better base shape that would set the sights on the 5.12 neckline of the large pre-Q2 top terrain. Alas, if intercepted in that mid 4.90’s area to keep the downtrend in control, do still be prepared for another swerve lower back to the 4.70’s again.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.